The EU Taxonomy and the CSRD represent critical elements of the future of corporate sustainability reporting. It is therefore vital to understand what are the changes from current regulations and which companies will be impacted.

In this article we will make a quick overview on the different regulations that are part of the sustainable finance framework and how do they relate to each other, from SFDR, to NFRD, EU Taxonomy and finally the latest CSRD.

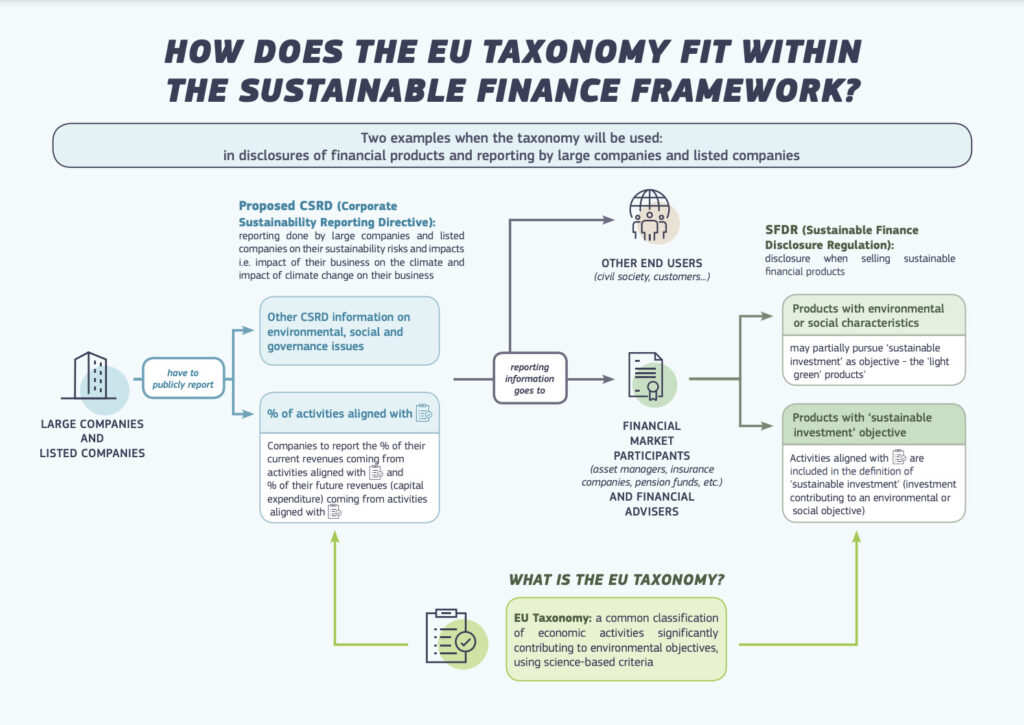

How does the EU Taxonomy fit within the sustainable finance framework?

The EU Taxonomy is a complex science-based classification system establishing which economic activities can be considered environmentally sustainable.

Practically speaking, it enables businesses to transition toward sustainability by gradually growing their share of green activities. Or, in other terms, it aims to boost the flow of investments toward sustainable activities and help with the European Green Deal’s goal to make the EU a climate-neutral economy by 2050.

The factsheet you can find below could help understand how the EU Taxonomy fits in the European Commission’s action plan on sustainable finance.

For more details about the EU Taxonomy, we previously wrote about it in our blog, illustrating the EU Taxonomy objectives, as well as the impact on the Real Estate sector and the banking and sustainable investing

What is the Sustainable Finance Disclosure Regulation (SFDR)?

The SFDR is a critical part of the European sustainable development plan. It’s a legislation that entered into force in 2021 and imposes a range of sustainability-related disclosure obligations and transparency requirements for financial advisers (FAs) and financial market participants (FMPs) operating in the EU.

The obligation to disclose the required sustainability-related information, apply at the entity and product levels to facilitate the comparison between different investment opportunities, increase the degree of transparency and reorient capital flows towards sustainability.

What is the Non-Financial Reporting Directive (NFRD)?

The NFRD was adopted in 2014 as an amendment to the Accounting Directive to improve the disclosure of non-financial information by large listed companies, banks and insurance companies.

NFRD was considered a significant step forward compared to the Account Directive, but still, its application was restricted to a relatively limited number of large companies. In fact, under the NFRD, only “public interest entities” – large listed companies, banks and insurance companies with more than 500 employees – were required to publish reports disclosing policies about sustainability, social responsibility, respect for human rights, etc.

What is the Corporate Sustainability Reporting Directive (CSRD)?

Now that we clarified what the NFRD, the SFDR and the EU Taxonomy are, it’s time to talk about the new CSRD.

The CSRD is a new EU legislation extending the existing scope and reporting requirements for what concerns the environmental and social impact activities of large companies. The application of CSRD will start on 1 January 2024, for the 2023 financial year. It will be initially impacting only a limited number of companies (500+ employees), before entering full force in 2025.

While maintaining the same goals of the other measures previously adopted, with the CSRD, the EU aims to fix some of the NFRD’s known issues, substantially expand the scope of application to a far larger number of companies, and further accelerate the transition towards Net Zero

In fact, if the companies concerned by the NFRD are just around 11,700, with the CSRD, the number will substantially increase to about 49,000. This broader application represents a key difference between the CSRD and NFRD. As we have seen above, the NFRD is applied only to companies considered of public interest with more than 500 employees. In contrast, the CSRD, when in full force, will apply to all listed and non-listed companies with at least two of the following criteria: a. more than 250 employees; b. €40 million turnover or more; c. €20 million or more in total assets.

The impact of CSRD on non-EU companies

Companies headquartered outside of the EU but with a significant presence in it should still pay attention to the CSRD.

More specifically, CSRD will apply to non-EU companies with annual revenues of over €150 generated inside the EU that have a significant EU branch generating more than €40 million in annual revenues, or a large EU subsidiary.

In practice, are the respective subsidiaries or branches that will be subject to publish sustainability reports also for their non-EU parent companies at a consolidated level (starting from 2028).

AI and years of experience to make CSRD compliance easier

As we have seen there are plenty of upcoming changes for what concerns companies’ obligations. While these are positive developments, helping Europe to become a greener economy, it’s now important to understand that January 2024 is just around the corner, and if your company is subject to CSRD, it’s time to start planning ahead.

At DYDON AI we are here to help you stay on top of all this with the advantages of AI-powered solutions for the EU Taxonomy plus a team of committed professionals with several years of expertise in the field ready to assist you in your sustainability journey.

Recently awarded as the “Best taxonomy data solution for ESG”, at the ESG Insight Awards 2022, and winner of the Innovation Award at the Global Sustainable Digital Finance Forum, our commitment to simplifying companies’ compliance has never been stronger.