Sustainability Reporting

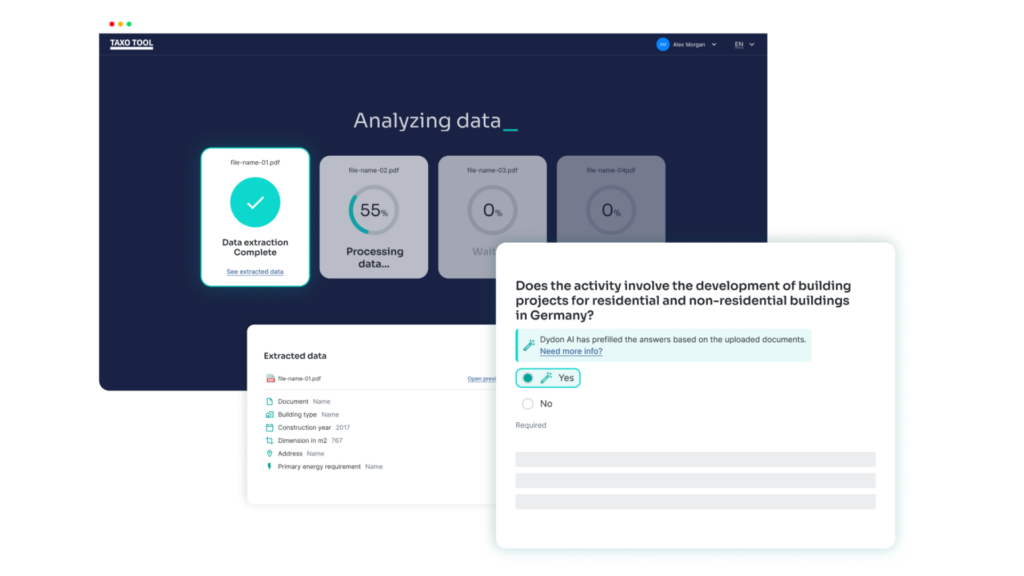

_AI-powered automation for EU Taxonomy Reporting and ESG Data Capture

Your ready-to-go AI solution for getting your company up to the next sustainable level

Easy, transparent, fast.

Sustainability reporting is evolving rapidly, driven by regulatory demands like the EU Taxonomy, CSRD, and increasing pressure from investors and stakeholders. Traditional reporting processes often rely on manual work, fragmented data sources, and interpretation-heavy tasks that consume time and create risk.

At Dydon AI, we bring automation, precision, and transparency to sustainability reporting. Powered by Natural Language Processing (NLP) and Agentic AI, our solutions transform unstructured documents and siloed information into structured, auditable, and regulator-aligned reports.

The EU Taxonomy Reporting

The EU Taxonomy is a classification system that helps companies and investors identify “environmentally sustainable” economic activities to make sustainable investment decisions. A project or an investment can be deemed “eligible” by the EU Taxonomy if its economic activity has been nominated and ruled by this regulation.

AI-Document Reading and ESG Data Capture

Stop spending hours searching for data. Our AI agents read, extract, and structure ESG and sustainability data from documents like company reports or other type of documents.