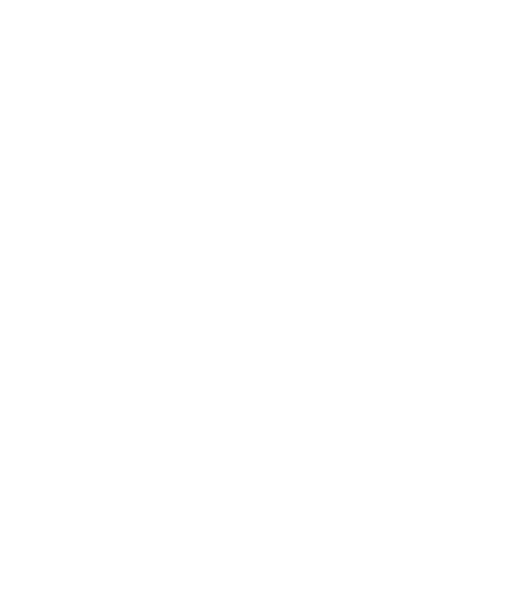

Compliance & Reporting made easy with AI

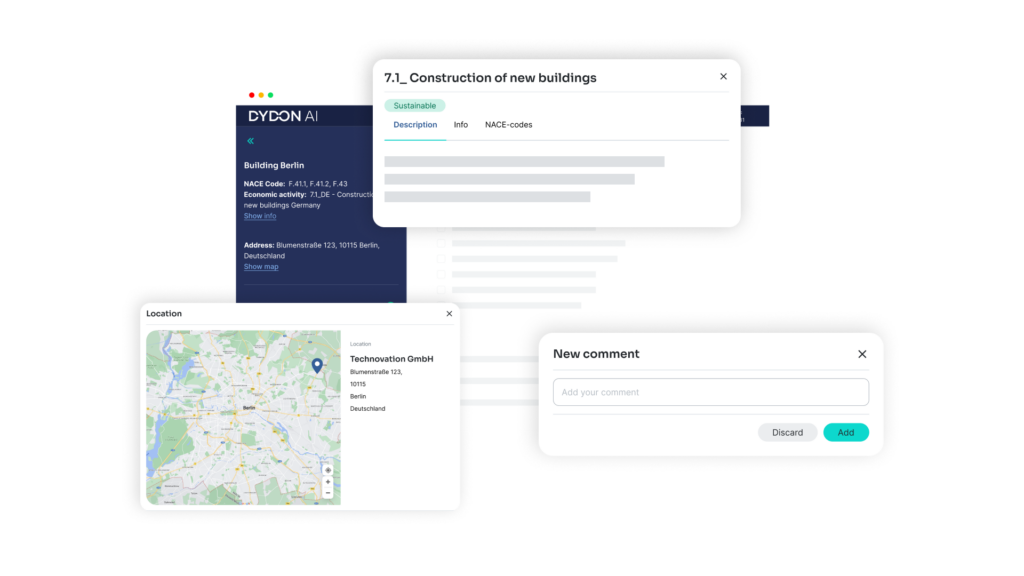

At Dydon AI, our mission is to empower organizations across industries to navigate the complexities of compliance and sustainability reporting with unparalleled clarity and efficiency. At the core of our platform is cutting-edge Natural Language Processing (NLP) technology — powered by advanced language models (LLMs), Retrieval-Augmented Generation (RAG), and purpose-built AI agents for regulatory intelligence.

_Secure AI-powered Data Capture from Documents

Dydon AI is a Swiss company offering transparent and flexible artificial intelligence (AI) solutions for sustainable finance and compliance, focused on Fintech and Regtech solutions.