Press release, Zürich 17th January 2024

In the future, savings banks will be able to work with their customers to make their financing projects more sustainable: The TAXO TOOL from VÖB-Service GmbH and Dydon AI enables savings banks to carry out a systematic, structured assessment of their private and corporate customers’ financing projects to determine whether they meet the European Union’s standards for green business practices.

“The move towards greater sustainability in all areas of daily life has now become highly relevant to society. For example, savings banks specifically support corporate customers in successfully leading their business into a sustainable future by analyzing and supporting financing projects with the help of the TAXO TOOL. This creates additional security for our customers,” says Karolin Schriever, Executive Member of the Management Board of the German Savings Banks Association (DSGV).

It is the declared aim of the EU taxonomy to set the course for the transition to a sustainable and climate-neutral society throughout Europe. Investments are therefore increasingly being directed into environmentally friendly technologies and companies. Schriever: “The path is clearly defined. Companies and private customers need a reliable partner who can accompany them on their individual path when it comes to a wide range of issues. This is where savings banks play a decisive role and fulfill their social responsibility.”

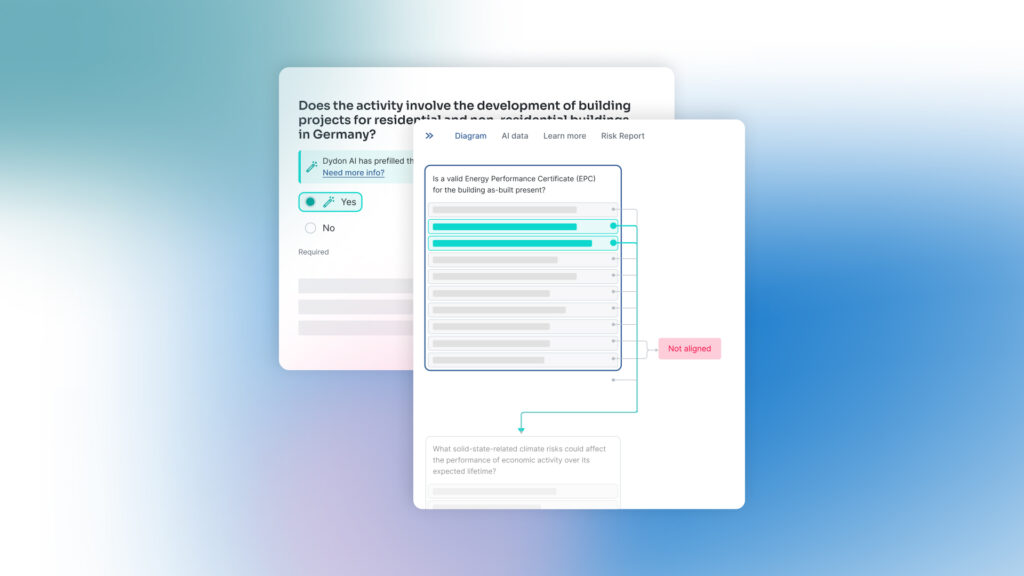

The TAXO TOOL guides advisors and clients through the assessment process facilitating it. Artificial intelligence (AI) is used to automate and simplify the EU taxonomy assessment. The AI supports the collection and processing of relevant data from various sources (such as energy certificates for buildings). Among other things, it uses intelligent search algorithms and automated CO₂ calculations. The result is a sustainability assessment tailored to the specific needs of the respective industry. A certificate confirms conformity and enables companies to transparently document their commitment to sustainability to customers and partners.

Geodata that identifies climate risks for specific addresses is a significant additional benefit. Savings banks can optionally integrate this data from Munich Re’s Location Risk Intelligence Platform into TAXO TOOL. Knowing how the risk of flooding will develop at a building site, for example, creates more planning security for the construction of a home.

Schriever: “This new service is an important building block on the way to a climate-neutral future. Companies and private customers have a reliable partner at their side with their savings bank. The savings banks use all digital possibilities to make complex issues as simple and understandable as possible. In this way, they create real added value for everyone.”

***

About Dydon AI:

Founded in 2016 by Dr. Hans-Peter Güllich, Dydon AI is a Swiss start-up that offers an AI solution for sustainable finance that enables a fast, comprehensible, and transparent assessment of all necessary criteria to classify and analyze the level of sustainability in terms of ESG, EU taxonomy, and supply chain risk. Dydon AI developed the TAXO TOOL in cooperation with the Association of German Public Banks (VÖB) and its subsidiary VÖB-Service GmbH.

Press contact:

Silva Rosmarie Lanz

Dydon AG

Hechlenberg 17

CH-8704 Herrliberg

Telefon +39 345 0217062

silva.lanz@dydon.ai

About VÖB-Service:

VÖB-Service GmbH, based in Bonn, was founded in 1991 and is a wholly-owned subsidiary of the Association of German Public Banks (VÖB). It is a provider of consultancy services, software products, and training programs for VÖB member companies, local authorities and the entire credit and property industry. The services offered by VÖB-Service are divided into four service areas: banking software, academy, information services, and consulting. The core competencies include special banking and regulatory topics. With the Academy of Finance, VÖB-Service operates one of the largest credit academies in Germany, which is also an educational institution of HypZert GmbH for employed and freelance property valuers.

Press contact:

Pascal Witthoff

VÖB-Service GmbH

Godesberger Allee 88

D-53175 Bonn

Telefon: +49 228 8192-273

E-Mail: pascal.witthoff@voeb-service.de

About the German Savings Banks Association (DSGV):

The German Savings Banks Association (DSGV) is the umbrella organization of the Savings Banks Finance Group. This includes 353 savings banks, six Landesbanken groups, DekaBank, five Landesbausparkassen, nine primary insurer groups of the savings banks, and numerous other financial services companies.

Press contact:

Wiebke Schwarze

Deutscher Sparkassen- und Giroverband

Charlottenstraße 47

10117 Berlin

Telefon: +49 228 8192-273

Tel. +49 30 20225 5115, presse@dsgv.de

Download the press release in GERMAN

LINK TO THE PRESS RELEASE OF German Savings Banks Association (DSGV)