This year, for the first time, European banks had to include in their reporting ratios related to taxonomy-eligible exposure and to entities not subject to the Non-Financial Reporting Directive (NFRD). These novelty requirements came from the Article 8 of the Sustainable Finance Taxonomy Regulation and represent the first step towards more comprehensive reporting obligations that will be required starting next year with the implementation of the Green Asset Ratio (GAR).

What is the Green Asset Ratio (GAR)?

The GAR is a new KPI for EU banks, intended to provide a standard and comparable measure of the percentage of a lender’s assets invested in environmentally sustainable projects and activities. It’s a part of a major effort to accelerate the adoption of sustainable banking practices, where the European Banking Authority (EBA) has taken a decisive step by announcing that starting in 2024, about 150 large EU lenders will be required to disclose this new metric.

But before further talking about the GAR and the current challenges for banks, it’s worth taking a step back and reminding what the EU Taxonomy is. It is a framework for classifying and identifying environmentally sustainable activities. It comprehends a set of technical screening criteria determining whether an economic activity can be considered environmentally sustainable.

By providing a common classification system for sustainable activities, the EU Taxonomy serves as a tool for green finance. It is intended to help financial market participants identify environmentally sustainable economic activities and channel capital toward that. So, as easy to understand, the EU taxonomy and GAR are strictly related to each other and serve the same purpose of transitioning to a greener financial system and economy.

Taxonomy key performance indicators (KPIs)

As Accenture has accurately detailed in this comprehensive report about sustainable banking, European banks are currently required to disclose seven KPIs related to their assets:

- 1. Taxonomy-eligible activities;

- 2. Taxonomy-non-eligible activities;

- 3. Exposure to undertakings that are not obliged to NFRD;

- 4. Exposure to derivatives;

- 5. Exposure to on-demand interbank loans;

- 6. Exposure to trading books;

- 7. Exposure to central governments, central banks, and supranational.

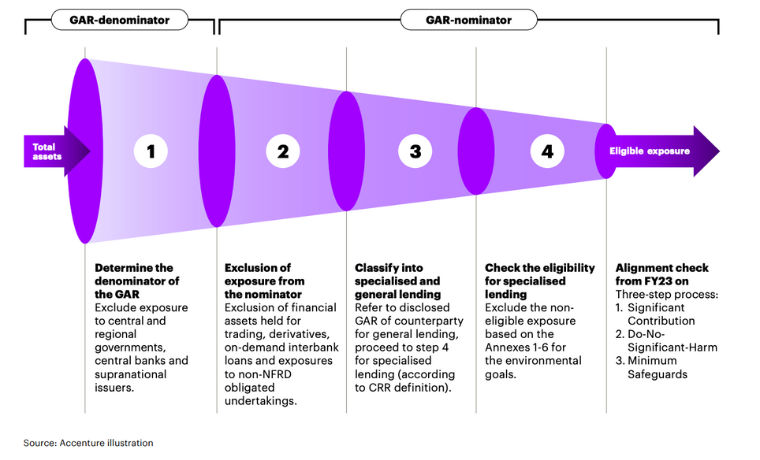

These figures, which have to be disclosed now, and the GAR that will be compulsory from next January, can be calculated as the following:

A schematic and simplified calculation process for determining the key figures to be published currently, and also the GAR for future publication – Source: Accenture

While this may seem relatively straightforward, there is currently a clear challenge that needs to be addressed: the need for more reliable data.

The reliability of counterparty data

Only those undertakings that are subject to the NFRD and, therefore, must disclose their alignment with the EU Taxonomy should be included in the numerator of the GAR (see the Accenture illustration above). But the poor availability of reliable counterparty data is a significant challenge, and many corporates still need to prepare for that.

Inadequate accounting systems, a partial understanding of these new complex regulations and the lack of granular data can result in a GAR score that is significantly lower than in reality. Also, for certain types of loans – e.g. car loans and mortgages – banks will have the cumbersome task of analyzing the assets themselves, which could quickly become hard to manage, considering the number of loans and conditions that are country specific.

Moreover, the EU Commission has clarified that estimates are not acceptable for mandatory reporting. However, financial institutions may choose to include ratios based on forecasts in separate voluntary reporting.

This situation leads banks to follow different directions, with some taking a cautious approach where entire portfolios and special-purpose vehicles (SPVs) are excluded from consideration as a precautionary measure.

Difficulties with NACE codes and the exclusion of transactions

NACE is derived from the French Nomenclature statistique des activités économiques dans la Communauté européenne and is a classification scheme used in the European Union (EU) since 1970 to group together different types of businesses and industries according to the products or services they produce. NACE serves to collect and analyze data on economic activity, and it’s also used for compiling and analyzing data on environmental performance and sustainable development.

The EU Taxonomy is mainly based on this system. The problem here is that NACE codes are usually solely available at the level of the business partner’s sector of activity. And at the same time, the Taxonomy requires banks to classify transactions according to financing purposes.

As for the difficulties in obtaining reliable counterparty data, also in this case, the uncertainty about the NACE codes implies that financial institutions follow a conservative approach excluding from the EU Taxonomy relevant transactions or even entire portfolios.

Adapting to Changing Regulatory Requirements: The Role of Data Management

As we have seen, the granularity required for taxonomy reporting is really high, and with the Green Asset Ratio, things are about to level up even further.

Banks require more than granularity and precision in data management to quantify environmental, social and governance (ESG) aspects. In fact, given the rapidly evolving regulatory framework, banks need to have the capacity to react quickly and update their data architecture and models when required.

Furthermore, given the rapidly increasing reporting obligations, along with the complexity and volumes of data that need to be processed, their data management needs to be highly scalable to be prepared for their current needs and the foreseeable future.

Last but not least, there’s a clear need for standardisation and harmonisation of data, with a substantial increase in flexibility, regarding how data is connected.

Artificial intelligence and EU Taxonomy: the TAXO TOOL

As one of the leading startups using AI-powered solutions to help European banks become more sustainable – recently named “Best taxonomy data solution for ESG” at the ESG Insight Awards 2022 – we are here to help banks and big corporates to make this whole transaction simpler and get prepared for the years to come. With TAXO TOOL we have built an artificial intelligence software specifically thought for the EU Taxonomy to be managed easily and cost-efficiently.