What is the EU Taxonomy?

The EU Taxonomy is a classification system established to determine whether an economic activity is environmentally sustainable. Its primary objective is to provide clarity and transparency to investors, companies, and policymakers, thereby facilitating the transition towards a low-carbon, resilient, and resource-efficient economy. By setting clear criteria for sustainability, the Taxonomy aims to prevent “greenwashing”—the practice of falsely portraying activities as environmentally friendly—and to promote genuine sustainable investments.

Financial institutions are required to assess the economic activities that are asking for investments, loans and mortages, and the corporates that fall under the regulation are asked to disclose how their activities align with the following 6 environmental objectives.

Six Environmental Objectives defined by the EU Taxonomy:

- Climate Change Mitigation – Reducing greenhouse gas emissions.

- Climate Change Adaptation – Enhancing resilience to climate change.

- Sustainable Use & Protection of Water and Marine Resources – Ensuring responsible water management.

- Transition to a Circular Economy – Promoting resource efficiency and waste reduction.

- Pollution Prevention & Control – Minimizing pollutants and hazardous substances.

- Protection & Restoration of Biodiversity and Ecosystems – Safeguarding natural habitats.

For an activity to be Taxonomy-aligned, it must:

- Make a substantial contribution to at least one of the six environmental objectives.

- Do No Significant Harm (DNSH) to any of the remaining five objectives.

- Comply with Minimum Safeguards, ensuring social and governance principles are met.

Economic Activities (EAs) covered by the EU Taxonomy regulation so far

As of January 2024, the EU Taxonomy encompasses over 150 economic activities across various sectors, including energy, manufacturing, transportation, and agriculture and many more. These activities are evaluated against the six environmental objectives to determine their sustainability credentials. Each activity is assessed based on its ability to contribute to one or more environmental objectives while ensuring compliance with DNSH and Minimum Safeguards criteria.

Technical Screening Criteria: How to Determine Alignment

When the reporting process is completed, the economic activity can have the following status:

- Not Eligible – The activity does not meet the eligibility criteria.

- Not Aligned – The activity is eligible but does not meet alignment criteria. This can be due to:

- Not meeting “Substantial Contribution” (SC) criteria

- Failing “Do No Significant Harm” (DNSH) requirements

- Not complying with “Minimum Safeguards” (MS)

- Aligned – Within this main results, activities can be:

- 3.1. Sustainable Activity: it meets Substantial Contribution, DNSH and Minimum Safeguards criteria

- 3.2. Enabling Activity – Supports other activities in achieving sustainability (e.g., battery storage for renewable energy).

- 3.3. Transitional Activity – Activities that contribute to sustainability but are not yet fully green (e.g., efficient gas-fired power plants).

Some Economic Activities (EAs) are only transitional or enabling, while others can be classified as either sustainable, transitional, or enabling, depending on their role in the green transition.

Evolution of the EU Taxonomy regulation: the latest Omnibus proposal

Designed as a cornerstone of the EU Green Deal, since its inception in 2020 the EU Taxonomy has undergone a series of evolving updates aimed at refining and expanding its scope.

However, as implementation progressed, it quickly became clear that the complexity and administrative burden of compliance posed significant challenges, especially for smaller and non-financial companies.

For this reason in early 2025, the European Commission introduced the proposal “Omnibus Simplification Package,” aiming to streamline the EU’s sustainability regulations, including the EU Taxonomy, Corporate Sustainability Reporting Directive (CSRD), and Corporate Sustainability Due Diligence Directive (CS3D).

Key Proposed Changes to the EU Taxonomy with the Omnibus:

- EU Taxonomy Adjustments:

- Mandatory taxonomy reporting will apply only to large companies, specifically those with over 1,000 employees and a net turnover exceeding €450 million.

- Companies below this threshold can opt-in to report on taxonomy alignment if they choose to claim their activities are environmentally sustainable.

- Simplified reporting templates are proposed, reducing data points by nearly 70%.

- Activities contributing less than 10% to turnover, CapEx, or OpEx may be exempt from taxonomy eligibility assessments.

The Omnibus proposal still requires approval by the European Parliament and a reinforced majority of EU member states. Its final form may evolve through negotiations, shaping the future of corporate sustainability reporting in Europe.

Get ready for EU Taxonomy Reporting with AI

This constant regulatory flux makes a flexible, AI-driven approach to sustainability essential for banks operating in the European Union. AI solutions deliver significant advantages, enabling financial companies to extract critical data from technical documentation with high precision, allowing them to efficiently process the extensive information required for compliance.

When facing insufficient data—particularly common with SME clients and small financial institutions—AI tools can support carbon emission calculations and other Technical Screening Criteria, as well as automate document reading and data collection using Natural Language Processing.

Risk evaluation is similarly enhanced through geolocation-based analysis that correlates project coordinates with comprehensive geological and climatic risk datasets, providing precise evaluations aligned with the Do No Significant Harm criteria.

The flexibility of AI architectures enables institutions to create audit-ready reporting and incorporate regulatory amendments without requiring fundamental system redesigns, maintaining compliance continuity throughout regulatory transitions.

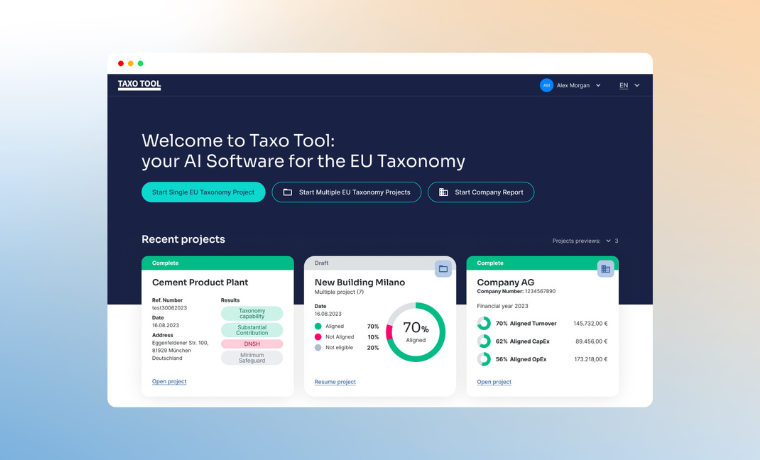

What is the TAXO TOOL?

The TAXO TOOL is the AI solution for the EU Taxonomy developed by Dydon AI in collaboration with the Association of German Public Banks (VÖB) and its subsidiary VÖB-Service GmbH, designed to simplify and enhance compliance with the latest EU regulations for sustainable finance.

Several German financial institutions have already adopted this solution to simplify their EU Taxonomy reporting processes like the Landesbanken BayernLB, NordLB, SaarLB, LBBW, and numerous savings banks through the agreement with DSGV – German Savings Banks Association, such as Sparkasse Bremen, Frankfurter Sparkasse, Hamburger Sparkasse, Sparkasse Mainfranken just to mention some.

Join our next upcoming free webinars in 2025:

- Monday 12th May 2025 at 10,00 – 11,00 CEST

- Thursday 12th June 2025 at 15,00 – 16,00 CEST

- Wednesday 9th July 2025 at 15,00 – 16,00 CEST

- Monday 11th August 2025 at 10,00 – 11,00 CEST

- Monday 15th September 2025 at 15,00 – 16,00 CEST

- Thursday 16th October 2025 at 10,00 – 11,00 CEST

- Thursday 13th November 2025 at 15,00 – 16,00 CEST

- Monday 15th December 2025 at 10,00 – 11,00 CEST

This series of webinars is organised by our partner VÖB-Service GmbH and will take place ONLY IN GERMAN LANGUAGE.