Zürich, 19. August 2024

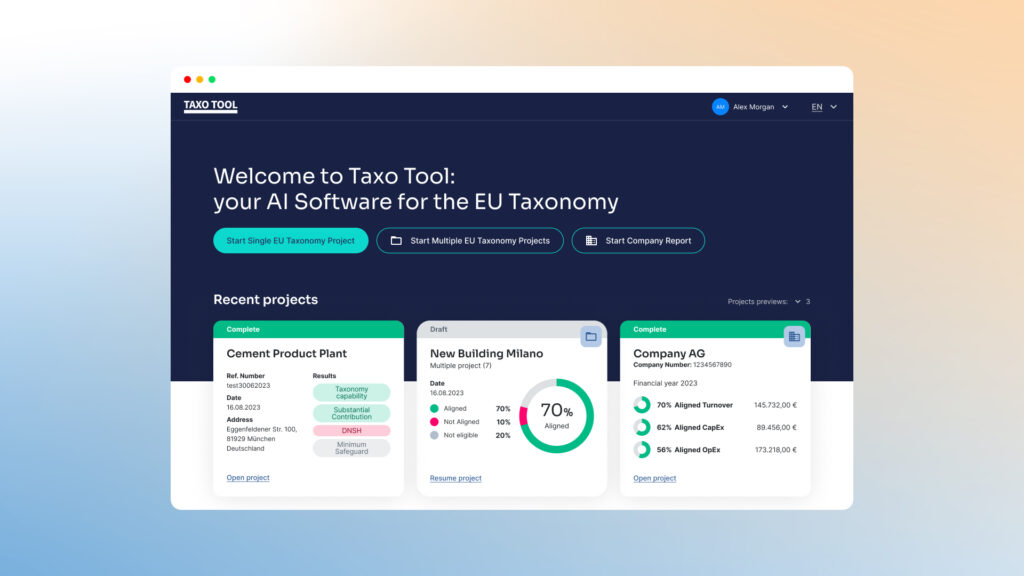

Dydon AI is thrilled to announce the launch of Taxo Tool 2.0 – the AI solution for the EU Taxonomy developed in collaboration with the Association of German Public Banks (VÖB) and its subsidiary VÖB-Service GmbH, designed to simplify and enhance compliance with the latest EU regulations for sustainable finance. This new version integrates extensive regulatory updates and new features, ensuring a comprehensive and user-friendly experience for sustainability reporting.

The formal adoption of a new delegated environmental act and changes to the climate and taxonomy disclosure acts by the European Commission on June 27, 2023, have expanded the scope and complexity of the EU Taxonomy. The new 2.0 version is designed to address these changes, providing businesses with the tools they need to navigate the updated regulations efficiently.

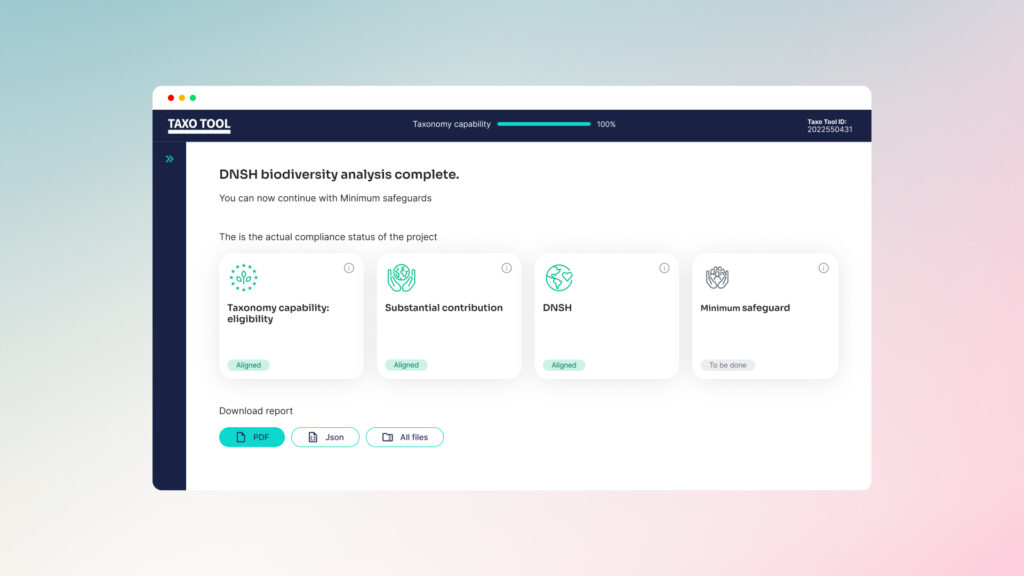

Taxo Tool 2.0 includes all environmental goals set forth by the EU Taxonomy, covering also the latest 4 goals (Taxo4): the sustainable use and protection of water and marine resources, the transition to a circular economy, the prevention and reduction of environmental pollution, and the protection and restoration of biodiversity and ecosystems. Additionally, the latest changes to environmental goals 1 and 2, which focus on climate change mitigation and adaptation, have been seamlessly integrated into the platform.

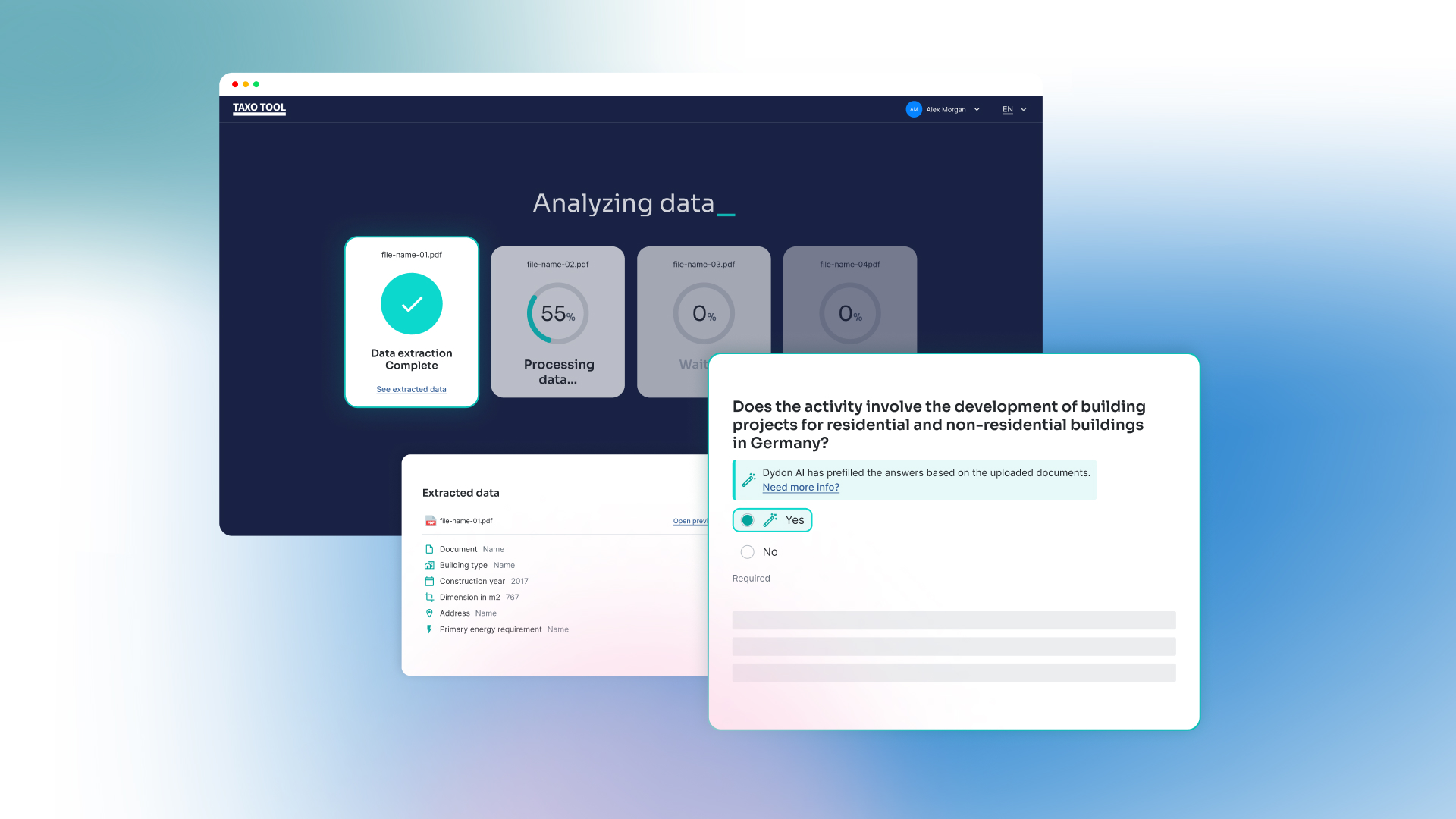

The document upload and readout functions of Dydon AI’s Natural Language Processing (NLP) stack have been optimized, streamlining the process of data extraction from documents and data analysis even more, with a focus on documents like energy certificates for buildings.

The interface of Taxo Tool 2.0 has a new user experience and design providing improved user guidance and optimized information content, making the whole reporting process more intuitive and efficient. The design of the new interface respects accessibility criteria too, so that the interaction with the technology is made as easy as possible.

Overall, the AI solution supports the answers to the EU Taxonomy’s long list of questions, streamlining the workflow for banking personnel, and speeding up the process enormously. Integrating the external data of Munich Re, the solution provides clients also geolocalisation-based climate and geological risk assessment, as an additional feature.

Several German financial institutions have already adopted this solution to simplify their EU Taxonomy reporting processes like the Landesbanken BayernLB, NordLB, SaarLB, LBBW, and numerous savings banks through the agreement with DSGV – German Savings Banks Association, such as Sparkasse Bremen, Frankfurter Sparkasse, Hamburger Sparkasse, Sparkasse Mainfranken just to mention some.

“We want to thank our clients for their invaluable support throughout the whole development process. Our close cooperation with German financial institutions, together with the Association of Public German Banks (VÖB), has allowed us to develop a solution that perfectly fits the internal banking processes for EU Taxonomy reporting. We look forward to continuously improving this solution and setting a standard for AI-driven processes in European banks,” shares Dr. Hans-Peter Güllich, CEO & founder of Dydon AI.

By improving the AI features and making the user interface even more accessible to anyone, Dydon AI continues to lead the way in AI-driven sustainability solutions. The goal of the Swiss AI company is to support financial institutions all over Europe in meeting their reporting obligations under the EU Taxonomy, ensuring transparency and promoting sustainable investments.

For more information, please contact:

Silva Lanz – Senior Marketing Manager at Dydon AI

silva.lanz@dydon.ai

+39.345.0217062

About Dydon AI:

Founded in 2016 by Dr. Hans-Peter Güllich, Dydon AI is a Swiss start-up that offers an AI solution for sustainable finance that enables a fast, comprehensible and transparent assessment of all necessary criteria to classify and analyse the level of sustainability in terms of ESG, EU taxonomy and supply chain risk. Dydon AI developed the TAXO TOOL in cooperation with the Association of German Public Banks (VÖB) and its subsidiary VÖB-Service GmbH.