_AI-powered

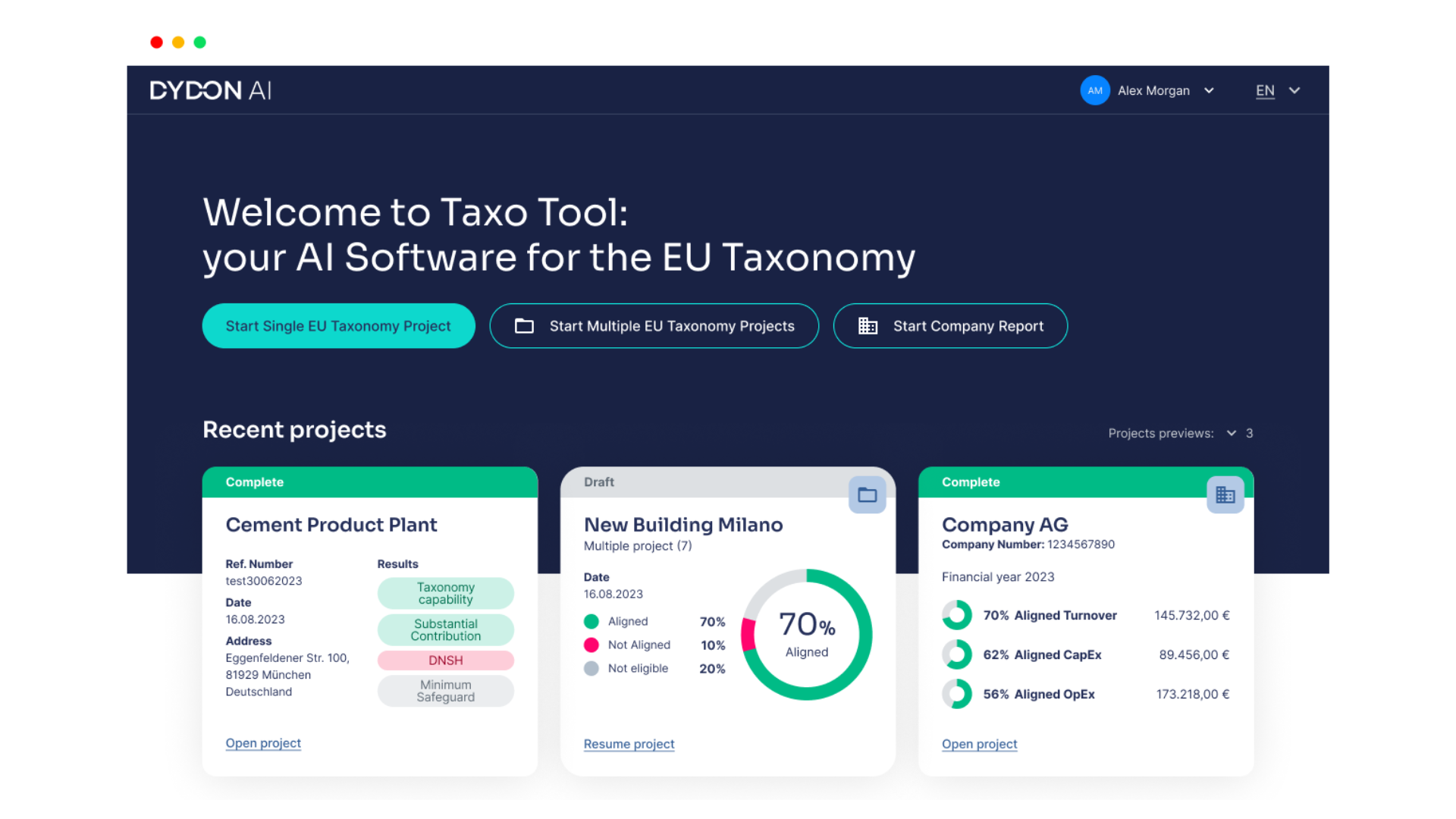

Our AI reads documents and extracts key data, answers regulatory assessments, and screens documents for sustainability criteria — automatically and at scale.

_Streamlined Regulation

Our solution can assess all economic activities (more than 150 EA) defined as eligible by the EU Taxonomy. It provides an audit-ready Article 8 report for companies and multi-project assessment for banks in case of complex credit checks.

_Automation

Generate an audit-ready export in just a few clicks. Our AI-based automation and workflows simplify every stage of the reporting process.

_Designed for banks, trusted by leaders in finance

We developed TAXO TOOL (AI solution for the EU Taxonomy reporting) in cooperation with the Association of German Public Banks (VÖB) and its subsidiary VÖB-Service GmbH. The solution is trusted by several financial institutions in Germany and Europe.

What makes our TAXO TOOL unique

01

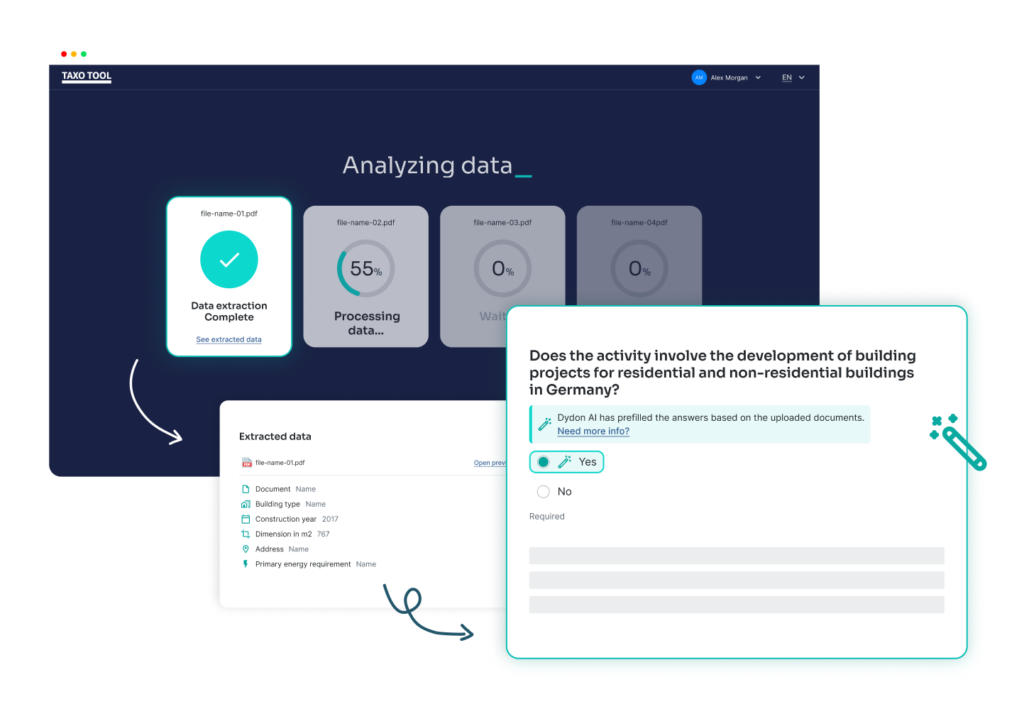

Secure Document Analysis and Data Capture

The solution leverages AI language models to capture numeric and textual data from various documents, and specifically for energy certificates for buildings these extracted data can be used to suggest appropriate answers to EU Taxonomy questions, accelerating the assessment process.

02

Easy Calculation Box, help boxes and guidance for the user

AI-supported calculations related to carbon emissions and other technical screening criteria ensure an easy and accurate assessment process. This is particularly valuable for financial institutions assessing SMEs or private customers without readily available carbon emission data.

03

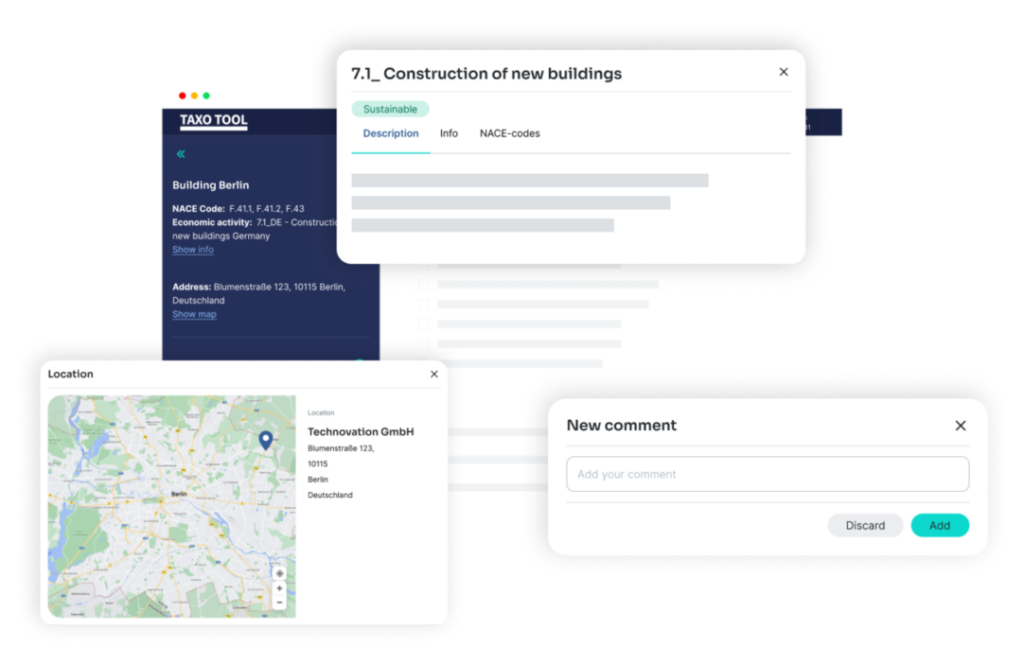

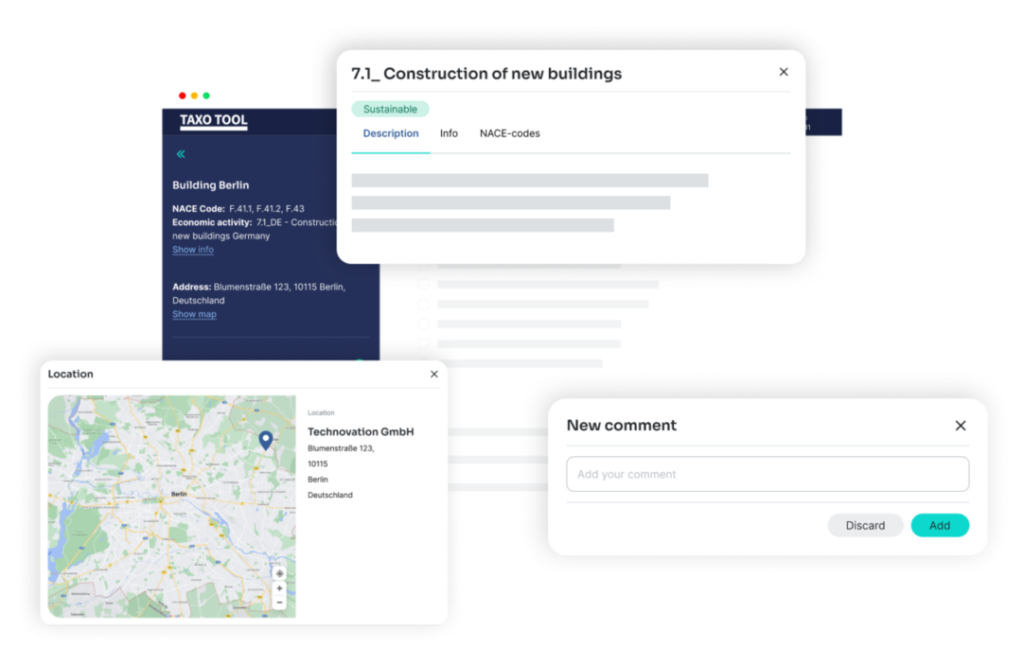

Geolocalisation-based Geological and Climate Risk Analysis within the DNSH

Taxo Tool retrieves relevant risks by simply entering the project address, integrating the data from Munich Re to provide geolocation-based assessments of climate and geological risks during the Do No Significant Harm (DNSH) assessment.

04

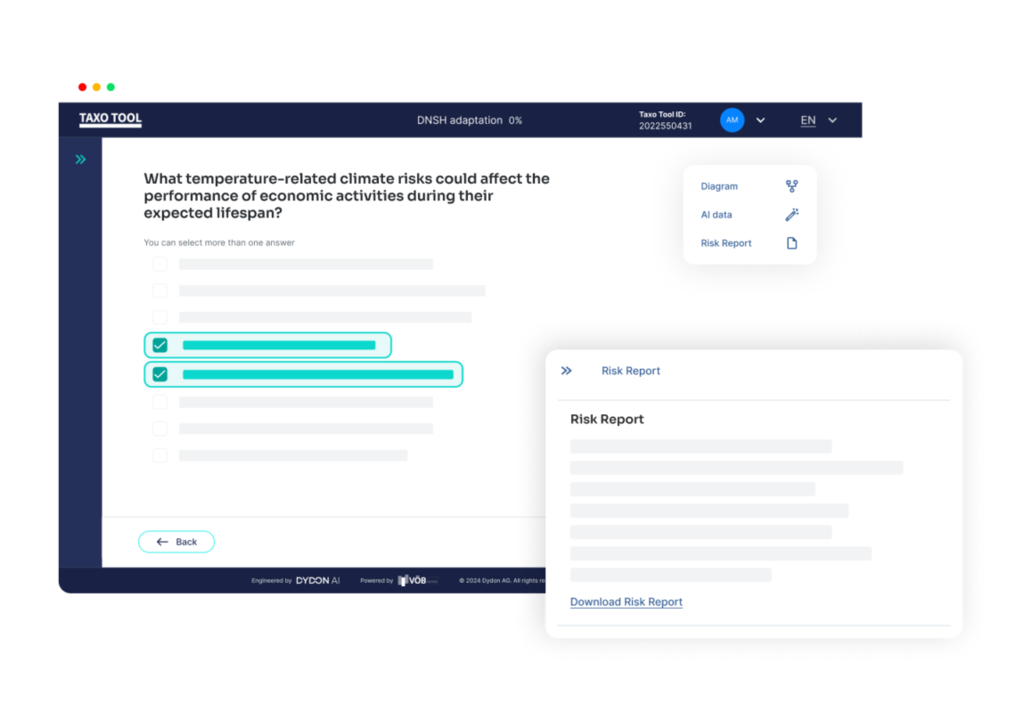

Transparency of the Assessment Process

Our AI-solution enables companies to keep always an eye on the complex EU Taxonomy assessment processes through diagram flows allowing users to easily navigate and understand the various assessment stages, promoting transparency and clarity.

05

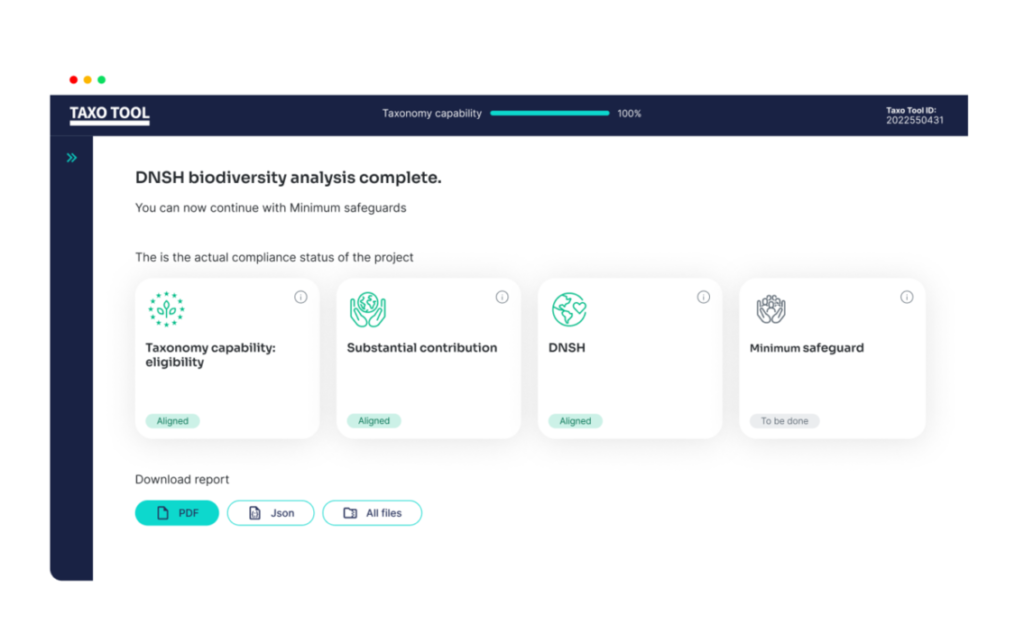

Streamlined Assessments EU Taxonomy Report

Taxo Tool offers guidance to the user through the questions and requirements of the EU Taxonomy to simplify the assessment regarding the alignment of Substantial Contribution, Do No Significant Harm, and Minimum Safeguards criteria to a specific environmental goal.