Press release, 29. June 2023

EU Taxonomy: German Pfandbrief Banks use AI software Taxo Tool

Financial institutions in particular, as well as companies in the real estate industry, play a central role in the sustainable transformation of the economy. Quite a few of them have been active for many years in business areas that are considered sustainable and climate-friendly, for example in the financing of renewable energies, infrastructure projects such as hospitals, schools or energy-efficient buildings. For an economic activity to be classified as sustainable, it must meet the criteria of the EU taxonomy for sustainable investment. The taxonomy aims to steer financial flows towards ESG (Environment, Social, Governance) throughout the EU, to establish the assessment of environmental sustainability and to strengthen investor confidence in making green investments more transparent.

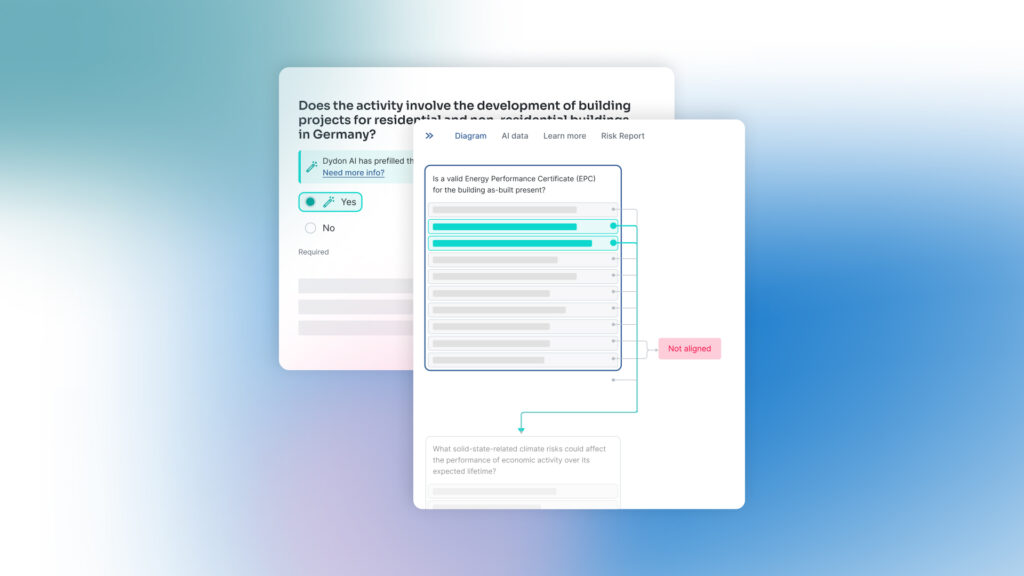

For the companies concerned, the process of checking taxonomy compliance involves a great deal of effort, because data must be collected that in many cases is not yet available or is constantly changing. The higher the data granularity of the information to be reported, the higher the implementation effort. In addition, the high complexity of the regulations poses a problem. In order to be able to carry out the legal tasks of EU taxonomy more easily, cheaply and efficiently, the clients of vdpResearch GmbH, which include Pfandbrief banks, credit cooperative institutions, savings banks, private banks as well as independent real estate valuers, can access, via their real estate valuation software, the AI solution “Taxo Tool” – a software for implementing EU taxonomy that was jointly developed by Bundesverband Öffentlicher Banken Deutschlands, VÖB, its subsidiary VÖB-Service and Dydon AI. The technology of the Taxo Tool is a highly efficient solution in the field of artificial intelligence to digitise and map information gathering, process implementation and reporting.

This includes automated data collection from various documents, such as energy certificates for real estate, the calculation of technical assessment criteria (e.g. CO2 emissions) in cases of missing or unavailable data, and the consideration of country-specific laws for buildings. In addition, assessments for climatic and geological risks to help companies develop effective mitigation and adaptation strategies. This will ensure that construction and real estate projects receive an accurate assessment of their environmental impact.

“The EU taxonomy sets high requirements for the energy efficiency of buildings. This should lead real estate companies to invest more in energy retrofitting of buildings in order to meet the regulatory requirements. The aim is to achieve a reduction in energy consumption and greenhouse gas emissions in the real estate sector,” explains Reiner Lux, Managing Director of vdpResearch GmbH.

Dr. Stefan Hirschmann, Member of the Management Board at VÖB-Service GmbH, adds: “Sustainable properties that meet the criteria of the taxonomy are likely to have a higher market value in the long term. The increasing demand for sustainable properties will give them a competitive edge in the market and should be more attractive to tenants, buyers, and investors.” The desire for complexity and cost reduction as well as for extensive automation and digitalisation of the taxonomy check is therefore currently very pronounced in the market. According to Hirschmann, many companies still underestimate the enormous effort required to implement the regulatory requirements of the EU taxonomy.

“Through the partnership with vdpResearch, we are once again significantly expanding the customer base of the Taxo Tool and are jointly creating a market standard,” says Dr. Hans-Peter Güllich, CEO of Dydon AI, who programmed the taxonomy software with his team. “Without IT support, adequate implementation of the taxonomy requirements is unlikely to be possible. The EU regulation is particularly demanding in terms of data input, reporting, and IT. “

About vdpResearch:

vdpResearch GmbH, founded in 2008 and headquartered in Berlin, is a subsidiary of Verbands deutscher Pfandbriefbanken e.V. (vdp), of Bundesverbandes der Deutschen Volksbanken und Raiffeisenbanken (BVR) and of Deutscher Sparkassenverlag. The four main business areas cover the analysis, valuation and forecasting of regional real estate markets in Germany and selected regions abroad, the calculation of the vdp real estate price indices, the provision of property-related valuation parameters and comparative prices and rents for the determination of market and mortgage lending values as well as BelWertV-compliant valuation programmes for all types of real estate. The results determined and products developed by vdpResearch are now an essential building block for the assessment and valuation of market and property risks in many credit institutions.

More about vdpResearch at vdpresearch.de

About VÖB-Service:

VÖB-Service GmbH, based in Bonn, was founded in 1991 and is a 100% owned subsidiary of Bundesverband Öffentlicher Banken Deutschlands e.V., VÖB. It is a provider of consulting services, software products and educational measures for VÖB member companies, municipalities and the entire credit and real estate industry. The range of services offered by VÖB-Service is divided into the four service areas of banking software, academy, information services and consulting. The core competencies cover special banking and regulatory topics. With the Academy of Finance, VÖB-Service operates one of the largest banking academies in Germany, which is also an educational institution of HypZert GmbH for employed and freelance real estate valuers.

More about VÖB-Service at voeb-service.de

About Dydon AI:

Founded in 2016 by Dr Hans-Peter Güllich, Dydon AI is a Swiss start-up that offers an AI solution for sustainable finance that provides fast, comprehensible and transparent assessment of all necessary criteria to rank and analyse the sustainability level in terms of ESG, EU taxonomy and supply chain risk. Dydon AI developed the Taxo Tool in cooperation with Bundesverband Öffentlicher Banken Deutschlands (VÖB) and its subsidiary VÖB-Service GmbH.

More about Dydon AI at dydon.ai