So why should firms and asset managers add a sustainability strategy to their already overloaded priorities? Will the extra effort pay off?

The answer is, absolutely!

Sustainability, sustainable production and products are increasingly within in the core focus of consumers, regulators, investment firms and corporations. The 2020 Global Risks Report of The World Economic Forum ranks 3 environmental risks (climate action failure, biodiversity loss and extreme weather) as among the top five threats humanity will face in the next ten years. Similarly, the latest global analysis report from McKinsey illustrates that trillions of dollars in economic activity and hundreds of million lives are at risk from the changing climate. As research clearly illustrates , paying attention to environmental, social, and governance

(ESG) issues does not compromise returns – rather the opposite. At the same time consumers are actually buying more sustainable goods , ESG-oriented investing has experienced an unprecedented spike with global sustainable investment levels sky rocketing

- Gunar Friede, et al, ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment, Dec 2015

- New York University Center for Sustainable Business (CSB), Sustainable Share IndexTM, Research on IRI Purchasing Data (2013-2018), March 2019

to $30 trillion3 — up 68 percent since 2014 and a tenfold increase since 2004. Underpinning this trend BlackRock CEO Larry Fink recently warned, that the intensifying climate crisis will bring about a fundamental reshaping of finance, with a significant reallocation of capital set to take place “sooner than most anticipate”.

To gain a better insight into how corporations are handling sustainable activities, regulators, global organisations (e.g. Global Reporting Initiative – GRI), consulting firms and investment corporations have defined best practice standards allowing an objective monitoring and assessment of an organization’s positive or negative contribution to sustainable development. Accordingly, ESG frameworks now comprise of numerous parameters, each of them based on meteorically rising data volumes that need to be analysed. AI (Artificial Intelligence) based solutions are the optimum choice for continued ESG monitoring of a firm’s sustainable activities, enabling constant and repetitive information capturing and processing.

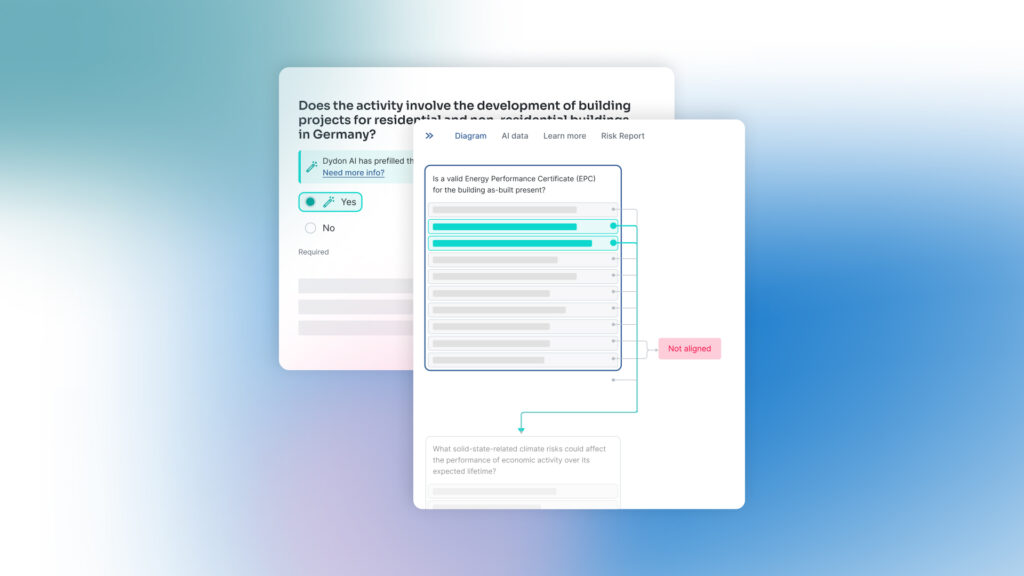

To take on this challenge, Swiss AI company Dydon and consulting firm d-fine have joined forces to build an easy to use and fully transparent ESG monitoring solution.

Based on d-fine’s ESG framework, Dydon has built a fully comprehensive and easily customisable ESG monitoring service. The Dydon AI platform constantly captures multiple parameters (e.g. CO2 emissions, water and waste management, corruption, etc.) and company-specific public information from various sources. Each piece of captured text is automatically filtered for relevance and semantically analysed using Natural Language Processing (NLP) and Sentiment Analysis. Utilising Dydon’s unique prediction algorithm, corporate-specific Key Performance Indicators (KPIs) are calculated for each ESG parameter, and finally aggregated into a meaningful ESG profile per corporation monitored. Each generated result is fully explainable and allows for a detailed analysis of the core drivers behind any ESG profile.

Summary

As research and market development clearly indicates, adding sustainability to a firm’s strategy is essential. As continued ESG profiling requires the processing of huge volumes of ESG related data, Dydon and d-fine built the AI-based ESG service. The solution is based on Dydon’s flexible AI platform, allowing rapid implementation, ease of use and intuitive result presentation. The platform thereby enables firms and asset managers to easily and cost efficiently execute an ESG-compliant strategy.

Author

Dr. Hans-Peter Guellich is the founder and CEO of Dydon AG, a leading Swiss-based provider of bespoke market information for active Risk & Compliance Management. The Dydon AI platform utilises the latest in Artificial Intelligence and Machine Learning technology. He is a serial entrepreneur and strategic investor in small and mid-cap corporations with an IT and industry focus. His passion is the creation of new business ideas and the building of respective IT-focused corporations. In 1999 he founded Avanon AG, which became a leading vendor of cross-industry IT solutions for governance, risk and compliance management. Avanon AG was acquired by Thomson Reuters GRC in 2012.