As financial institutions grapple with the intricate web of ESG reporting regulations under the SFDR and the EU Taxonomy, data availability emerges as one of the paramount challenges. This hurdle has led many to consider the use of proxy data as a means to comply with these sustainability criteria. Yet, the European Commission enforces stringent rules around the use of proxy data in EU Taxonomy reporting.

Unlike financial data, which is traditionally structured and regulated, ESG data often needs more consistency in presentation and measurement. One of the key objectives of the new European regulations is to foster transparency in terms of ESG risk exposure and impacts, requiring a solid baseline of data availability.

Significant gaps persist between the information required with the Corporate Sustainability Reporting Directive (CSRD), which from 2024 enhances and broadens the scope of the Non-Financial Reporting Directive (NFRD), and what’s readily available. Consequently, some resort to proxy data to evaluate performance against the technical screening criteria of the EU Taxonomy. But before going into more detail, let’s clarify some important aspects first.

What’s the meaning of ESG proxy data?

ESG proxy data refers to alternative or indirect sources of information used to evaluate ESG performance when direct ESG data is not available or inadequate. This could include a range of data types, from industry benchmarks, averages, and peer company data, to estimations derived from sophisticated modeling techniques. The purpose of using proxy data is to fill gaps in ESG reporting and provide a more comprehensive view of a company’s ESG performance or risk exposure.

However, the use of proxy data presents its own challenges and is subject to specific regulatory guidelines, particularly in the context of the EU Taxonomy reporting. In this light, understanding the permissible use of proxy data is critical to ensuring compliance and making informed ESG-related decisions.

How does the European Commission view the use of proxy data in these circumstances? Are there instances where the use of proxy data is permitted? We’ll answer these questions in the section below.

Decoding the rules on proxy data for EU Taxonomy reporting

The European Commission (EC) permits using proxy data in EU Taxonomy reporting only under particular conditions.

The EC allows financial market participants (FMPs) to utilize estimated or proxy data when dealing with companies not subject to the Non-Financial Reporting Directive (NFRD). “Equivalent information” is the term the Platform on Sustainable Finance (PSF) uses to indicate Taxonomy permitted estimate.

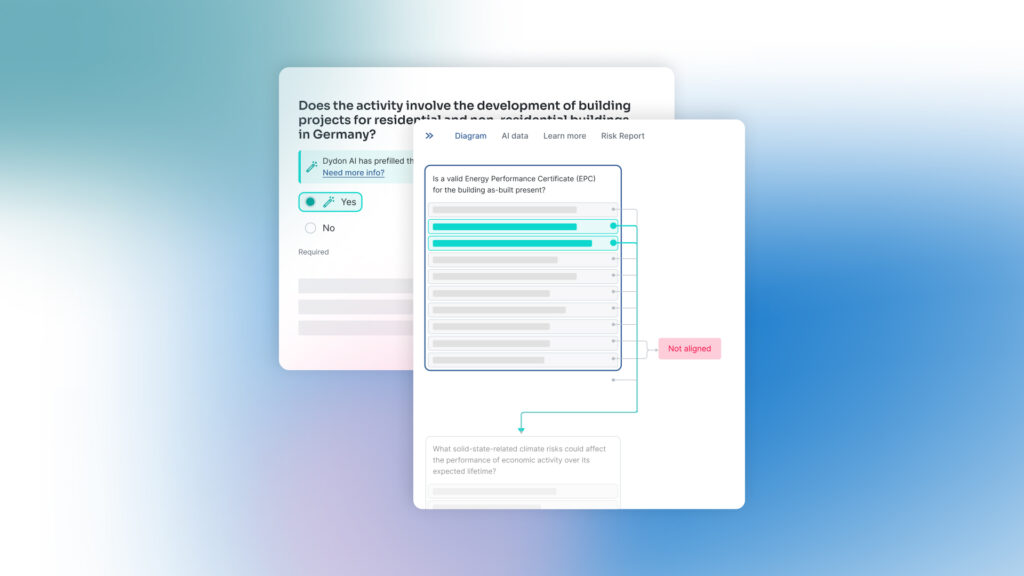

But the EC allows FMPs to use “equivalent information” only for particular elements of the Taxonomy assessment. The PSF breaks down this Taxonomy Assessment model into four steps: Eligibility, Substantial Contribution, Do No Significant Harm (DNSH), and Minimum Safeguards (MS).

1. Eligibility

Financial market participants (FMPs) are not required to disclose eligibility as part of Articles 5 and 6 disclosures within the Taxonomy Regulation. However, if FMPs wish to explain the eligibility values of their product, they can do so as part of their periodic disclosures. The report advises that FMPs could disclose the percentage of revenues, capital expenditure (Capex), and operational expenditure (Opex) that is Taxonomy-eligible but not aligned. Still, it also notes that these investments should cause no harm according to Regulation (EU) 2019/2088.

2. Substantial Contribution

For substantial contribution, the key to determining it is that the data must be derived directly from the reporting company. The Platform on Sustainable Finance (PSF) outlined three potential scenarios to establish Taxonomy alignment in the absence of detailed company alignment reporting. Important to highlight that when data proxy is used, the approach must be conservative, avoiding underestimation of emissions or other scientific measurements.

Guidelines suggest that if a company has not reported key metrics required for substantial contribution, FMPs or data vendors should not estimate these values.

In cases where a company provides entity-level environmental metrics but lacks activity-level reporting, FMPs are permitted to use entity-level data to estimate the activity. However, a cautious approach must be maintained to avoid underreporting of metrics.

3. Do No Significant Harm (DNSH):

The ‘Do No Significant Harm’ (DNSH) encompasses qualitative, quantitative, and process-based criteria. The substantial contribution criteria combined with the DNSH criteria seek to ensure a baseline environmental performance in that the pursuit of one environmental objective doesn’t compromise another.

The PSF recommends not relying solely on environmental controversy scanning or adherence to local and national environmental laws to determine DNSH compliance. While such controversies and non-compliance can serve as signals for potential DNSH breaches, they are insufficient in themselves to confirm complete DNSH alignment.

Important to highlight also that ESG scoring models or DNSH assessments should always be complemented with detailed explanations of the methodologies utilized.

4. Minimum Safeguards (MS):

The “Minimum Safeguards” is a prerequisite for any economic activity to be classified as environmentally sustainable under Article 18 of the EU Taxonomy regulation. These safeguards are meant to ensure alignment with human rights standards defined by the OECD Guidelines and the United Nations (UN) Guiding Principles on Business and Human Rights (UNGPs).

The PSF here emphasizes the critical role of Human Rights Due Diligence (HRDD) – defined by the UN’s Office of the High Commissioner for Human Rights as “a way for enterprises to proactively manage potential and actual adverse human rights impacts with which they are involved” – in implementing these safeguards.

More specifically, the PSF provides guidance, including policy and procedures adoption, adverse impacts identification and mitigation, and public communication about these actions. Furthermore, the PSF establishes two critical criteria: adequacy of HRDD processes and the absence of human rights abuses due to improper HRDD implementation.

In summary, the complex reporting rules set by the EU Taxonomy pose significant challenges to banks, companies, and investors alike. The use of proxy data serves as a viable approach to bridge the gap in data availability and meet the stringent ESG reporting criteria. However, it’s crucial to understand that regulatory allowances for the use of such data are not unrestricted.

Specifically, the nature of proxy and estimated data that can be used is contingent upon the precise situation and the aspect of the EU Taxonomy assessment that it’s applied to – namely, Substantial Contribution, Do No Significant Harm (DNSH), and Minimum Safeguards. Thus, its application must be context-specific, meticulously assessed, and in line with the outlined requirements to ensure valid and compliant ESG disclosures.