_Summary

Artificial intelligence is transforming the banking and financial sector as we know it, with banks already reporting significant efficiency gains from generative AI. A 2024 Bain survey found financial services firms averaging around 20% productivity improvements, with major improvements in software code development, customer service, IT and more. AI enables more efficient operations across banking functions, streamlining processes and reducing human error. Other major consultancies echo these results, highlighting that AI-enhanced analytics enable substantial cost savings, for example by improving fraud detection and creditworthiness assessment in risk management.

The use of AI in banking may also present certain risks, particularly given the critical importance of security in financial services, but a 2025 IBM study revealed that 55% of CEOs in business and financial markets believe the potential productivity gains from automation are so substantial that accepting significant risks is necessary to remain competitive.

AI-Driven Risk Management in Banking

Banks are applying AI across many risk management functions. Key use cases include:

Detecting Fraud and Preventing Cyberattacks

Machine learning excels at spotting patterns of fraud or cyberattacks that elude manual checks. In a recent survey, 61% of bank risk executives identified AI-driven fraud detection as the highest-value use case for artificial intelligence integration, with another 52% of respondents highlighting the potential for cybersecurity protection. AI systems can analyze millions of transactions in real-time, flagging anomalies or known fraud patterns more effectively than rule-based systems. While still in an initial phase, practical use cases and results are emerging. For example, JPMorgan Chase has significantly reduced fraud rates and cut false positives, with a 20% reduction in validation rejections, by deploying AI for payment validation.

Improving Credit Risk Assessment

Advanced analytics can improve lending decisions. By analyzing large datasets including borrower profiles, repayment history, and borrower behaviors, AI models can predict default risk more accurately than traditional scorecards. McKinsey cites a case where a bank applied AI to its small-business lending pipeline, as AI-based credit scoring allows institutions to detect at-risk loans earlier, enabling proactive adjustments and reducing losses and capital charges.

Enhancing Stress Testing and Scenario Planning

Simulating extreme market conditions is another important AI application. According to IBM research, bank executives largely prioritize AI-driven stress-test simulations as a key initiative. AI can generate numerous macroeconomic or portfolio scenarios to assess how complex models behave under stress. Banks use this to discover model weaknesses, refine risk assumptions, and ensure regulatory capital adequacy. By carefully testing models before deployment, financial institutions gain confidence that their AI risk tools will perform safely under real-world volatility and market conditions.

Overall, the use of AI helps banks detect threats faster and make risk decisions more data-driven. Studies show AI-enabled risk management can improve fraud detection and credit assessment, and generate substantial cost savings in risk management. At the same time, banks must manage new challenges, since generative AI models can introduce biases or security risks, so financial institutions are emphasizing AI explainability, data quality, and human oversight in their AI deployments.

AI in Regulatory Reporting and Compliance

Beyond risk scoring, AI is reshaping banks’ reporting and compliance processes. European regulators are demanding ever-greater transparency, and are pressing banks to deliver disclosures that are granular and audit-ready. There’s an increasing number of rules and regulations in sustainable finance, from CSRD, ESRS and the EU Taxonomy, which are making artificial intelligence an indispensable ally for banks in their regulatory reporting efforts.

Meeting ESG and EU Taxonomy Requirements

Under the EU’s sustainable finance regulations, banks must assess the environmental alignment of their exposures. The Green Asset Ratio (GAR), is the proportion of assets aligned with the EU Taxonomy, introduced to signal the sustainability of a bank portfolio. Calculating the GAR is a complex task, even with the changes introduced by the Omnibus simplification package, as it requires structured, consistent ESG (Environmental, Social, Governance) data availability across counterparties.

Given the complexity of the EU taxonomy reporting calculations and questionnaires, manual spreadsheets are not the ideal tools for the job, and cross-departmental data collection ends up in exhaustive internal coordination processes.

Traditional approaches often result in:

- Data fragmentation across multiple departments and systems;

- Version control issues with constantly changing spreadsheets;

- Human error risks in complex calculations and classifications;

- Audit trail challenges when documenting compliance decisions;

- Time-intensive processes that delay regulatory submissions.

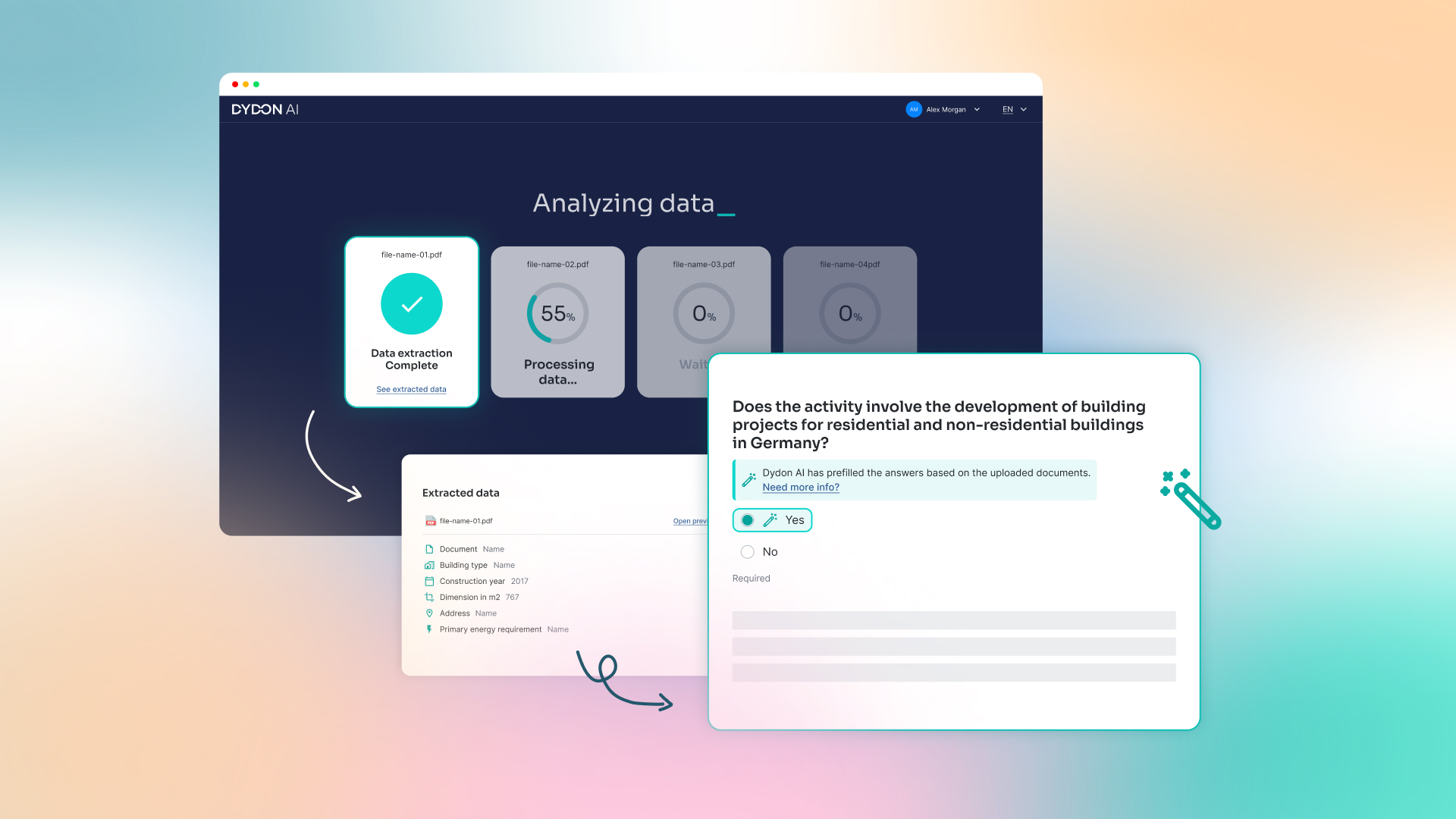

This is where an AI-powered sustainable reporting software, like the TAXO TOOL we built at Dydon AI, can substantially simplify EU taxonomy alignment by extracting relevant sustainability indicators from public and internal data, classifying activities, and constantly updating GAR estimates. This ensures that banks can navigate the complex EU Taxonomy requirements with confidence, maintaining full auditability while significantly reducing the manual workload usually required for compliance.

Automating Capital and Risk Disclosures

AI can automate data aggregation for complex banking reports, like Pillar-3 risk disclosures or IFRS 9 loan-loss provisions. Natural language processing (NLP) and machine learning (ML) for intelligent document analysis enable banks to generate regulatory narratives and check calculations across multiple data sources. For example, banks use AI to auto-fill compliance reports, freeing analysts from repetitive data collection. AI also improves reporting accuracy by catching errors or inconsistencies.

Digitizing Compliance Documentation

Many banks treat compliance record-keeping as a proving ground for AI since it allows firms to build trust in AI outputs while training models on historical audit trails. By using artificial intelligence to review transaction logs, KYC files, and audit reports, banks can accelerate internal reviews and ensure no compliance issue is omitted. Over time, the data collected in these “exercises” helps banks refine and expand into more sophisticated automation.

CSRD and ESG Data Integration

The European Sustainability Reporting Standards (ESRS), the Corporate Sustainability Reporting Directive (CSRD), and the EU Taxonomy regulation, significantly expand ESG reporting disclosure requirements and are prompting banks and large companies to adopt AI-powered sustainability reporting tools to extract climate and ESG metrics from unstructured sources and compile them into structured reports.

Sustainability experts are well aware that banks have difficulties to incorporate ESG data, since the datasets lack quality, standardization, structure, and traceability, making AI a key enabler for ESG data management and reporting.

As the EU seeks to uphold the ambitious goals of the European Green Deal while delivering on its promise of administrative relief through deregulation, compliance excellence is shifting away from manual effort toward AI-driven systems. Today’s evolving AI architectures can absorb regulatory volatility, normalize unstructured ESG data, and automatically document every step, ensuring audit readiness. In a landscape defined by uncertainty, one thing is clear: banks that embrace these capabilities will gain a decisive advantage over their competitors.

Navigating AI Regulation: The EU AI Act

European banks face new AI-specific rules. The EU AI Act, which was formally adopted by the European Council in May 2024 and came into force in August of last year, established a risk-based framework for AI, and crucially for banking, classified credit-scoring and similar decision-making models as “high-risk.”

This means banks must document these AI systems thoroughly and comply with strict requirements regarding accuracy, robustness, and transparency. The legislation mandated that banks maintain an AI inventory, comprehensive technical documentation, risk management processes, and human oversight for high-risk AI.

Non-compliance exposes banks to heavy fines of up to 7% of global annual revenue or €35 million (whichever is greater). Financial institutions have then to ensure their AI tools, especially those affecting lending or compliance, are auditable and bias-controlled to meet the EU AI Act’s standards.

Enabling the Future of Banking with AI

Despite regulatory changes and global geopolitical uncertainties, the trend toward AI in banking is accelerating with heavy investments. Forward-thinking financial institutions understand that now is the time to act, by embedding AI across risk management and reporting.

The regulatory framework changes of the Omnibus simplification packages and the delays introduced by the EU’s “Stop-the-Clock” directive are part of an ongoing regulatory process and should be seen as a major opportunity for European banks to leap ahead with AI and set the foundation for future growth. In fact, AI-powered banks can underwrite more loans at lower risk, detect fraud sooner, respond faster to market shocks, accelerate the transition to sustainable finance to reduce the environmental footprint, and ultimately obtain stronger financial and sustainability performance.

As Chris Scislowicz, Managing Director and Global Lending Lead at Accenture, put it: “Most bank execs are sincere about reaching their sustainability goals. […] But few know how. Banks have earmarked $130 trillion to tackle climate change and sustainable development. Yet they’re struggling to make progress on operationalizing these ambitions.” This gap between ambition and execution underscores the urgency for practical, AI-driven solutions that deliver impact.

In a financial services industry increasingly defined by sustainability, transparency, resilience, and real-time data, is a core driver of competitiveness and compliance. In short, AI adoption becomes not just optional but strategic.

At Dydon AI, we partner with banks to deliver configurable, explainable AI solutions tailored to today’s regulatory demands. Our AI tools empower financial institutions to accelerate sustainable finance reporting and adapt confidently to the evolving European compliance landscape. Request a demo today!

Get your free demo

Let’s get in touch, our experts will show you through our solutions with a live demo!