AI solutions for Compliance & Reporting

Trusted by banks. Powered by AI.

Your AI Co-Pilot for Compliance

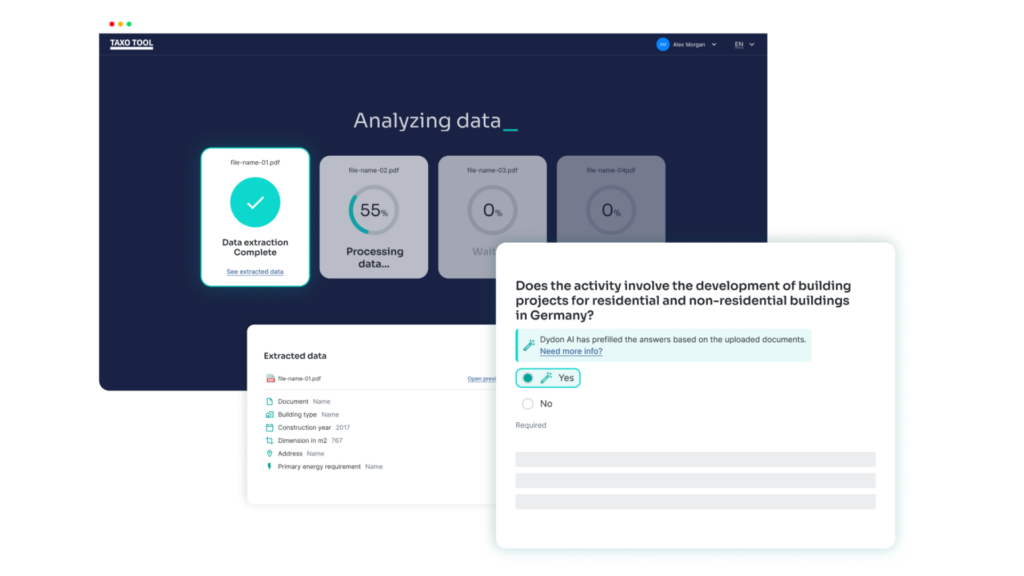

From sustainability disclosures to cross-framework compliance, our AI platform based on Natural Language Processing (NLP) helps ESG, sustainability, and compliance or legal teams with various AI solutions to make sense of evolving regulations and keep pace with reporting obligations — securely and efficiently.

_More AI modules

How Dydon AI’s technology works

_01

Data Capture and Crawling

_02

Natural Language Processing and Data Preparation

_03

Calculating KPI’s for the ranking

_04

Prediction: aggregation via linear and non-linear inference

_05

Transparent result presentation