Environmental, Social, and Governance (ESG) factors and the EU Taxonomy are no longer just buzzwords – they’re reshaping the business landscape. Consumers are voting with their wallets, investors are demanding transparency, and regulators are tightening disclosure requirements.

A recent PwC survey revealed that over 60% of consumers base purchasing decisions on sustainability, a trend that shows no signs of slowing down, with a 10% growth year over year.

In 2023, companies in Germany reported the highest taxonomy-aligned investments (€114bn), followed by France, Spain, and Italy. Companies with high Taxonomy alignment have outperformed the overall market. Additionally, mortgages and other loans to activities within the scope of the Taxonomy represent over 50% of the assets of large EU banks, based on first-year figures.

This growing emphasis on ESG and EU Taxonomy presents a large opportunity for businesses to demonstrate their commitment to sustainability. However, it also poses a considerable challenge due to the complexities of reporting – challenges that can easily overwhelm even the most dedicated compliance teams.

Challenges of ESG and EU Taxonomy Reporting

Here are some of the most common challenges:

- Dynamic Regulatory Environment: The EU Taxonomy and the EU sustainable finance framework are constantly evolving, with new economic activities, evolving technical screening criteria (TSC), and changing reporting standards.

- Extensive Regulatory Know-How and Document Analysis: Manual analysis of extensive regulations and documentation to identify and extract relevant data is a time-draining activity. Highly skilled sustainability personnel are required, especially for bank compliance, where the regulatory understanding concerns many economic activities in all its details (over 150 EA now in the EU Taxonomy).

- Data Discrepancies: Some organizations struggle with a lack of sustainability data (ESG / EU Taxonomy / CSRD), while others are overwhelmed by the sheer volume. Finding the right balance between data availability and efficient analysis is a perpetual challenge.

- Complexity and Scalability: The EU Taxonomy’s extensive list of economic activities, each with unique criteria, presents a formidable challenge, especially for highly regulated entities like banks. Ensuring consistent and accurate reporting across diverse projects demands a standardized yet scalable approach where AI can play a key role.

How AI empowers Sustainability and ESG Managers

AI, particularly with Natural Language Processing (NLP) models, can be of great help to sustainability managers dealing with ESG and EU Taxonomy reporting. These models, including Large Language Models (LLMs) and Retrieval-Augmented Generation (RAG), empower organizations to overcome the complexities and time-consuming tasks related to compliance.

Key AI Capabilities for ESG Compliance:

- Intelligent Document Analysis: AI algorithms are capable of quickly analyzing numerous documents, such as annual reports, sustainability policies, and regulatory texts. This enables the identification of relevant data points, key performance indicators, and other essential information for EU Taxonomy reporting.

- Data Extraction and Validation: AI can automatically extract and validate specific data elements, reducing the need for manual data entry and minimizing errors, ensuring accuracy and consistency.

- Regulatory Compliance Mapping: AI-powered tools can compare internal policies and procedures against evolving regulatory frameworks. This helps identify gaps and inconsistencies, allowing organizations to adjust their practices and ensure compliance.

- Automated Report Generation: AI can generate reports based on extracted data and pre-defined templates, significantly reducing the time and effort required for manual report preparation.

Dydon AI’s Modular Platform for compliance needs

Dydon AI’s platform elevates AI-powered compliance with a modular approach, allowing banks and corporates to utilize specifically built modules thought to solve their unique compliance challenges:

- Secure Document Analysis and Data Capture: Dydon AI’s advanced LLM and RAG models efficiently extract required content for various topics (e.g. ESG, Emission Documents, etc.) from documents regardless of its formatting. This ensures secure processing and storage of sensitive information.

- Internal Policy Mapping: this Dydon AI’s module accurately compares internal policies with external regulatory documents, highlighting discrepancies and facilitating necessary amendments. This helps organizations stay aligned with evolving regulations.

- Customizable Training: Dydon AI’s platform can be trained on specific customer needs, adapting to various compliance requirements and industry-specific regulations. This flexibility ensures that the AI models deliver the most relevant and accurate results.

All AI services, documents, and extracted content are exclusively processed and stored on Dydon AI’s secure SaaS servers, ensuring maximum data security and confidentiality.

Contact us to schedule a demo!

Efficient EU Taxonomy reporting with Dydon AI

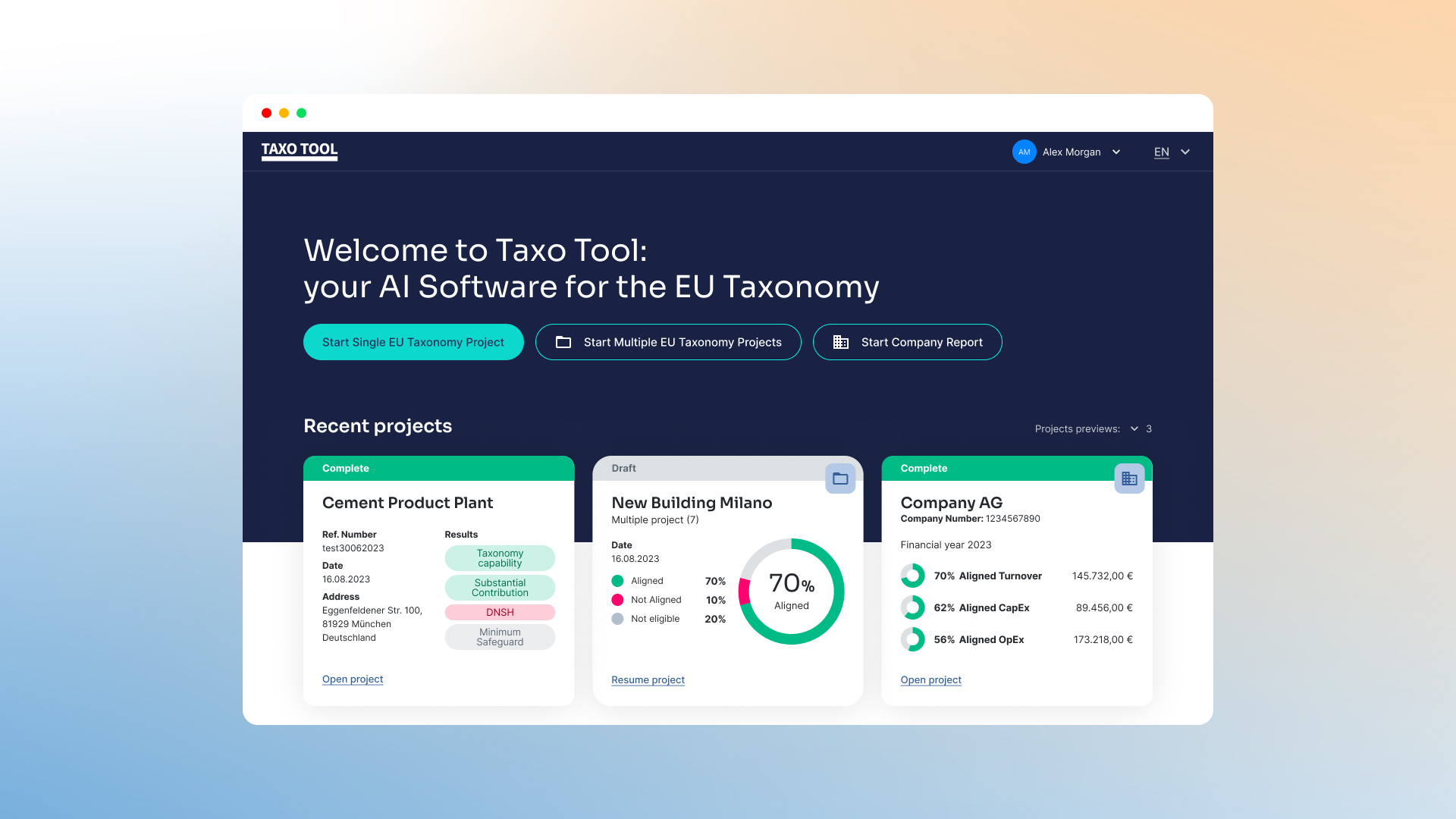

Dydon AI’s TAXO TOOL is designed to simplify EU Taxonomy reporting, offering a streamlined and efficient solution for financial institutions. Here are its key features:

Document Reading and Data Capture:

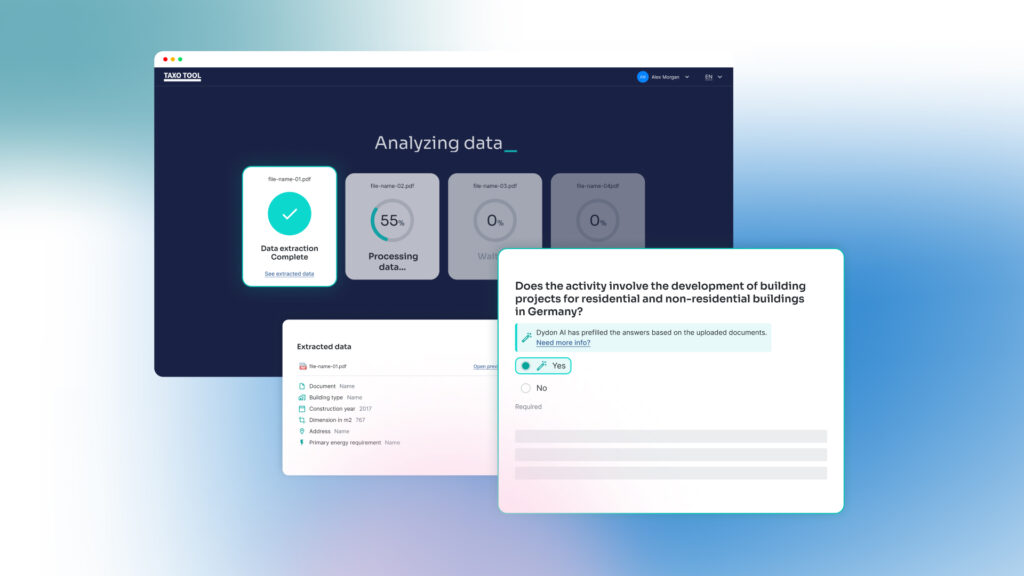

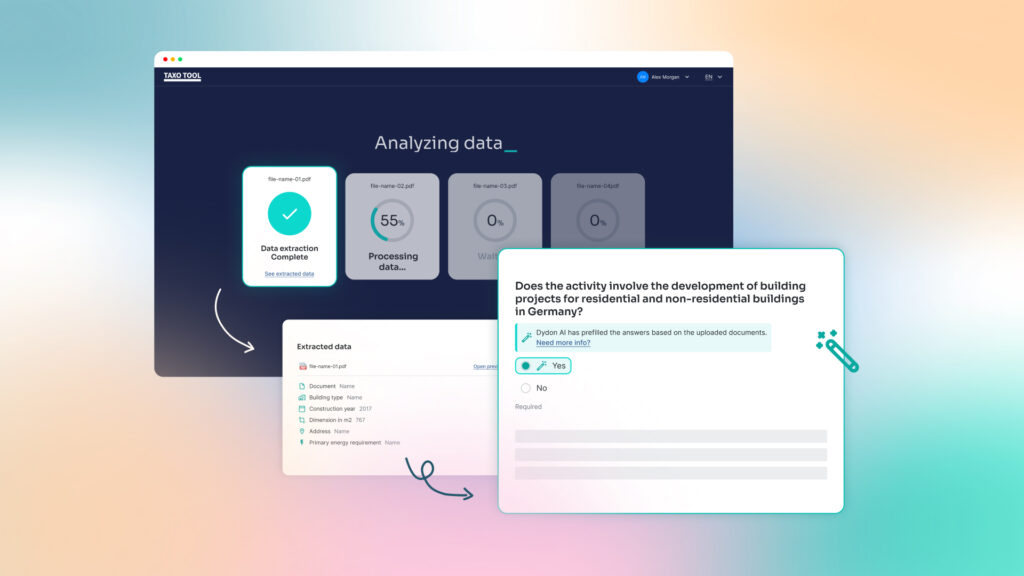

The solution leverages AI language models to capture numeric and textual data from various documents, and specifically for energy certificates for buildings these extracted data can be used to suggest appropriate answers to EU Taxonomy questions, accelerating the assessment process.

Carbon Emissions and Technical Screening Criteria (TSC) Calculations:

Automated calculations related to carbon emissions and other technical screening criteria ensure an easy and accurate assessment process. This is particularly valuable for financial institutions assessing SMEs or private customers without readily available carbon emission data.

Geological and Climate Risk Assessment through Geolocation:

Taxo Tool retrieves relevant risks by simply entering the project address, integrating the data from Munich Re to provide geolocation-based assessments of climate and geological risks during the Do No Significant Harm (DNSH) assessment.

Transparency of the Assessment Process:

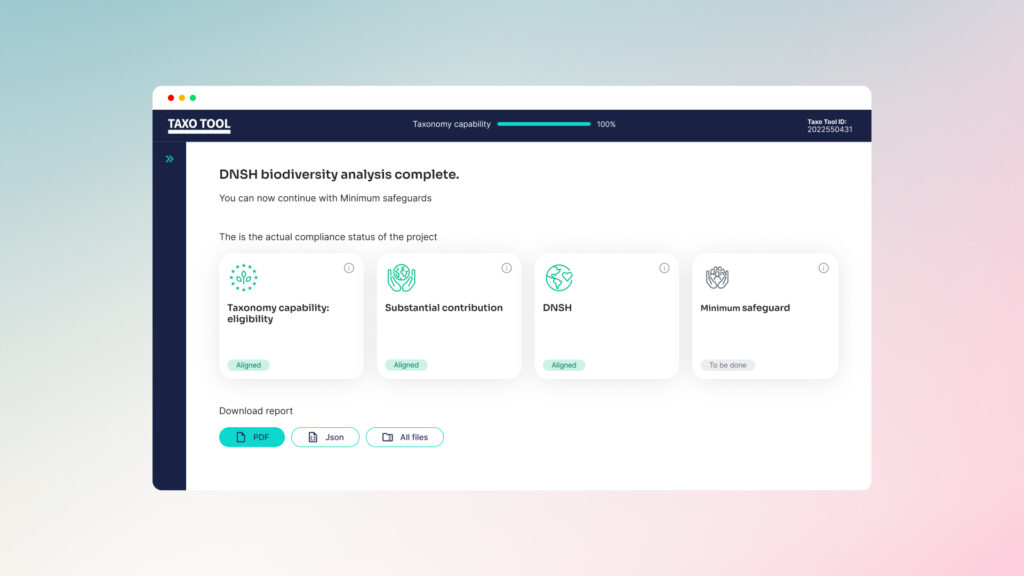

The solution enables companies to keep always an eye on the complex EU Taxonomy assessment processes through diagram flows allowing users to easily navigate and understand the various assessment stages, promoting transparency and clarity.

Streamlined Assessments:

Taxo Tool offers guidance to the user through the questions and requirements of the EU Taxonomy to simplify the assessment regarding the alignment of Substantial Contribution, Do No Significant Harm, and Minimum Safeguards criteria to a specific environmental goal.

EU Taxonomy Alignment Reporting:

It ensures audit readiness and facilitates stakeholder communication with readily available reports for completed assessments and ongoing projects.

By combining these features with a user-friendly interface and intelligent guidance we enable our clients to confidently assess and report their alignment with the EU Taxonomy, saving valuable time and resources while ensuring compliance.

Ready to streamline your EU Taxonomy reporting? Contact us to schedule a demo!