As 2025 approaches, the European regulatory landscape is set to undergo key changes and enter a new phase for the EU Taxonomy. This significant transition challenges organisations to prepare for stricter compliance requirements while meeting an expanded set of environmental objectives. Organisations will need to demonstrate full compliance with technical screening criteria and sustainability benchmarks.

This article delves into the evolving regulatory landscape, unpacking its implications for businesses while spotlighting the transformative role of artificial intelligence. From simplifying compliance processes to enhancing reporting accuracy, we explore how AI can help companies to meet the demands of the EU Taxonomy.

The Scope of the EU Taxonomy: Complexity and Evolution

The EU Taxonomy serves as a comprehensive framework to define and standardise sustainable economic activities, promoting transparency, and redirecting capital flow towards sustainable investments. This aligns with the European Green Deal‘s goals of achieving a climate-neutral economy by 2050 and reducing greenhouse gas emissions by 55% by 2030.

The EU Taxonomy is built on three key pillars:

- Substantial Contribution: Activities must make a measurable positive impact on specified environmental objectives.

- Do No Significant Harm (DNSH): Activities must not compromise other sustainability goals.

- Minimum Safeguards: Organisations must adhere to basic social and governance standards.

The EU Taxonomy framework incorporates both eligibility and alignment assessments:

- Eligibility: Identifies activities that can potentially be considered sustainable.

- Alignment: Determines if these activities meet the specific criteria for sustainability.

It’s important to highlight here that companies have been required to report eligibility for new activities from January 2024 and alignment from January 2025, indicating a gradual implementation process.

The Complexity of the 6 Environmental Objectives

The Taxonomy Regulation establishes six environmental objectives: 1. climate change mitigation; 2. climate change adaptation; 3. sustainable use & protection of water and marine resources; 4. transition to a circular economy; 5. pollution prevention & control; 6. protection and restoration of biodiversity & ecosystems.

Since January 2021, companies subject to the EU Taxonomy have been required to disclose their alignment with the first two objectives. In June 2023, the European Commission introduced new criteria for economic activities contributing to the remaining four objectives.

From 1 January 2024: Non-financial undertakings have been required to report taxonomy eligibility for the four non-climate environmental objectives and the new criteria for the two climate-focused objectives. Financial undertakings had to report eligibility.

From January 1, 2025: Non-financial undertakings will be required to report taxonomy alignment for the four non-climate environmental objectives and the new criteria for the two climate-focused objectives.

From January 1, 2026: Financial undertakings will be required to report taxonomy alignment for the four non-climate environmental objectives and the new criteria for the two climate-focused objectives.

Sector-Specific KPIs and Considerations

Financial Institutions

Financial institutions face unique reporting requirements under the EU Taxonomy:

- Banks: Credit institutions are required to report the Green Asset Ratio (GAR). This key performance indicator (KPI) represents the proportion of exposures related to Taxonomy-aligned activities compared to the total covered assets. The GAR effectively measures the percentage of a bank’s assets invested in environmentally sustainable activities as defined by the EU Taxonomy.

- Asset Managers: Investment firms and asset managers must report the Green Investment Ratio (GIR), which shows the proportion of Taxonomy-aligned investments in relation to the total assets under management (AuM), excluding sovereign exposures. It provides insight into how much of the managed portfolio aligns with sustainable activities. These KPIs require detailed alignment data across lending portfolios and investment activities, necessitating robust data collection and analysis systems.

Corporates

Non-financial companies are required to report on three main KPIs:

- Taxonomy-aligned Turnover: This is calculated by dividing the net turnover derived from products or services associated with Taxonomy-aligned economic activities by the total net turnover.

- Taxonomy-aligned Capital Expenditure (CapEx): This represents the proportion of CapEx related to assets or processes associated with Taxonomy-aligned economic activities. It’s calculated by dividing the Taxonomy-aligned CapEx by the total CapEx.

- Taxonomy-aligned Operating Expenditure (OpEx): This covers direct non-capitalized costs related to research and development, building renovation measures, short-term leases, maintenance and repair, and other direct expenditures relating to the day-to-day servicing of assets of property, plant and equipment. The Taxonomy-aligned OpEx is divided by the total OpEx to get this KPI.

Preparing for 2025: Timelines and Updates

As we have seen, full alignment under the EU Taxonomy is set to commence in January 2025. Companies must use enhanced reporting that accounts for both eligibility and alignment. Additionally, they are required to provide qualitative information explaining these calculations and key elements of the KPIs as outlined in the Commission Delegated Regulation.

However, the reporting timelines vary depending on organisational type:

- Non-Financial Undertakings: From January 1, 2025, large non-financial companies must report taxonomy alignment for the four non-climate environmental objectives, with the first reports due in 2026.

- Large Listed Companies with Over 500 Employees: These entities have already been reporting fully on taxonomy information since 2023.

- Large Listed and Non-Listed Companies with Over 250 Employees: From 2025, these organisations will be required to report on taxonomy-eligible and -aligned activities, with initial disclosures due in 2026.

It is also important to acknowledge that on 29 November 2024, the European Commission released a Draft Commission Notice alongside a set of Frequently Asked Questions (FAQs) to clarify the interpretation and application of the EU Taxonomy Environmental Delegated Act, Climate Delegated Act, and Disclosures Delegated Act. These documents are crucial for organisations aiming to align with 2025 requirements, as they provide:

- Detailed Guidance on General Taxonomy Requirements: Ensuring consistent interpretation and application.

- Technical Screening Criteria Clarifications: Addressing specific environmental objectives in the Climate and Environmental Delegated Acts.

- DNSH (Do No Significant Harm) Criteria: Offering comprehensive insights into ensuring activities do not hinder other objectives.

- Reporting Obligations: Clarifying requirements for compliance with expanded and updated objectives.

Leveraging AI for EU Taxonomy Compliance

AI-powered solutions for EU Taxonomy compliance are gaining traction, as these tools can assist organisations in multiple aspects, such as:

- Data Extraction: Automated systems retrieve relevant information from financial, operational, and environmental documents, minimising errors and inconsistencies. Specifically, Retrieval Augmented Generation (RAG) can assist in data collection for Taxonomy and ESG reporting by automating the extraction of relevant information from various documents.

- Regulatory Mapping: AI aligns internal activities with external regulatory frameworks, identifying gaps and suggesting corrective actions.

- Dynamic Updates: AI systems incorporate real-time regulatory changes, ensuring compliance readiness.

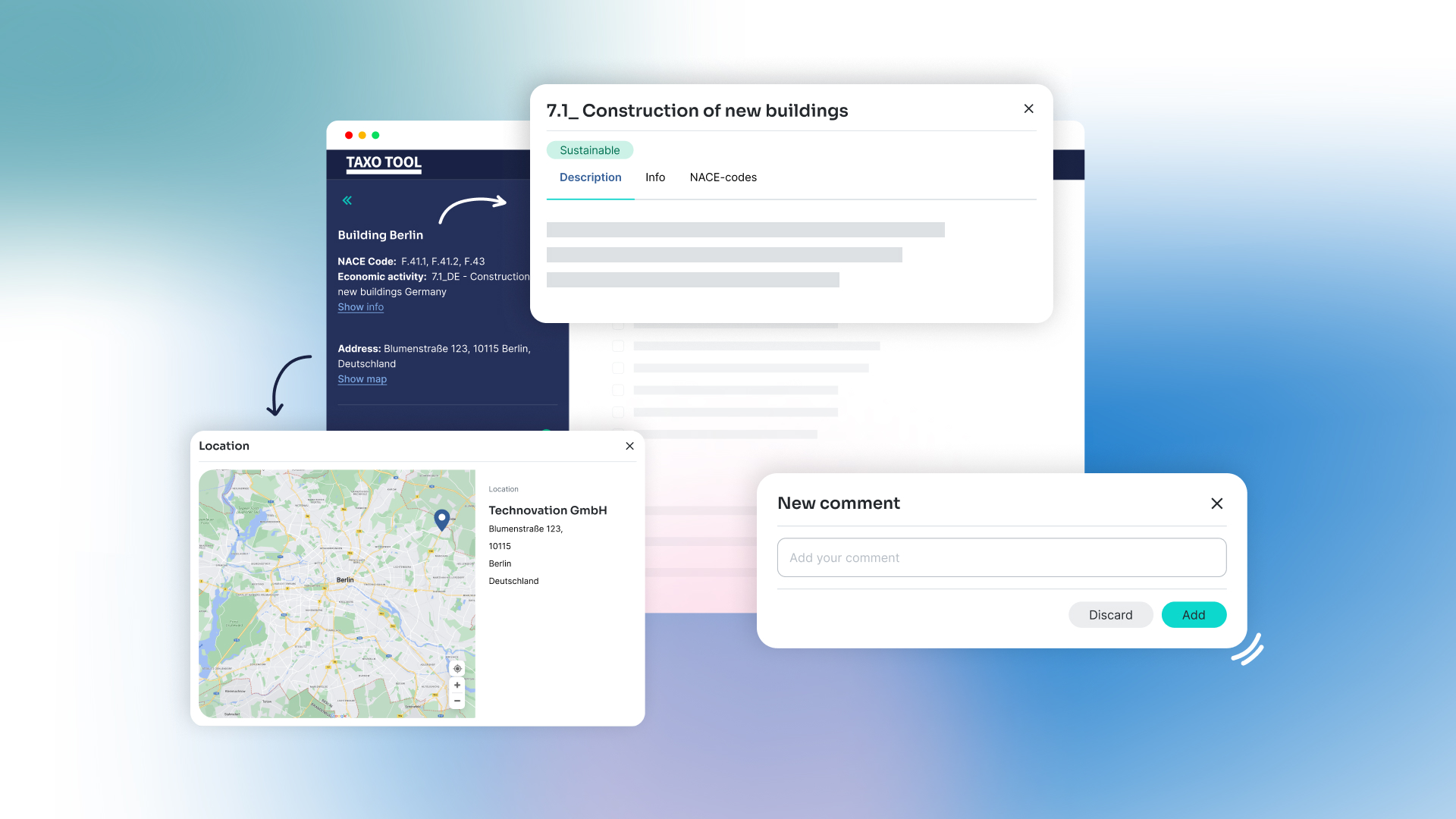

AI solutions, like the Dydon AI’s TAXO TOOL, have already proven their capabilities to streamline the EU Taxonomy processes. By integrating AI-driven insights into reporting workflows, organisations can:

- Ensure transparency with detailed compliance visualisations.

- Reduce the administrative burden of repetitive tasks.

- Improve data accuracy for audit readiness and regulatory confidence.

Why use Dydon AI’s TAXO TOOL for the EU Taxonomy reporting in 2025?

Dydon AI’s TAXO TOOL is an AI-powered solution specifically designed to simplify EU Taxonomy compliance for financial institutions and corporations. This tool provides a comprehensive approach to meeting sustainability reporting requirements, with some key features that include:

- Geolocation-Based Risk Assessment: By inputting a project’s address, TAXO TOOL retrieves geological and climate risks specific to that location, incorporating data from Munich Re to enhance the ‘Do No Significant Harm’ (DNSH) assessment.

- Automated Data Extraction: Utilising advanced AI language models, the tool captures numerical and textual data from diverse documents, such as energy certificates for buildings, ensuring accurate and efficient assessments.

- Regulatory Updates Integration: The tool ensures that changes in EU Taxonomy regulations are automatically incorporated, keeping compliance processes up-to-date.

- User-Friendly Interface: Featuring diagram flows, the tool guides users through different assessment stages, promoting transparency and clarity throughout the compliance process.

- Audit-Ready Reporting: Comprehensive reports generated by TAXO TOOL facilitate audit preparation and improve stakeholder communication, ensuring regulatory confidence.

If you want to streamline workflows, enhance transparency, and confidently meet the demands of the EU Taxonomy reporting in 2025, get in touch and book a free demo!