Despite the latest changes to EU sustainability regulations under the Omnibus Directive, large industrial companies across sectors — from energy and transport to chemicals, real estate and ICT — remain under pressure to comply with the requirements for timely, high-quality ESG disclosures, from the EU Taxonomy report to CSRD and more.

This article examines the latest regulatory developments impacting sustainability reporting, including the Omnibus I simplification package and the “Stop-the-Clock” directive. It highlights what changes are confirmed, what’s still pending, and what obligations remain in force for 2025. We also explore how companies can meet their EU Taxonomy and CSRD reporting requirements, look at practical guidance on how to efficiently tackle sustainability reporting using AI-powered software solutions.

Omnibus Package: EU Taxonomy and CSRD Changes

The European Commission recently unveiled an “Omnibus I” simplification package proposing amendments to multiple regulations, notably the Corporate Sustainability Reporting Directive (CSRD), the EU Taxonomy, and the Corporate Sustainability Due Diligence Directive (CSDDD), in one go. This package aims to reduce red tape (with a stated goal of cutting reporting burden by 25% for large companies) while still upholding the EU’s sustainability ambitions of the European Green Deal.

The “Stop-the-Clock” directive – relief on timelines:

The most immediate change, is a two-year delay for CSRD reporting obligations for most companies. Large companies that would have begun sustainability reporting in 2026 (so-called “Wave 2” firms) now have until 2028 to start, and listed SMEs (“Wave 3”) have until 2029. The “Stop-the-Clock” directive also delays the new CSDDD requirements by one year for the largest companies.

This extension recognizes the complexity of gathering ESG data and implementing processes, giving companies extra time to prepare. Importantly, the measure also impact the EU Taxonomy to some extent – companies that are not yet in scope of the Corporate Sustainability Reporting Directive will likewise get a reprieve from mandatory EU Taxonomy disclosures.

In short, the clock has been momentarily stopped on some deadlines, but it hasn’t reset ongoing obligations for those already under existing rules.

Proposed changes to EU Taxonomy scope and criteria:

Alongside the timeline postponement of the “Stop-the-Clock, the larger Omnibus package outlines several simplifications to EU Taxonomy reporting.

First, the scope of who must report taxonomy metrics would narrow, as only companies with more than 1,000 employees and more than €450 million turnover would be required to report their Taxonomy alignment.

Second, companies may be allowed to report “partial alignment”, crediting activities that meet some technical screening criteria even if they don’t meet every single requirement.

Simplifying technical screening criteria (TSC) and DNSH:

The European Commission has not changed the core definition of what counts as a “sustainable activity”, with the pillars of Substantial Contribution (SC), Do No Significant Harm (DNSH), and Minimum Safeguards that remain intact. However, they propose making the reporting process less granular and onerous. Standard reporting templates would be streamlined, potentially cutting out up to 70% of the data points companies originally had to provide, with companies that would be able to exclude very small or financially insignificant activities from the Taxonomy assessment using a de minimis threshold. In other words, if an economic activity represents less than 10% of turnover and is not financially material, a company might skip the detailed technical screening for that activity.

Many of these proposed changes, including the revised scope for Taxonomy reporting and the allowance for “partial alignment,” are expected to be formally introduced via Delegated Acts. These acts, issued by the European Commission, are the legal instruments used to amend or refine the EU Taxonomy’s technical screening criteria and implementation details.

For completeness, it’s worth noting that financial institutions see some adjustments too. For example, under the Omnibus proposals, banks could exclude certain exposures (clients outside the CSRD scope) from the denominator of their Green Asset Ratio calculation.

This change would raise banks’ reported green ratio by not “penalizing” them for clients who don’t report sustainability data. This underscores a larger effort to make metrics like the Green Asset Ratio and the Taxonomy alignment more representative and less burdensome.

2025 Reporting Obligations: No Time to Relax for Big Companies

Even with potential simplifications on the horizon, companies already under the sustainability reporting scope have significant duties in 2025. In particular, large companies that were subject to the prior Non-Financial Reporting Directive (NFRD) – effectively most large public-interest companies in the European Union – must move forward with sustainability reporting for fiscal year 2024, because they fall in “Wave 1” of CSRD adoption.

This means that in 2025, these companies will publish their first CSRD-compliant sustainability report, in accordance with the European Sustainability Reporting Standards (ESRS), covering a comprehensive set of ESG disclosures.

Crucially, EU Taxonomy reporting is still required for 2024 data. This year marks an important expansion: for the first time, companies have to assess all six environmental objectives defined in the Taxonomy. Previously, the reporting was focused only on climate change objectives, but starting with FY2024, non-financial companies must report Taxonomy eligibility and alignment for all the six environmental objectives (climate, water, circular economy, pollution, biodiversity).

So, for many large companies, 2025 brings a double reporting challenge: producing a full CSRD / ESRS sustainability report (with all the narrative and qualitative ESG disclosures that entail) and completing the quantitative EU Taxonomy alignment report for 2024.

Streamlining EU Taxonomy Reporting with Software and AI

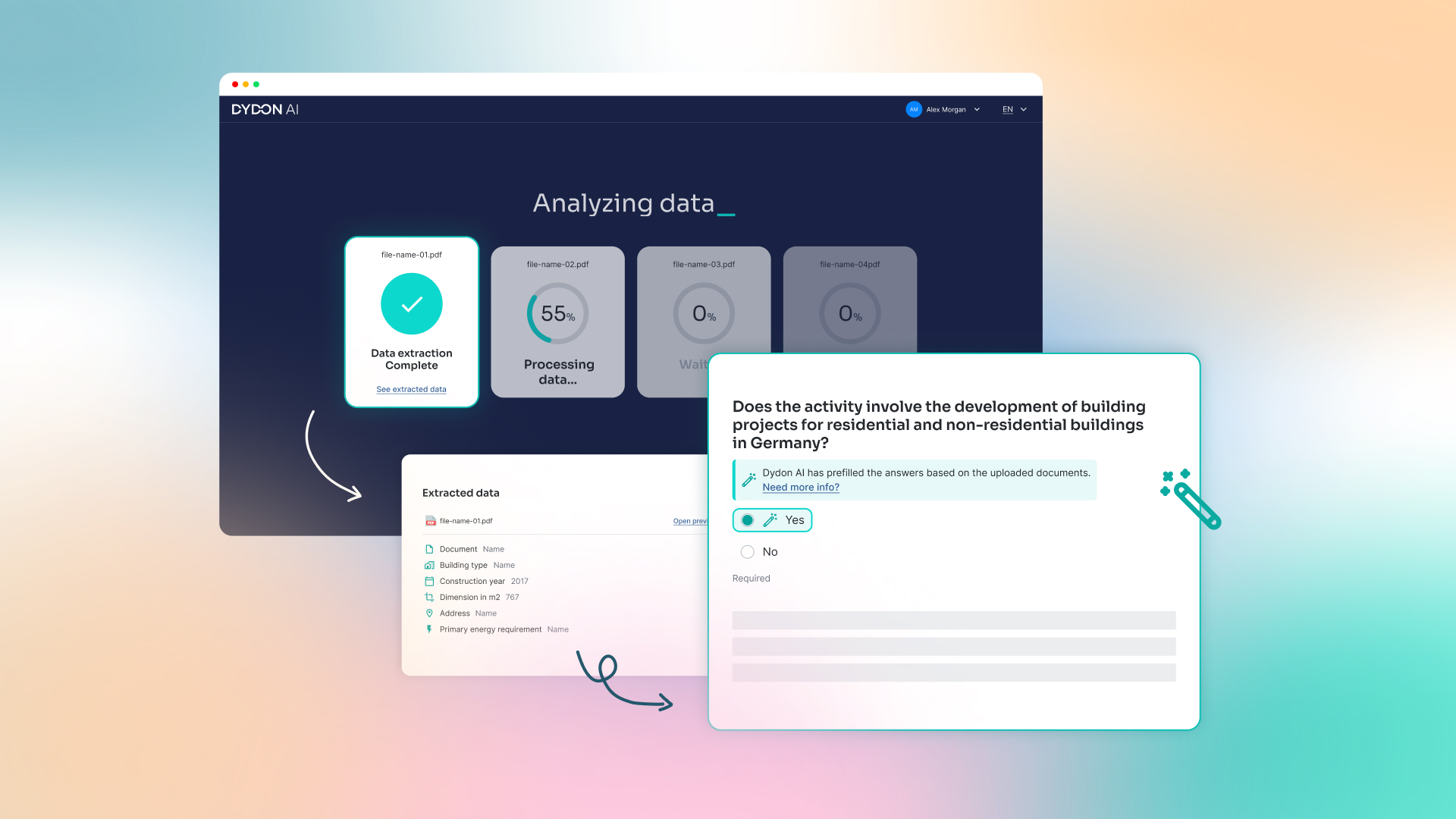

Given the complexity of the EU taxonomy reporting calculations and questionnaires, manual spreadsheets are not the ideal tools for the job, and cross-departmental data collection ends up in exhaustive internal coordination processes. This is where a sustainability reporting software, such as Dydon AI’s sustainability solution, makes a difference. The process of EU Taxonomy assessment using Dydon AI’s Taxo Tool typically works as follows:

- Company Profile Setup: Define all relevant data of the company

- Economic Activity Mapping: Within a newly created financial year, identify and list all of your company’s economic activities with their corresponding taxonomy categories and NACE codes, supported by search and filter functions.

- Substantial Contribution Screening: Assess each activity against quantitative and qualitative criteria, with AI assisting in data extraction and calculations.

- DNSH and Minimum Safeguards Checks: Verify that activities do not cause significant harm to other objectives and comply with social safeguards, with AI evaluating risk factors like climate exposure.

- Linking Activities to Financial KPIs (Turnover, CapEx, OpEx): Allocate financial figures to activities, tagging expenditures by Taxonomy categories

- Report Generation: Automatically compile results into the required Article 8 disclosure format, downloadable in Excel, ready for your audit trail.

Practical Challenges in Gathering Data, and How a AI Helps

Even with a robust process in place, companies face real-world challenges with the EU Taxonomy. Here are the most common pain points and how a dedicated sustainability reporting platform can help:

1. Mapping Eligible & Not Eligible Activities

For diversified companies, the first hurdle is mapping all business activities based on the Taxonomy-eligibility criteria, before even checking the alignment of each of them. Specialized corporate sustainability reporting software (like Taxo Tool) provides a comprehensive, up-to-date registry of all EU Taxonomy activities and NACE codes, ensuring no eligible activity is missed and that mapping is conducted systematically.

2. Gathering Sustainability Data to meet Technical Screening Criteria (TSC) for Alignment

Once activities have been mapped, companies must collect technical evidence to meet the EU Taxonomy’s Technical Screening Criteria (TSC). This may include emissions data, energy consumption and energy efficiency ratings. Often, this data is scattered across different departments and systems.

A dedicated tool can capture this data, track progress and centralise documentation. AI-powered features can extract figures from technical documents, transforming a potentially month-long search into a quick database query.

3. Coordinating Across Teams

As it involves diverse internal departments, from operations and sales to R&D, procurement, HR and finance, sustainability reporting is highly cross-functional. If this process is managed using spreadsheets and emails, it can be difficult to handle the inputs from many different stakeholders without errors occurring.

4. Mapping Data of Financial KPIs (Turnover, CapEx, OpEx)

Finance teams must assign KPIs of turnover, CapEx and OpEx to each economic activity in the report. Integrated tools connect with financial documents, automate data extraction and ensure that reported figures align with company totals. This streamlines the process and facilitates accurate, auditable reporting.

From ESG Compliance Burden to Strategic Opportunity

Important noting that as of May 2025, only the timeline delays of the Stop-the-Clock directive are confirmed; the other changes to scope and criteria are expected to be finalized in the coming months. Companies should stay tuned for final approval of these rules, but also consider that so far core 2025 sustainable reporting obligations remain in force despite talk of simplification.

Overall, if the EU sustainability reporting can feel overwhelming, especially with evolving regulations and tight deadlines, companies that plan ahead and invest now in structured processes and advanced AI tools are turning compliance into a strategic asset.

By addressing these practical challenges head-on and leveraging AI and sustainability reporting tools like Dydon AI’s Taxo Tool, organizations can move beyond compliance, enhance sustainability performance, and stay ahead of their competitors by building a reliable ESG data foundation for better decision-making and readiness for future regulatory changes.