Time needed: 6 minutes

This article in short:

- What is the Omnibus regulation and the Stop-the-Clock directive?

A short introduction to the recent Omnibus simplification package, including which regulations are affected and the main regulatory postponements in terms of timeline following the recently approved Stop-the-Clock directive.

- Sustainable finance reporting: compliance or competitive differentiation?

This postponement could be seen by banks and other financial institutions as a major opportunity to prepare for the future by organising themselves internally with tech and AI solutions that will also enable them to differentiate competitively in terms of how they deal with compliance and regulatory issues.

- AI: The Essential Tool for EU Sustainability Reporting Compliance

Constant regulatory changes make it clear that artificial intelligence (AI) could be the future for handling cross-regulatory monitoring, keeping up to date, and simplifying reporting.

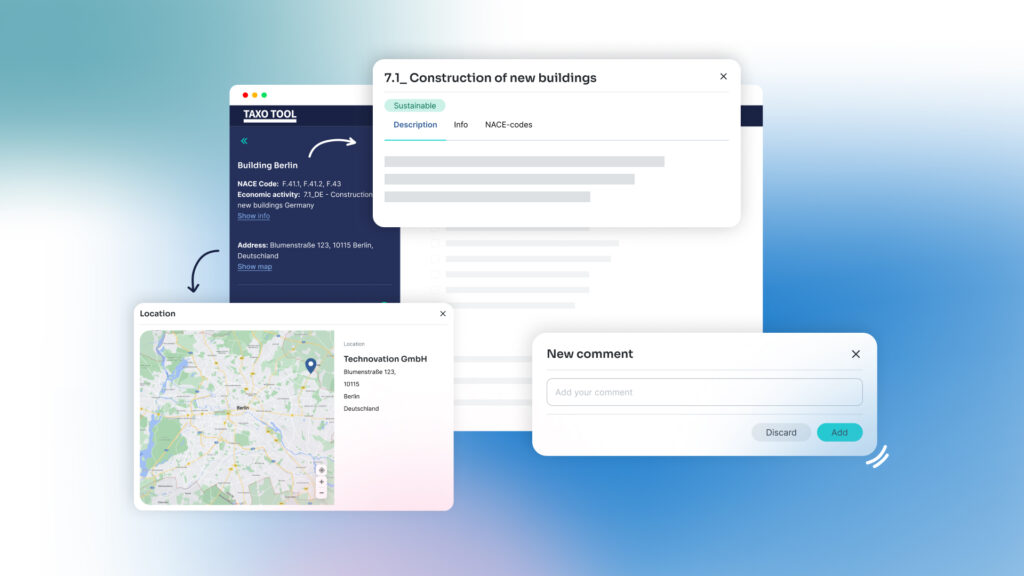

- Dydon AI’s Tools for Sustainability and EU Taxonomy Reporting

Taxo Tool is one of the AI solutions already in use by several German banks. It enables the fast and efficient streamlining of EU Taxonomy reporting. Dydon AI also provides other cross-regulatory AI applications, such as regulatory mapping and gap identification, and solutions for capturing ESG data from documents.

- The Big Opportunity for European Banks

The banks that will emerge as leaders are those that see sustainability as a strategic opportunity, not just a compliance issue, and use AI to turn this vision into reality.

What is the Omnibus regulation and the Stop-the-Clock directive?

The European Union’s recent “Stop-the-Clock” directive, which formally received its final approval from the European Council on April 14, 2025, creates both breathing room and strategic questions for financial institutions.

This directive postpones reporting and due diligence obligations for certain companies under the Corporate Sustainability Reporting Directive (CSRD), the EU Taxonomy Regulation, and the Corporate Sustainability Due Diligence Directive (CS3D). It forms a significant component of the recently presented EU’s “Omnibus I” simplification package, adopted by the European Commission in late February 2025 to streamline EU sustainability legislation.

The measure institutes two significant regulatory postponements:

– A two-year extension for CSRD implementation, providing additional preparation time for large companies that haven’t yet started reporting (Wave 2) and listed SMEs (Wave 3). In other words, large companies and banks now have until 2028 to begin CSRD reporting for the fiscal year 2027, with listed SMEs following a year later.

– A one-year delay for the CSDDD‘s initial implementation phase and transposition deadline, from July 2027 to July 2028, affecting primarily the EU’s largest companies.

This move responds directly to the challenges highlighted in influential reports by Enrico Letta (“Much more than a market“) and Mario Draghi (“The future of European competitiveness“), which underscored the pressing need to reduce administrative burdens on businesses. The European Commission, in President Ursula von der Leyen’s second term, is now focused on cutting red tape and reducing reporting burdens on businesses, particularly SMEs, while still advancing the bloc’s continental sustainability objectives as part of the broader European Green Deal strategy.

With its publication in the Official Journal of the EU on April 16, 2025, the law officially entered into force on April 17, 2025. The directive must now be transposed into national law. The member states have been given a deadline of December 31, 2025, to do so.

Sustainable finance reporting: compliance or competitive differentiation?

For financial companies executives navigating this regulatory pause with CSRD and indirectly the EU Taxonomy within the EU’s sustainable finance framework, isn’t a signal to relax – it’s a major opportunity to gain strategic advantage.

1. From Tick-Box Compliance to Strategy

Many European banks initially approached ESG, the EU Taxonomy and finance sustainability reporting as a compliance exercise—a box-checking activity driven by regulatory pressure from Brussels. The deadline extension creates space to shift from this reactive stance to a proactive strategy where sustainability becomes a core business value and competitive differentiator in the market.

Instead of meeting minimal financial sustainability reporting requirements, banks can now develop robust sustainable finance frameworks integrated into business operations, risk management, lending practices, and client relationships across the European Union member states. This foundation will prove invaluable regardless of how the sustainability reporting requirements evolve in the coming years.

2. Proving Genuine Green Credentials

When the Omnibus package was first proposed by the European Commission, 11 large international corporations co-signed an open letter criticizing the changes, because of concerns about potential uncertainty in corporate sustainability reporting, but also because they probably understood that it’s not time to retreat from moving toward a more sustainable economy and financial system.

Financial institutions now have a unique opportunity to demonstrate to clients, investors, and other stakeholders that their sustainable finance initiatives aren’t merely compliance-driven, but represent genuine strategic priorities aligned with the European Green Deal objectives.

3. Outpacing Competitors with Readiness

Financial institutions that use this extended timeline strategically will outpace competitors when the reporting requirements eventually take effect across the EU. As sustainability experts have noted following the European Parliament’s vote, financial institutions should use this extended implementation window to strengthen their sustainability data infrastructure and reporting capabilities, ensuring they’re well-positioned for compliance when requirements take full effect in 2028.

This preparation includes developing systems to collect and analyze sustainability data, training staff on sustainability standards, engaging with clients about their sustainability performance against EU criteria, and ensuring governance structures can support comprehensive ESG strategies aligned with the EU Taxonomy regulation requirements and environmental objectives.

AI: The Essential Tool for EU Sustainability Reporting Compliance

Despite the current delays, the EU’s “Stop-the-Clock” directive is part of an ongoing regulatory process. The evolving nature of the climate policy, EU climate science initiatives, and public expectations mean that finance sustainability regulations will continue to change.

This constant regulatory flux makes a flexible, AI-driven approach to sustainability essential for banks operating in the European Union. AI solutions deliver significant advantages, enabling financial companies to extract critical data from technical documentation with high precision, allowing them to efficiently process the extensive information required for compliance.

When facing insufficient data—particularly common with SME clients and small financial institutions—AI tools can support carbon emission calculations and other Technical Screening Criteria, as well as automate document reading and data collection using Natural Language Processing.

Risk evaluation is similarly enhanced through geolocation-based analysis that correlates project coordinates with comprehensive geological and climatic risk datasets, providing precise evaluations aligned with the Do No Significant Harm criteria.

The flexibility of AI architectures enables institutions to create audit-ready reporting and incorporate regulatory amendments without requiring fundamental system redesigns, maintaining compliance continuity throughout regulatory transitions.

Dydon AI’s Tools for Sustainability and EU Taxonomy Reporting

At Dydon AI, we’ve developed innovative AI solutions specifically designed to help European banks and financial institutions. Our suite of tools stands out for its sophistication and practical application – with EU Taxonomy reporting and beyond.

Our flagship product, the TAXO TOOL, which was developed in collaboration with the Bundesverband Öffentlicher Banken Deutschlands (VÖB) and VÖB-Service GmbH – has won the “Best taxonomy data solution for ESG” at the European ESG Insight Awards and is already used since 2022 by leading banks to streamline their EU Taxonomy reporting workflow.

Beyond the EU Taxonomy: A Comprehensive Suite of AI Solutions

Beyond the TAXO TOOL, we offer additional AI solutions designed for the European regulatory context that help financial institutions and corporations develop robust sustainability reporting and compliance strategies:

- Monitoring Compliance Gaps: accurately extracts and compares data and text between external regulatory documents and internal policies, highlighting differences to easily identify required changes to meet new regulatory requirements.

- Document Reading & ESG Data Capture: streamline reporting processes by automatically reading, capturing and extracting valuable ESG data from documents with dedicated AI agents trained on sustainability data.

- Private GPT: get artificial intelligence support to protect your and your clients’ data, train private GPTs on your documents and topics (e.g. sustainability reporting)

The Big Opportunity for European Banks

The EU’s “Stop-the-Clock” directive provides financial institutions with valuable time, but how this time is used will separate leaders from followers in the sustainable finance space. Rather than viewing this delay as a reason to slow down sustainability initiatives, leading banks should accelerate their efforts, supported by sophisticated AI tools that make sustainability strategies more effective and adaptable.

At a time of big geopolitical transformation and regulatory transition, the question isn’t whether sustainability will remain important in the EU—it certainly will—but rather which financial institutions will use this moment to build the technological capabilities and organizational expertise needed to thrive in a future where sustainability is fundamental to business success and to move towards a sustainable future.

The banks that emerge as leaders will be those that see beyond compliance to the strategic opportunity of sustainability, and who leverage AI to make their vision a reality. The clock may have stopped on regulatory deadlines, but the momentum toward sustainable finance continues and banks should maintain their pace now so they can lead the way when the clock starts again.