_Summary

Introduction

European banks and regulators are facing a turning point in sustainable finance reporting, with the Green Asset Ratio (GAR) under scrutiny. Introduced under the EU Taxonomy Regulation to signal how green and sustainable a bank’s portfolio is, the GAR has faced criticism for its complex design and data challenges.

The amendments pushed by the EU Commission with the recent Omnibus Directive, aimed at simplifying sustainability reporting rules, have reverberated throughout the GAR debate. While Omnibus seeks to cut red tape, for example by allowing partial alignment or de minimis exclusions, it also postpones or changes key reporting obligations.

Large banks now have additional time to prepare for the upcoming requirements due to the “Stop-the-Clock” directive; however, they are still required to produce EU Taxonomy reports for 2024 this financial year. The GAR will also remain mandatory for 2024 data, but the calculation rules are currently changing. Stakeholders must have clear which changes are confirmed in the Omnibus package versus those that are still pending, and how these affect the GAR’s scope and methodology.

Get your free demo

Let’s get in touch, our experts will show you through our solutions with a live demo!

Diverging opinions on Green Asset Ratio (GAR) after Omnibus: Regulators vs. Banks

Reactions to GAR’s future reveal substantial divisions among the stakeholders.

The European Banking Federation (EBF), representing the European banking sector by uniting national banking associations from across Europe, and representing the interests of thousands of banks, broadly welcomed the European Commission’s Omnibus initiative.

The EBF stated that aligning multiple GAR calculation methods “will not only be complex but also hinder comparability both between reporting entities and within reporting entities over different periods”. EBF requested that GAR disclosure obligations under Article 8 of the Taxonomy Regulation for the Corporate Sustainability Reporting Directive (CSRD) have to be put on hold until the full review is completed.

A recent ING research also presents interesting views and insights, highlighting issues with the GAR’s design. Their analysis found that the average GAR among 40 European banks was only about 3.7% for 2024, barely above the 3% registered in 2023, despite 35% of assets being EU taxonomy-aligned.

ING attributes these “poor results” to two main factors: massive data gaps and inflexible methodology. For example, strict eligibility criteria mean many transition-financing activities aren’t counted. ING also notes that Omnibus only partially fixes GAR’s known asymmetry, excluding out-of-scope clients from the denominator, and defers any deeper redesign to a future delegated act. In short, ING warns that banks will still face hidden reporting costs and uncertainty even after Omnibus.

On the other end, the European Central Bank’s (ECB) formal opinion takes a broader view of transparency. While sympathetic to reducing the compliance burden, the ECB cautions against narrowing the sustainability reporting scope. It argues that sustainability data are vital for financial stability and that some large risks may arise from smaller players.

As the ECB notes, “ESG risks are not necessarily proportionate to an institution’s size,” so at least all significant banks should continue disclosing comprehensive ESG metrics. By implication, the ECB appears uncomfortable with any solution that would allow substantial gaps, for example, excluding most small or mid-sized counterparties.

The ECB has urged lawmakers to ensure reporting stays “well calibrated,” warning that cutting 80% of firms from the Corporate Sustainability Reporting Directive, as Omnibus initially proposed, could significantly limit stakeholders’ access to information. In short, the ECB view is that GAR and related disclosures may need streamlining, but not at the expense of creating blind spots for financial risks.

Green Asset Ratio: Methodological and Practical Challenges

Regardless of different viewpoints and opinions, it is undeniable that the GAR brings intrinsic data and calculation challenges. Ones that banks with many SMEs or international clients feel acutely.

SME and non-EU exclusions

By design, the GAR numerator only counts alignment in large companies subject to the Corporate Sustainability Reporting Directive, that needs to report according to European Sustainability Reporting Standards (ESRS), and excludes small businesses and sovereigns.

Meanwhile, the denominator comprehends almost all loans and bonds, including loans to SMEs and non-EU firms. This asymmetry means banks with many SME loans or third-country exposures are structurally penalized, as their loans to small businesses, even if potentially green, may not contribute to the numerator due to lack of detailed data for EU taxonomy eligibility or full alignment assessment.

As the EBF noted, “banks predominantly financing SMEs and clients in third countries will show structurally lower green ratios compared to banks predominantly financing large undertakings”. In other words, a bank may help local small firms become greener, but none of that appears in its GAR.

Significant data gaps

Banks frequently lack client data on energy use, emissions, or technical screening criteria metrics. For energy efficiency, they may rely on a few public data points, like national building label rules, and for industrial clients even less. As we have seen, the broader problem with fragmented and unstructured ESG data is real.

Regulatory timeline and scope shifts

The ongoing changes amplify confusion. Currently, a bank could report one GAR for 2024 under the old rules, then another for 2025 under revised criteria, and then again under a future Delegated Act. This GAR ping-pong complicates comparability and partly wastes prior work. In practice, banks with SME-heavy or cross-border portfolios have to track both EU taxonomy updates and divergent national approaches.

In short, the GAR is burdened by incomplete coverage and operational complexity. Many banks feel they are chasing a moving target that doesn’t fully reflect their green lending. The Omnibus simplifications could be helpful, in theory, but the data and methodological challenges remain significant.

Dydon AI’s Perspective: Artificial Intelligence to the Rescue

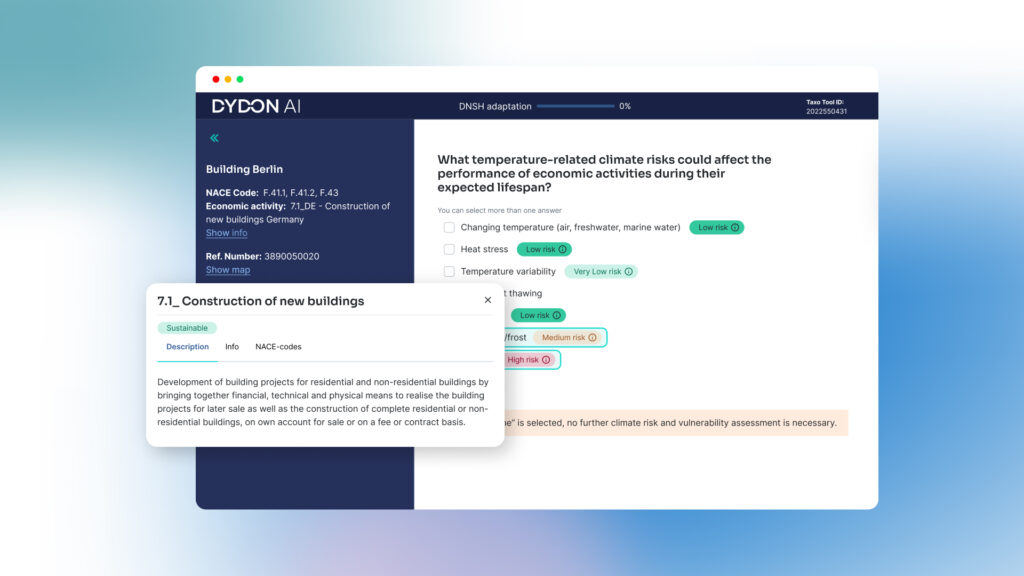

At Dydon AI, we see GAR challenges as the kind of problems that AI-driven tools can solve. Our EU Taxonomy TAXO TOOL wants to be a solution designed to streamline the sustainability reporting processes burdening banks today, offering banks and their ESG teams the following advantages:

Automated AI-powered data extraction and EU Taxonomy alignment assessment

Instead of hand-curating spreadsheets, the TAXO TOOL uses AI to scan corporate documents, like annual reports, energy audits, and client questionnaires, and pull out relevant data points. It can automatically answer many standard EU taxonomy questions by reading uploaded files. For example, the AI can ingest a factory’s CO₂ report and flag which emissions tests pass the technical screening thresholds. This results in significantly reduced manual data entry and a lower chance of missed inputs.

Geolocation-driven DNSH checks

One standout feature is integrated climate-risk analysis, with geological and climate risk data for the “do no significant harm” (DNSH) criteria. The tool is connected to climate data providers, like Munich Re’s databases, so users need only input a project’s address. The system then assesses physical risks, like flood and drought, and matches them to DNSH criteria automatically. In effect, the software “knows” if a coal plant sits in a high-risk zone or if a building renovation might impact protected habitats. This geo-enabled approach simplifies the DNSH workflow ensuring more consistent, auditable DNSH analysis.

Seamless regulatory updates

The TAXO TOOL embeds the full set of EU taxonomy rules, including over 150 activities and technical screening criteria, and is constantly updated, ensuring compliance processes remain current without manual intervention. This dynamic knowledge base practically relieves banks from constantly monitoring hundreds of legal texts manually.

Cross-team collaboration and audit-ready documentation

The platform is built for multi-stakeholder use. Compliance officers, risk managers, and front-line bankers can each work on taxonomy assessments within the system. The tool logs audit trails link final GAR figures back to source documents. Moreover, with clear diagram flows, the tool guides users through each assessment stage, enhancing transparency and ease of use. Reports come pre-populated, with all assumptions documented.

These AI capabilities address the pain points banks often cite. By automating document analysis, ensuring up-to-date criteria, and mapping complex DNSH logic to climate data, Dydon AI’s tools help banks tackle GAR calculations with much less manual overhead.

Conclusion

The Omnibus Directive’s changes highlight the difficulties in making sustainability reporting both simple and comprehensive. Banks face a tough challenge, as they must manage incomplete taxonomies, constantly changing regulations, and inconsistent client data. All factors that can easily lead to mistakes or delays in measurement.

However, this challenge also presents a valuable opportunity. If it’s true that with Omnibus and the new EU’s “Stop-the-Clock” directive financial institutions can have some extra time, it’s how they use this time that will distinguish leaders from followers in sustainable finance. Instead of slowing down, leading banks should accelerate their sustainability efforts by leveraging advanced AI-powered ESG reporting software to enhance strategy effectiveness and adaptability, turning compliance headaches into operational strength.

With solutions like Dydon AI’s TAXO TOOL, financial institutions can automate data gathering, dynamically adapt to new requirements, and produce transparent, and accurate GAR figures. In doing so, they not only meet regulators’ demands but also gain deeper insights into the real sustainability of their portfolios.

If this interests you, book a free demo to discover how our AI-powered solution can simplify, accelerate, and enhance the accuracy of your bank GAR compliance and sustainability reporting!

Talk to our AI experts and get a free demo:

FAQ

The Green Asset Ratio (GAR) is a key KPI introduced by the EU Taxonomy to measure the proportion of a bank’s assets financing environmentally sustainable activities. Specifically, it shows the share of taxonomy-aligned exposures (e.g., loans, advances, debt securities) in a credit institution’s banking book relative to its total covered assets. The GAR must be calculated and disclosed annually by large, listed EU banks in line with the EU Taxonomy Regulation and the accompanying Disclosures Delegated Act. It helps investors and stakeholders assess how much of a bank’s financing supports economic activities that substantially contribute to the EU’s climate and environmental objectives.

As of January 1, 2024, Europe’s largest banks are required to measure and report the GAR (Green Asset Ratio) in their Pillar 3 reports, or the proportion of taxonomy-aligned investments of the total assets. The GAR is mandatory for large, EU-listed credit institutions identified under the Capital Requirements Regulation (CRR). Smaller banks and non-EU institutions are generally exempt.