What is the Sustainability Omnibus?

On February 26, 2025, the European Commission unveiled the “Omnibus” packages, a set of proposals aimed at simplifying sustainability rules, cutting red tape and reducing administrative burden, while enhancing the competitiveness of European businesses. These measures, which promise annual savings of €6.3 billion for European businesses, seek to streamline corporate sustainability reporting and supply chain transparency rules, addressing concerns that extensive regulations may hinder Europe’s ability to compete globally, particularly with the United States and China.

The package presented impact four key regulations part of what was the European Green Deal: the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD), the EU Taxonomy on Sustainable Investments, and the Carbon Border Adjustment Mechanism (CBAM).

While the package is still at proposal stage and will need to be reviewed by the European Parliament and the Council of the European Union, it is facing intense debates from environmental organizations and other stakeholders, who see it as a policy reversal by the European Commission.

Key changes proposed by the Commission:

Corporate Sustainability Reporting Directive (CSRD)

Revised Reporting Scope:

- The reporting scope would be limited to companies with more than 1,000 employees (currently 250+ employees) and either more than €50 million turnover or a total balance sheet of over €25 million. For companies no longer falling under the future CSRD’s scope, the European Commission plans to introduce a voluntary reporting standard through a delegated act. This standard, based on the SME-specific framework developed by the European Financial Reporting Advisory Group (EFRAG), aims to limit the amount of information that larger companies or financial institutions can request from smaller entities within their supply chains, with the goal to reduce the reporting burden on smaller companies.

Reduced Number of Businesses in Scope:

- The number of companies subject to CSRD would be reduced by approximately 80%, from 50,000 to around 10,000, concentrating regulatory efforts on larger businesses.

Extended Compliance Deadlines:

- The deadlines are proposed to be postponed by up to two years, deferring until 2028 the sustainability reporting requirements for companies under CSRD’s scope, which are required to report as of 2026 and 2027.

Elimination of ESRS Sector-Specific Standards:

- The package presented also propose to cancel the introduction of European Sustainability Reporting Standards (ESRS) sector-specific standards, meaning that in-scope companies would only report against the general sector-agnostic ESRS standards, with no additional sector-specific requirements forthcoming.

EU Taxonomy Regulation on Sustainable Investments

Voluntary EU Taxonomy Reporting for Medium-sized Companies:

- Under the proposal, only companies with more than 1,000 employees AND at least €450 million turnover would be required to report the full EU Taxonomy alignment. Companies with more than 1,000 employees but less than €450 million turnover would be able to report voluntarily.

Partial EU Taxonomy Alignment Reporting:

- The proposal would allow companies to report partial Taxonomy alignment, enabling them to demonstrate incremental progress toward sustainability goals even when they cannot achieve full alignment. This change would encourage transition efforts and provide recognition for companies on their sustainability journey.

Modified Green Asset Ratio for Banks:

- Under the proposed amendments, banks would be able to exclude from their Green Asset Ratio (GAR) denominator any exposures to companies that fall outside the scope of the future CSRD (e.g., companies with fewer than 1,000 employees).

Simplified DNSH and Materiality Thresholds:

- The package propose to introduce a materiality threshold, exempting companies from assessing EU Taxonomy eligibility and alignment for activities representing less than 10% of their business. Additionally, the “Do No Significant Harm” (DNSH) reporting requirements would be simplified, potentially reducing the overall reporting burden by approximately 70%.

Carbon Border Adjustment Mechanism (CBAM) and Corporate Sustainability Due Diligence Directive (CSDDD)

If adopted, from 2026 CBAM would require companies importing carbon-intensive goods such as steel and cement to pay a fee based on the embedded emissions—but only if they import more than 50 metric tons per year, effectively exempting around 182,000 of the 200,000 currently covered importers. Additionally, the process for claiming reductions in CBAM costs would be simplified by using published annual average carbon prices from 2027.

On the due diligence side, the CSDDD would delay the initial reporting deadline from mid-2027 to mid-2028, narrow the due diligence obligations to direct suppliers (excluding further-downstream subcontractors), and reduce the frequency of supply chain assessments to every five years. Companies would also be required to suspend contracts with non-compliant suppliers rather than immediately severing them, with the overall scope still covering over 6,000 large firms.

Declarations and Reactions About the EU Simplification Omnibus

Ursula von der Leyen, President of the European Commission, released an official statement praising the changes, declaring: “EU companies will benefit from streamlined rules on sustainable finance reporting, sustainability due diligence and taxonomy. This will make life easier for our businesses while ensuring we stay firmly on course toward our decarbonisation goals.” Von der Leyen’s comment emphasizes two key aims of the Omnibus – reducing the regulatory burden on companies while still maintaining the EU’s overall trajectory towards a low-carbon economy.

Helena Viñes Fiestas, Chair of the EU Platform on Sustainable Finance and co-Chair of the Taskforce on Net Zero Policy, expressed satisfaction with the Omnibus proposals in a LinkedIn post, saying that “the continued maintenance of the EU Taxonomy, widely regarded as the world’s leading standard, is a welcome development. Clarity on sustainability issues is vital for both investors and corporates. […] I welcome the preservation of the Taxonomy on this critical issue and that many of the Platform’s recommendations have been taken on board.”

However, the simplification package also attracted significant criticism from environmental organizations and other stakeholder. The WWF, for instance, labeled the Omnibus “a devastating blow to EU environmental objectives.“

Critics seem mainly concerned that the changes represent a deregulation agenda aimed at scaling back the EU’s green ambitions and catering to corporate lobbying. They worry that by raising reporting thresholds, reducing the frequency of assessments, and simplifying certain methodologies, the Omnibus will weaken the transformative power of the sustainable finance regulations and EU’s global leadership on sustainability issues.

Next Steps

The Omnibus proposal still requires approval by the European Parliament and a reinforced majority of EU member states. Its final form may evolve through negotiations, shaping the future of corporate sustainability reporting in Europe. Businesses and sustainability professionals should closely monitor these developments to anticipate potential compliance changes.

For more information:

- Full press release by the European Commission: https://ec.europa.eu/commission/presscorner/detail/en/ip_25_614

- Questions and answers on simplification omnibus I and II: https://ec.europa.eu/commission/presscorner/detail/en/qanda_25_615

- Proposal for a Directive amending the Audit Directive, Accounting Directive, Corporate Sustainability Reporting Directive, and the Corporate Sustainability Due Dilligence Directive – Omnibus I – COM(2025)81

- Proposal postponing the application of some reporting requirements in the Corporate Sustainability Reporting Directive and the transposition deadline and application of the Corporate Sustainability Due Diligence Directive – Omnibus I – COM(2025)80

- Draft Delegated act amending the Taxonomy Disclosures Delegated Act, as well as the Taxonomy Climate and Environmental Delegated Acts

How to simplify EU Taxonomy Reporting with AI

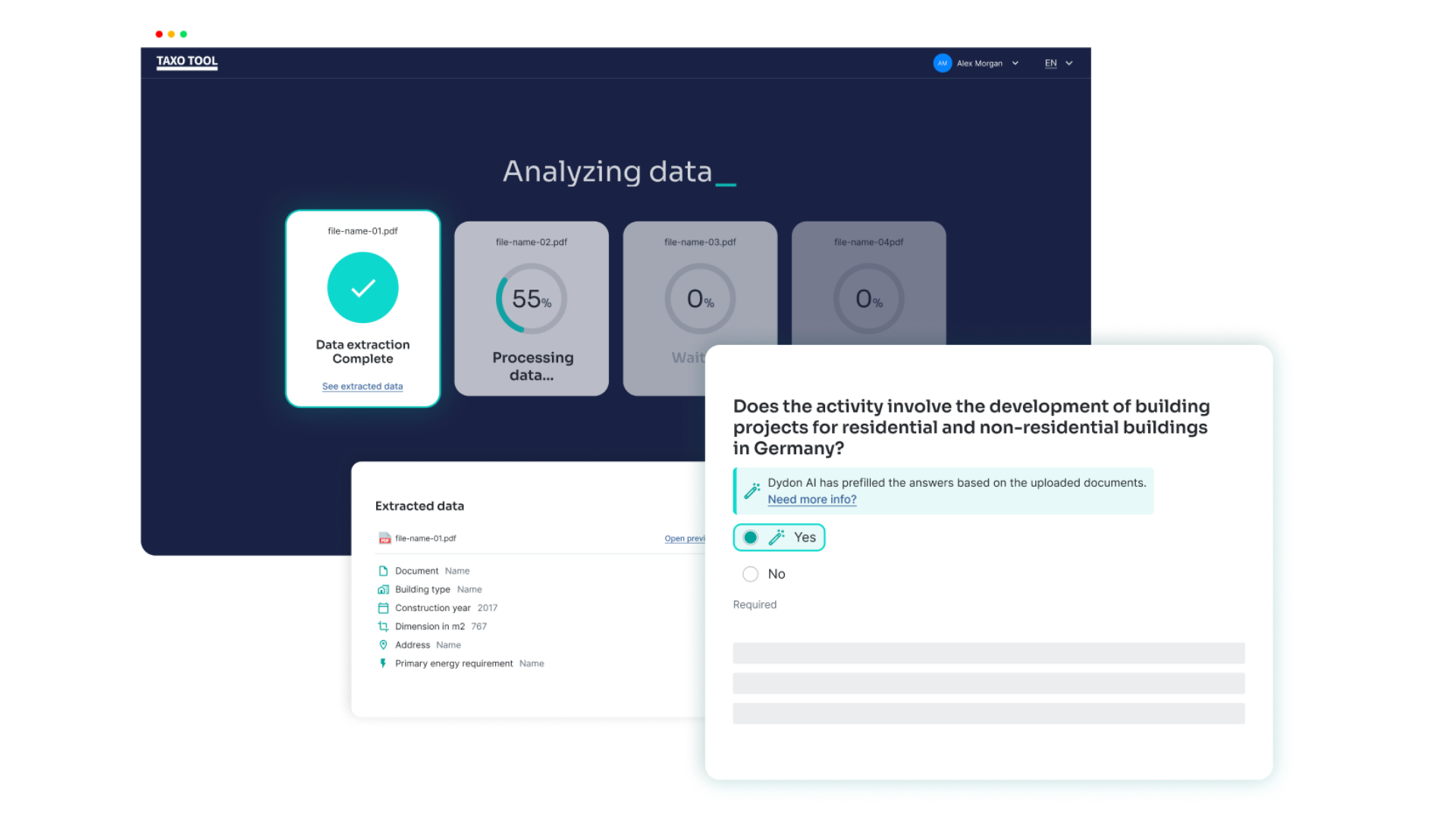

The continuous regulatory updates and changes to the requirements are making the reporting and compliance work even more complex. TAXO TOOL is a sophisticated AI-driven platform that streamlines and automates EU Taxonomy alignment and sustainability reporting for financial institutions and corporations. Utilizing state-of-the-art artificial intelligence, it enhances efficiency and compliance.

Here some features of Dydon AI’s solution:

- AI-Powered Data Extraction: Using advanced language models, the tool automatically extracts numerical and textual information from various documents, such as building energy certificates, ensuring precise and efficient evaluations.

- Geological and Climate Risk Data for DNSH: By entering a project’s address, TAXO TOOL retrieves geological and climate risk data specific to that site, leveraging Munich Re’s insights to strengthen the ‘Do No Significant Harm’ (DNSH) assessment.

- Seamless Regulatory Updates: TAXO TOOL continuously integrates updates to EU Taxonomy regulation, ensuring compliance processes remain current without manual intervention.

- Intuitive User Experience: With clear diagram flows, the tool guides users through each assessment stage, enhancing transparency and ease of use.

- Audit-Ready Documentation: TAXO TOOL generates comprehensive reports that support audit preparation and facilitate effective stakeholder communication, reinforcing regulatory confidence.

If this interests you, book a free demo to discover how our AI-powered solution can simplify, accelerate, and enhance the accuracy of EU Taxonomy reporting!