The EU Taxonomy Regulation is a comprehensive transparency tool adopted by the European Parliament and Council in June 2020, aiming to help companies, investors, issuers and project promoters “to navigate the transition to a low-carbon, resilient and resource-efficient economy”.

Specifically, this new regulation establishes a set of common definitions and terms that can be used to better describe sustainable investment products and services with the aim of increasing the flow of investment money toward sustainable activities.

Who is affected by the EU Taxonomy?

The EU Taxonomy Regulation, which has wide-ranging consequences for a large number of sectors and companies, represents one of the most significant steps taken at the EU level to achieve a climate-neutral European economy by 2050.

In particular, it adds to the disclosure obligations set out by the European Union Sustainable Finance Disclosure Regulation (EU SFDR), additional requirements that target three different groups:

- Banks, pension providers and other financial institutions. And more in general, any companies offering financial products inside the EU.

- Large companies that are already required to provide a non-financial statement under the Non-Financial Reporting Directive.

- The EU and the Member States, when setting public measures, standards or labels for green financial products or green bonds.

Disclosure obligations

In terms of disclosure obligations, the market participants adhering to the EU Taxonomy now have two additional types of disclosure requirements:

1. Article 8 requires banks, as well as non-financial institutions, to disclose “how, and to what extent, their activities are associated with Taxonomy aligned activities”;

2. Article 6 introduces an additional disclosure requirement to any company that markets or manufactures financial products (e.g. insurance-based investment products, pensions and asset management products, corporate and investment banking products, such as VC and index funds) in the EU.

Companies falling under the categories mentioned above must disclose how they used the EU Taxonomy to determine the sustainability of their underlying investments, to which environmental objectives these investments contribute, and the percentage of the investments aligned with the EU Taxonomy requirements and goals.

Benefits of the EU Taxonomy

Banks and other companies offering financial products generally recognize the EU Taxonomy as a positive development.

Having a common set of definitions and a homogeneous way to evaluate things can bring more transparency and reputation benefits to an industry that needs to win back people’s trust. In fact, despite the communications efforts, financial institutions and corporations are still often accused of showing environmental attention only for brand and marketing reasons without taking any concrete sustainability actions (greenwashing).

Furthermore, the EU Taxonomy can expand the availability of corporate data for sustainability, increasing people’s confidence in ESG related products, bringing more demand for such products and investment opportunities and more opportunities for businesses offering those. And ultimately to direct the flow of investments needed towards sustainable and green innovation.

The transparency requirements

We talked about the advantages of increased transparency that the EU Taxonomy brings to the banking sector for clients and investors. Still, we also need to consider the other side of the table, with the transparency requirements for the other market participants.

Going in-depth about the transparency requirements would require a separate article. But speaking in general, this new regulation further broadens the information and reporting obligations for sustainable financial products from the Sustainable Finance Disclosure Regulation (SFDR) – with banks that are asked to clearly show how their green financial products align with the EU taxonomy framework.

As we have seen before, if these products don’t fully comply with the new regulation, companies need to disclose the exact percentage of the underlying products that don’t adhere to the taxonomy.

Challenges for the banking industry

The United Nations Environment Programme Finance Initiative (UNEP FI) and the European Banking Federation (EBF) partnered to give 26 banks the opportunity to test the EU Taxonomy Regulation before broader adoption.

In particular, they tested the applicability of the new regulation to banks and their products. With the results obtained, they created a comprehensive report containing some of the insights we reported above as well as the challenges that financial institutions encountered during the testing period.

As a starting point, applying this regulation to retail loans, trade finance transactions, and general-purpose facilities unveiled to be particularly challenging for banks.

Furthermore, talking more in detail, the report highlights that a lack of standardized and comparable data resulted in being the most significant challenge for banks, which struggled to find the data and information, especially when they had to evaluate the Do No Significant Harm (DNSH) criteria.

The other challenges for banks emerged during this test period are:

- The difficulties to manage more documentation requirements.

- The necessity in some cases of IT system upgrades.

- The operational complexities in evaluating and classifying multi-sector clients.

Data lack for SMEs

The European banks’ exposure to small and medium-sized businesses (SMEs) – and “we are not talking about a few thousand of corporate clients, but hundreds of thousands or millions of customers” – represents a critical challenge when applying the EU taxonomy because of the lack of data available for this kind of businesses.

However, while the availability and quality of data to evaluate green activities and products may not always be available, bank and portfolio managers have the opportunity to buy sets of data from third-party providers that can facilitate their assessments. Something that remains more arduous when it comes to SMEs as they are not subject to large data collectors.

So, if earlier we have seen that data availability for all the market participants, it’s once again worth to stress that for SMEs is even more problematic.

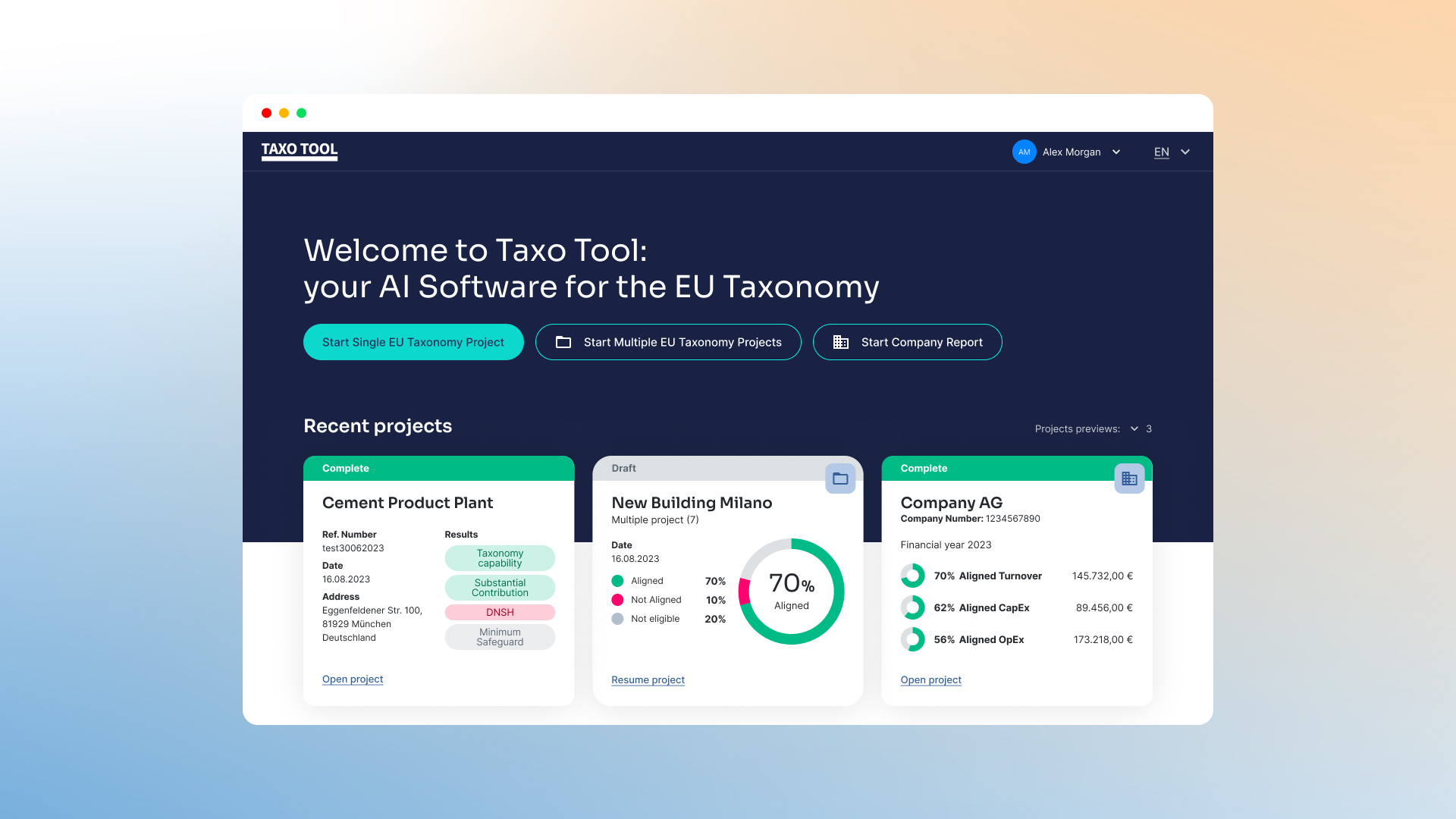

In that sense, Artificial intelligence (AI) comes to give us a hand, allowing us to make the whole process more manageable if used appropriately. That’s why with Dydon AI we created, in partnership with Bundesverband Öffentlicher Banken Deutschlands (VÖB) and VÖB-Service, the TAXO TOOL – a solution using AI to help banks implement the EU Taxonomy, facilitating cases involving SMEs thanks to an extensive knowledge base.