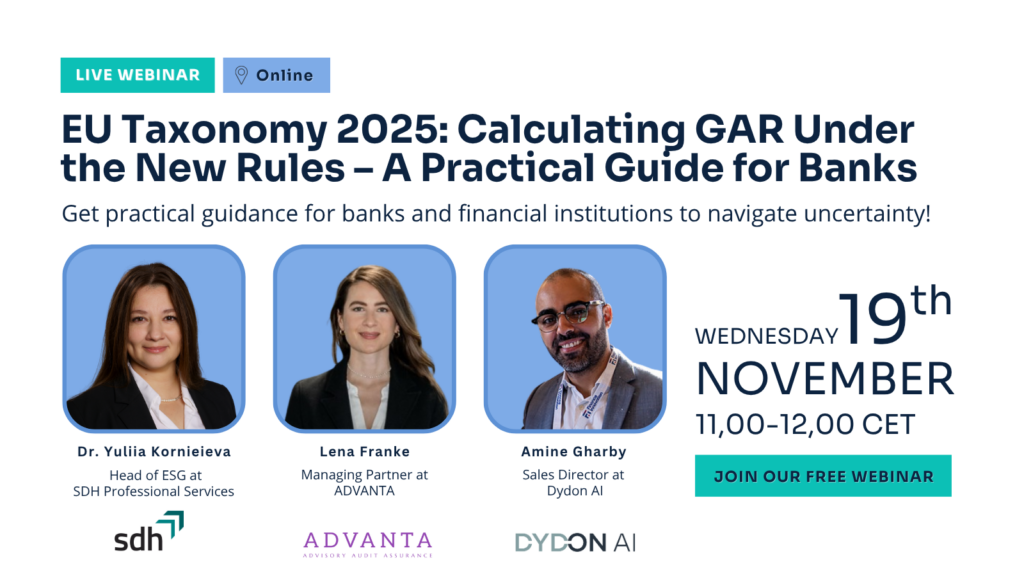

Wednesday 19th November at 11,00 – LIVE online webinar organised by Dydon AI in collaboration with SDH and ADVANTA

The EU Taxonomy framework mandates financial institutions to quantify and disclose their exposure to environmentally sustainable activities through standardized Key Performance Indicators (KPIs). For banks, the Green Asset Ratio (GAR) serves as the primary metric, measuring the proportion of total assets financing Taxonomy-aligned economic activities.

The amended Disclosures Delegated Act (July 2025), adopted as part of the Commission’s Omnibus simplification package, introduces targeted changes to reduce administrative burden while safeguarding disclosure integrity — including the application of materiality thresholds, refinements to asset scope, and the streamlining of reporting templates.

This technical webinar session provides implementation-ready guidance on navigating these regulatory updates, with particular focus on practical application for FY 2025 reporting cycles.

We will also explore how technology, specifically AI, can automate the reporting process from data capture from documents, to pre-filling of questionnaires to calculation support for technical screening criteria and integration of geological and climate risk data.

What Makes This Webinar Different?

This session delivers practical, implementation-focused guidance on calculating GAR under the updated framework, applying new materiality thresholds, and navigating the three FY 2025 compliance pathways available to banks.

Unlike theory-heavy briefings, this webinar bridges regulation to implementation through concrete examples, and the application of AI solutions.

Programme:

- Applying the EU Taxonomy in Banking: Green Asset Ratio (GAR) Evaluation Process

- How the Omnibus Changes EU Taxonomy Requirements for Banks

- What changes to asset scope do the latest EU Taxonomy Amendments bring for Banks? (to be illustrated with practical examples)

- How Should Banks Apply the New Materiality Thresholds in EU Taxonomy Reporting?

- Compliance options for FY 2025 reporting under the latest amendments to the DDA

- AI Automation in the EU Taxonomy Reporting – live demo of Dydon AI’s EU Taxonomy solution

Speakers:

- Dr. Yuliia Kornieieva, Head of ESG | Sustainability Senior Manager | SDH Professional Services GmbH

- Lena Franke, Managing Partner | Advanta GmbH WPG

- Dr. Hans-Peter Güllich, CEO & Founder | Dydon AI

Language of the webinar: English

When: Wednesday 19th November 2025 from 11,00 to 12,00 am CET

Where: Online on Zoom

Who Should Attend?

- Sustainability and ESG reporting teams

- Risk management and regulatory reporting officers

- Financial controllers (non-financial disclosures)

- Compliance and EU Taxonomy managers

- Internal audit teams

Duration: 60 minutes of practical insights to bring clarity into your reporting process

Watch the webinar now (available on-demand):

Dydon AI

Founded in 2016 by Dr. Hans-Peter Güllich, Dydon AI is a Swiss-based RegTech and AI company with deep expertise in sustainability reporting and compliance. Dydon AI developed TAXO TOOL (AI solution for the EU Taxonomy reporting) in cooperation with the Association of German Public Banks (VÖB) and its subsidiary VÖB-Service GmbH. The solution won the Innovation Award at the Global Sustainable Digital Finance Forum organized by the University of Zürich and Stanford University (2022), and a couple of times the “Best taxonomy data solution for ESG” (2022, 2023). In September 2024, Dydon AI’s solution TAXO TOOL received the label «Finance Durable et Solidaire» by Finance Innovation. Over 100 financial institutions across Germany and Europe are using Dydon AI’s solution with over 2500 active users. Dydon AI’s solution has been featured in leading German media such as Handelsblatt, Finanz Business, Frankfurter Allgemeine, and many others.

Check out the website: https://dydon.ai/

SDH Professional Services GmbH

SDH Professional Services GmbH is a professional services firm that partners with financial institutions to address complex challenges in banking, regulation, risk management, and sustainability. We help clients integrate sustainability into strategy, governance, risk, and reporting, ensuring ESG is embedded across business and operations. Combining expertise in risk modelling, supervisory remediation, and sustainability reporting, we deliver pragmatic, data-driven solutions that strengthen compliance, enhance resilience, and support long-term value creation.

Check out the website: https://www.sdh.eu/

ADVANTA GmbH WPG

ADVANTA GmbH Wirtschaftsprüfungsgesellschaft is a Frankfurt-based audit and advisory firm specializing in financial services, IT compliance, and ESG-related services. As a registered auditing company, ADVANTA supports organizations in meeting the increasing regulatory demands of sustainable finance and non-financial reporting. The firm provides independent audit services, develops strategy and risk management frameworks, and offers advisory on implementing effective governance and control systems aligned with EU Taxonomy and CSRD requirements. With expertise at the intersection of finance, technology, and sustainability, ADVANTA helps clients build trust and transparency in their sustainability reporting and corporate responsibility practices.

Check out the website: https://advanta.de/