_Summary

The European Union’s Omnibus Simplification Package and the “Stop-the-Clock” directive represent the most significant changes to Europe’s sustainability reporting since the introduction of the Corporate Sustainability Reporting Directive (CSRD) and EU Taxonomy regulation.

Designed to cut red tape and reduce administrative burdens for SMEs, the package introduces transformative changes impacting financial institutions and their approach to sustainability reporting and risk management.

The Omnibus Package: A Strategic Recalibration?

The EU’s first Omnibus simplification package emerged from mounting pressure to enhance European competitiveness while maintaining sustainability ambitions. The initiative targets five key areas: the CSRD, EU Taxonomy Regulation, Corporate Sustainability Due Diligence Directive (CSDDD), Carbon Border Adjustment Mechanism (CBAM), and InvestEU programmes.

The most drastic change under the latest CSRD proposal raises the scope threshold from 250 to 1,000 employees. It also sets financial criteria at €50 million turnover or €25 million balance sheet. Industry analysts expect that this change can reduce by about 80% the number of companies subject to reporting obligations, significantly shrinking the pool of companies required to file sustainability reports.

Moreover, as part of the Omnibus package, the EU adopted the “Stop-the-Clock” Directive to postpone reporting and due diligence obligations for most companies. Specifically, those defined as “Wave 2” firms, which are the large companies that would have needed to start sustainability reporting in 2026, can wait for two more years, until 2028, to start reporting. Furthermore, the listed SMEs, categorised as “Wave 3” firms, will now have until 2029 to start their sustainability reporting. The “Stop-the-Clock” directive also delays the new CSDDD requirements by one year for the largest companies.

This extension acknowledges the challenges of collecting ESG data and setting up the necessary processes, giving companies more time to prepare. Businesses not yet covered by the CSRD will also benefit from a temporary postponement from mandatory EU Taxonomy reporting.

While some companies may welcome reduced obligations, others highlight that these changes could further increase costs and reporting difficulties for corporations. “Shifting the standards for EU business … that are part of a larger group and have already implemented will only add additional costs and reporting burden, because the framework is going to change [which] creates more costs to accompany this change, to implement it”, said Héléna Charrier, Head of Socially Responsible Investing at La Banque Postale Asset Management (LBPAM).

Financial Institutions Implications for EU Taxonomy Reporting

Under the amended Taxonomy Disclosure Delegated Act, banks may claim exemption from EU Taxonomy reporting until December 2027 if they demonstrate no exposures to Taxonomy-aligned activities. This represents a significant operational relief for institutions with minimal involvement in sustainable finance, allowing resources to be allocated more efficiently.

The new rules also exclude specific asset categories, including derivatives, cash equivalents, on-demand interbank loans, goodwill, and commodities, from Key Performance Indicator (KPI) calculations. By refining what must be reported, the framework acknowledges that certain assets do not fit the EU Taxonomy’s criteria, reducing complexity and compliance costs for banks.

Importantly, the European Banking Federation has advocated for alignment between the Green Asset Ratio (GAR) calculation and the reduced scope of the Corporate Sustainability Reporting Directive (CSRD). Under this approach, exposures to non-reporting companies are omitted from the denominator, offering a more accurate picture of sustainable lending and investment portfolios.

Recent industry research analyzing 140 banks across 15 European jurisdictions indicates that about 20% of financial institutions could benefit directly from reduced reporting requirements. Impacts are particularly notable in the Nordics, where over 50% of banks may be exempt, and in Belgium, the Netherlands, and Germany, with approximately 30% of banks affected.

EFRAG’s Simplified ESRS With 60-Day Public Consultation

Sustainability reporting news are not limited to the Omnibus Simplification Package. On July 31, 2025, the European Financial Reporting Advisory Group (EFRAG) published exposure drafts for simplified European Sustainability Reporting Standards (ESRS), with the goal to “make sustainability reporting under the CSRD more manageable while preserving its relevance and alignment with the European Green Deal.”

The simplified standards achieve an approximately 57% reduction in mandatory datapoints across all standards, with voluntary datapoints completely eliminated. The restructured standards separate mandatory content from guidance, with a new Non-Mandatory Illustrative Guidance (NMIG) document providing contextual support without creating additional legal obligations. This architectural change aims to improve both usability and compliance efficiency.

Important to note that, the simplified standards maintain the core double materiality principle while introducing practical considerations for execution. The new “top-down” approach allows companies to focus assessments on areas where material impacts, risks, and opportunities are most likely to arise.

“EFRAG is fully aligned with the strategic vision set out by the European Commission. These revisions aim to deliver what Europe needs at this moment: a more focused, more usable sustainability reporting system that remains ambitious but does not overburden companies. Capitalising on effective experience, this is about making ESRS a more workable reality—so that sustainability reporting supports, rather than hinders, resilience, investment, and long-term value creation.”, said Patrick de Cambourg, Chair of the EFRAG Sustainability Reporting Board.

The public consultation will be open until 29 September 2025, as stakeholders, including auditors, civil society, investors, and national authorities, are encouraged to review the updated drafts and provide feedback.

ECB President Lagarde’s Critical Warning

European Central Bank (ECB) President Christine Lagarde has warned EU lawmakers that efforts to weaken sustainability reporting rules risk undermining the ECB’s ability to manage climate-related financial risks.

In her letter, Lagarde emphasised that climate change has profound implications for price stability and the wider financial system. She stressed that the ECB requires high-quality firm-level climate data to integrate these considerations into the Eurosystem’s monetary policy framework.

While some lawmakers have argued for even deeper cuts, Lagarde cautioned that the proposed scope reduction in the CSRD would sharply limit the availability of such data, weakening the ECB’s ability to conduct granular assessments of climate-related financial risks across its balance sheet and collateral framework. She further noted that other delays and modifications to the CSRD and CSDDD could hinder the ECB’s climate-related initiatives.

The ECB President ultimately called for amendments that “strike the right balance between retaining the benefits of sustainability reporting for the European economy and financial system while also ensuring that the requirements are proportionate.”

Preparing for the Future: Opportunities and Challenges Ahead

The current regulatory simplifications’ developments represent a significant moment in the evolution of sustainability reporting, offering both relief and uncertainties for financial institutions. While the reduction in administrative burdens and extended timelines provides welcome breathing space, it also introduces challenges, and for the moment, more uncertainty.

For banks and other financial institutions, this is both a call to cautious navigation and a strategic opportunity. It demands careful balancing of reduced compliance costs with the need to keep investing in digital solutions, while preserving transparency, data integrity, and long-term sustainability integration.

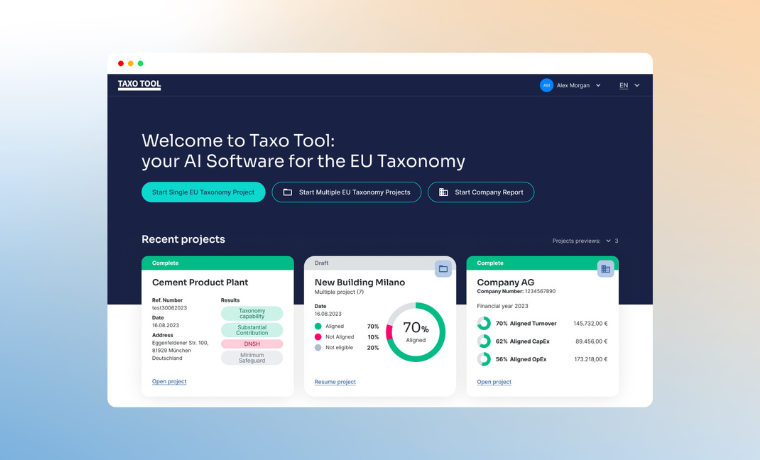

The ongoing legislative process means financial institutions must prepare flexibly, building robust foundational capabilities that serve them well across possible regulatory outcomes. Leveraging advanced technology like DYDON AI’s AI-powered TAXO TOOL for EU Taxonomy reporting will be essential to automate data collection, adapt dynamically to changing regulatory requirements, and generate reliable reporting.

Institutions that take advantage of this time to strengthen their sustainability reporting systems will not only meet evolving regulatory demands but will also enhance their strategic positioning in the path toward a more sustainable financial services industry. With a forward-looking approach grounded in innovation and resilience, financial institutions can transform the regulatory-imposed challenges into competitive advantages.

Get your free demo

Let’s get in touch, our experts will show you through our solutions with a live demo!