The Do No Significant Harm (DNSH) principle is a regulatory mechanism within the European Union’s sustainable finance framework. It establishes a systematic approach to environmental risk assessment, implemented through the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR). The DNSH principle provides a structured methodology to evaluate the environmental impact of economic activities, ensuring compliance with sustainability goals.

At its core, the DNSH principle is based on a dual requirement:

- Economic activities must contribute positively to at least one environmental objective.

- They must avoid causing significant harm to others.

This approach shifts environmental compliance from a binary pass/fail evaluation to a nuanced, multi-dimensional assessment of ecological interactions. By requiring a detailed analysis across six environmental objectives, the EU has developed a sophisticated framework for assessing and managing environmental risks.

The six environmental objectives are:

- Climate Change Mitigation: Reducing greenhouse gas emissions.

- Climate Change Adaptation: Minimising the impacts of climate change.

- Sustainable Use of Water and Marine Resources: Protecting aquatic ecosystems.

- Transition to a Circular Economy: Promoting resource efficiency and reducing waste.

- Pollution Prevention and Control: Reducing harmful emissions and contamination.

- Biodiversity and Ecosystem Protection: Preserving and restoring natural habitats.

This framework compels organisations to integrate comprehensive environmental risk assessments into their operations, aligning with the EU’s sustainability objectives.

Key Differences in DNSH Application: EU Taxonomy vs SFDR

The DNSH principle is applied differently under the EU Taxonomy and the SFDR, reflecting the distinct purposes of these frameworks:

- Level of Focus:

- The EU Taxonomy applies DNSH criteria at the activity level, ensuring that individual economic activities meet specific sustainability thresholds.

- The SFDR adopts a broader focus, applying DNSH at the portfolio or company level to assess the overall sustainability performance of financial market participants (FMPs).

- Scope of Objectives:

- The EU Taxonomy focuses exclusively on six defined environmental objectives, using technical, science-based criteria.

- The SFDR includes a wider range of considerations, encompassing both environmental and social objectives, requiring FMPs to align their investments with broader sustainability standards.

These distinctions highlight the need for organisations to adapt their compliance strategies according to the framework they are addressing. As these regulations continue to evolve, staying informed about updates is key for effective implementation.

Recent Clarifications on the EU Taxonomy Delegated Acts

On 29 November 2024, the European Commission released a set of frequently asked questions (FAQs) to simplify the application of the EU Taxonomy and reduce administrative burdens for companies.

These FAQs provide technical guidance on several aspects of the taxonomy, including:

- General requirements and technical screening criteria.

- Reporting obligations for activities under the Climate and Environmental Delegated Acts.

- Clarifications on DNSH criteria, offering practical insights to help organisations align their activities with regulatory expectations.

Commissioner Mairead McGuinness emphasised the importance of these updates, stating:

“The EU taxonomy provides investors with a common understanding of the environmental impacts of their investments while guiding companies’ sustainable transition efforts. Our focus now is to improve the usability of the framework and these FAQs will help companies as they apply the taxonomy”.

Conducting a DNSH Assessment in the EU Taxonomy reporting

Conducting a Do No Significant Harm (DNSH) assessment within the EU Taxonomy framework involves a structured process to ensure that economic activities contribute positively to environmental objectives without causing significant harm to others. Below are the key steps involved:

1. Identify the Economic Activity

- Determine the specific economic activity under evaluation and confirm its eligibility under the EU Taxonomy’s classification system, such as the NACE codes.

- Verify that the activity is covered by the relevant Delegated Acts, including the Climate Delegated Act and the Environmental Delegated Act.

2. Apply Technical Screening Criteria

- Refer to the Taxonomy’s technical screening criteria (TSC) for the activity in question.

- Evaluate the environmental performance against thresholds defined in the TSC.

- Ensure compliance with science-based standards and benchmarks specified in the Delegated Acts.

3. Conduct a Multi-Objective Impact Analysis

- Systematically assess the activity’s potential impacts across all six environmental objectives (previously outlined).

- Use both quantitative and qualitative evaluation methods to capture the full scope of environmental implications.

- Develop a comprehensive understanding of how the activity interacts with relevant objectives without causing significant harm.

4. Documentation and Reporting

- Maintain detailed records of the assessment process, including methodologies, data sources, and evidence.

- Prepare transparent reports demonstrating compliance with DNSH criteria.

- Ensure traceability of all evaluation steps to facilitate audits or reviews by external parties.

The Role of AI in DNSH Reporting

As we saw, the Do No Significant Harm (DNSH) principle plays a central role in ensuring that economic activities not only contribute positively to environmental goals but also avoid adverse effects on other sustainability objectives. However, conducting a DNSH assessment can be resource-intensive, and a real burden for financial institutions, requiring detailed evaluations across multiple environmental parameters.

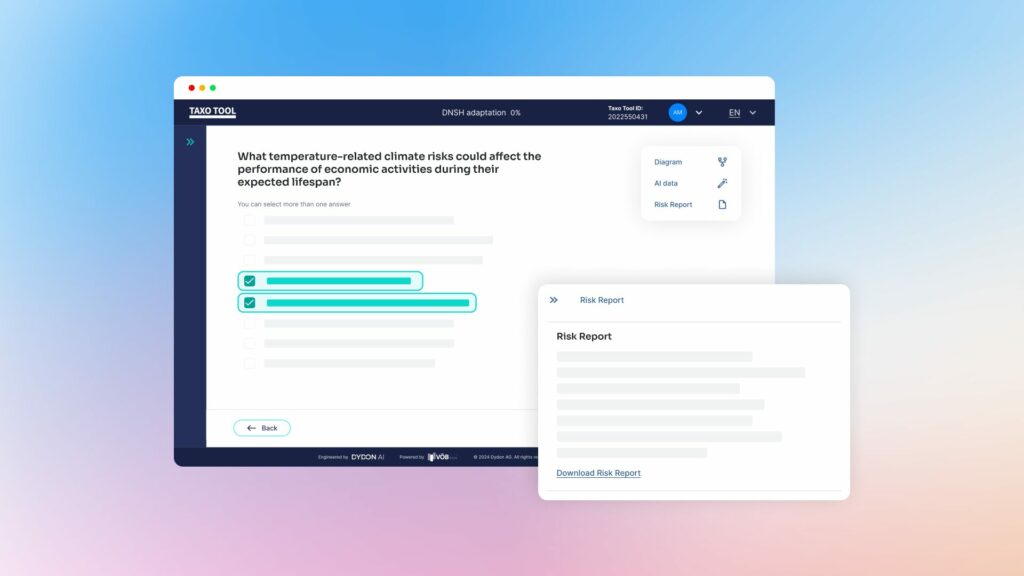

Artificial intelligence is a valuable ally in this process, particularly through tools like the Taxo Tool. By automating data analysis and offering structured guidance, AI helps simplify compliance with the EU Taxonomy’s technical screening criteria (TSC). AI is increasingly important in supporting financial organisations to manage the intricate workflows of DNSH reporting, reducing administrative complexities, and enhancing the precision of assessments.

Taxo Tool for DNSH: Geological and Climate Risk Assessment through Geolocation

A particularly innovative feature we developed at Dydon AI with the Taxo Tool is the geolocation-based risk assessment for evaluating climate and geological hazards. These risks are critical in DNSH assessments, especially under objectives like climate change adaptation and biodiversity protection.

How It Works

- Input and Data Retrieval: Users input the project address into the Taxo Tool.

- Integration with Munich Re: The tool accesses Munich Re’s extensive databases, which include precise data on climate and geological risks such as flood zones, earthquake activity, and vulnerability to extreme weather events.

- Automated Risk Assessment: The integrated AI processes the data, generating a detailed analysis of location-specific risks.

Benefits of Geolocation-Based Assessment

- Enhanced Accuracy: By leveraging geographic coordinates, the Taxo Tool provides tailored risk insights specific to the project’s environmental context.

- Efficient Compliance: Automated analysis ensures timely evaluations, reducing the complexity of manual data gathering.

- Actionable Insights: The output includes risk scores and summaries that help organisations identify and mitigate potential threats, aligning with DNSH criteria.

The Taxo Tool’s geolocation capability highlights how AI can transform DNSH and EU Taxonomy reporting. This feature supports compliance and proactive risk management, enabling organisations to align projects with the EU’s sustainability goals while safeguarding against environmental and financial risks.