The landscape of sustainability reporting has undergone a profound evolution in recent years. Corporations and financial institutions must navigate multiple overlapping frameworks, including the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy, as well as Green Asset Ratio (GAR) calculations and Pillar 3 disclosures. Continuous regulatory changes further complicate the reporting process.

Despite recent efforts towards simplification, such as the Omnibus Regulation, sustainability reporting remains a challenging task for compliance teams. Many organisations still rely on fragmented, manual processes to extract ESG data, validate information and complete compliance questionnaires.

Fortunately, Agentic AI has arrived to help overcome these challenges.

The ESG reporting bottleneck: more data, more compliance requirements, more pressure

ESG reporting frameworks require organizations to integrate vast amounts of data from multiple sources. For ESG teams, this poses a significant challenge, with 60 to 70% of their time often consumed by labor-intensive activities such as data extraction, validation, and report preparation. These tasks tend to be repetitive, prone to human error, and offer limited strategic value.

Gathering data from disparate systems, spreadsheets, and unstructured documents, then mapping it manually to regulatory requirements and validating it against compliance criteria, can take weeks. Compounding these challenges, by the time reports are finalized and submitted, market conditions may have shifted, new regulations may have come into effect, and the data may already be outdated.

The manual approach on this carries serious risks. Delays in insight generation increase compliance exposures, while the inability to scale portfolio assessments limit comprehensive risk management. Additionally, ESG professionals are taken away from strategic sustainability initiatives to focus on operational data tasks.

Regulatory compliance management and the need for automation

The European Union’s Omnibus package was introduced to simplify the Corporate Sustainability Reporting Directive (CSRD) and related regulations, aiming to cut the red tape and streamline sustainability reporting. However, in late October 2025, the European Parliament rejected the accelerated trilogue negotiations on Omnibus I, delaying the adoption of these simplifications. A final parliamentary vote is now scheduled for 12-13 November 2025, with negotiations expected to resume towards the end of November.

This delay prolongs legal uncertainty and underscores a critical reality. Companies cannot afford to wait for regulatory relief. They must proactively find ways to automate and scale their ESG compliance operations today to keep pace with changing regulations and gain a competitive advantage.

Enter Agentic AI: autonomous intelligence for regulatory compliance

Traditional AI and large language models (LLMs) have enhanced ESG reporting workflows incrementally. However, these typically require human orchestration and manual validation at multiple points.

Agentic AI represents another significant step forward. Rather than performing isolated tasks, AI agents operate autonomously, planning complex workflows, using multiple tools in sequence, reasoning through dependencies, and iterating until tasks are completed.

In ESG reporting, agentic AI systems can orchestrate entire data pipelines, from document identification and analysis through data extraction, technical criteria matching, validation, and final report generation.

The following outlines the process in practice:

Document intelligence and classification

Agentic AI ingests all relevant documents (annual reports, energy performance certificates, sustainability statements, financial records, policy documents) and automatically identifies document type and source. The system uses contextual analysis in combination with metadata to distinguish different types of documents, then routes each to the appropriate processing pipeline.

Intelligent text analysis and ESG data extraction

Once documents are classified, agentic AI employs natural language processing (NLP) to perform semantic segmentation, dividing documents into contextually meaningful sections rather than arbitrary chunks. The system simultaneously extracts structured data (tables, quantitative metrics) and unstructured insights (narrative disclosures, qualitative assessments). Critically, it preserves the context and provenance of each data point, creating an audit trail that regulators demand.

Technical criteria matching and validation

Rather than simply extracting data, the system applies domain-specific rules and technical screening criteria. For EU Taxonomy reporting, the agent verifies whether an economic activity meets eligibility thresholds, applies Do No Significant Harm (DNSH) criteria, and calculates aligned activities percentages. For CSRD, it maps extracted data against ESRS requirements and flags gaps or inconsistencies.

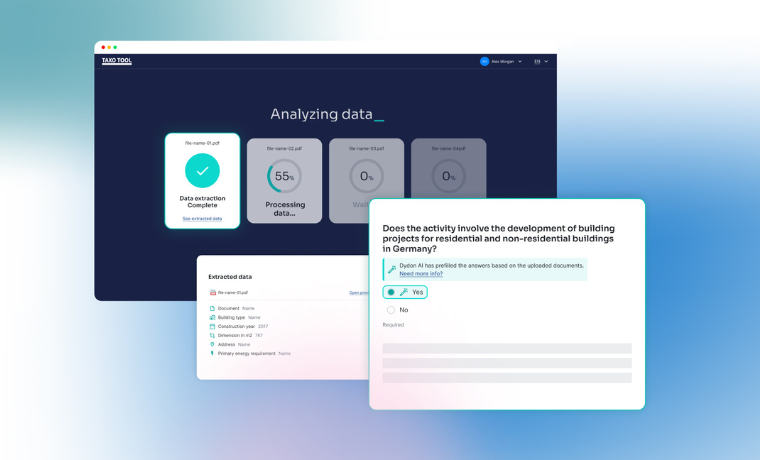

Automatic questionnaire pre-filling

One of the most time-intensive tasks in ESG compliance is completing regulatory questionnaires and disclosure templates. Agentic AI automatically populates these forms with extracted and validated data, generating narrative responses where required and flagging fields where human judgment is essential.

Continuous validation and evidence linking

Unlike batch processes that validate only after completion, agentic systems continuously verify data quality throughout the workflow. They link each extracted data point back to its source document through lineage tracking, ensuring traceability and audit readiness. When discrepancies between narrative disclosures and quantitative metrics are detected, the system flags them for review rather than propagating errors.

ESG Data and corporate compliance: from weeks to hours

The transformative potential of agentic AI is already evident in practice, as organizations implementing it for ESG reporting have reported large reductions in preparation timelines.

These time savings translate directly into cost reductions and resource redeployment. By automatically extracting, validating, and mapping data across multiple regulatory frameworks, the AI system ensured high data traceability, reduced audit risk, and enabled faster regulatory submissions.

According to PwC’s Global Sustainability Reporting Survey, organizations are increasingly prioritizing technology investments to address the complexity of expanding ESG disclosure requirements. The survey highlights that companies recognize automation as essential to managing the volume and complexity of ESG data, particularly as multiple frameworks converge.

The Dydon AI approach: ESG reporting automation with AI agents

Dydon AI’s ESG data capture solution leverages agentic and language model technologies to transform compliance workflows and ESG data management. The platform automates ingestion of multiple document types, including financial reports, energy performance certificates, sustainability disclosures, and policy documents.

A specialized AI agent is assigned to each document type, tailoring the analytical framework accordingly. The system’s natural language processing (NLP) stack breaks down documents into small, analyzable elements, simultaneously extracting structured data from tables and unstructured insights from text and images.

Each data element is mapped precisely to relevant regulatory categories, such as CAPEX, OPEX, or turnover for EU Taxonomy compliance, or specific topics under ESRS for CSRD disclosures—guided by custom user-defined KPIs.

Dydon AI automates the generation and pre-filling of regulatory questionnaires, using advanced prompting strategies tailored to specific rules. Every answer is validated with contextual evidence traced directly back to source documents, ensuring both auditability and transparency—a critical requirement for regulatory and internal governance.

Further, the system evaluates data elements in context using Retrieval Augmented Generation (RAG), an AI method combining external data retrieval with language model reasoning to enhance context and accuracy, avoiding isolated data points and strengthening the robustness of disclosures.

The final output is a fully validated, regulator-ready report available in multiple formats (JSON, PDF, and others), accelerating ESG reporting timelines while reducing manual errors and streamlining audit processes.

When combined with Dydon AI’s Private GPT and compliance gap monitoring features, organizations gain a fully AI-augmented approach to ESG that is customizable, transparent, and future-proofed for ongoing regulatory change.

Get a free demo with our experts

If you want to learn more about how agentic AI can transform your ESG reporting process, our experts are ready to demonstrate the power of Dydon AI’s ESG reporting solutions in a live demo.

Discover how AI-powered automation can simplify data capture, enhance compliance accuracy, and free your ESG team to focus on strategic sustainability initiatives.

Get your free demo

Let’s get in touch, our experts will show you through our solutions with a live demo!