The landscape of sustainable finance is undergoing a rapid transformation, driven by a confluence of factors. Increasing regulatory pressures, heightened investor awareness, and the urgent need to address global environmental and social challenges contribute to this shift. However, perhaps most notably, it’s the rise of artificial intelligence (AI), and AI Agents in particular which are considered the next frontier of generative AI (Gen AI) are emerging among the most powerful catalysts for change.

AI offers innovative solutions to the complex challenges of sustainable finance, and Agent AI is set to transform how companies manage ESG data and produce sustainability reports. With its ability to operate autonomously and learn from experience, Agent AI can streamline processes, extract valuable insights, and help banks and companies comply with new regulations such as the EU Taxonomy.

Or, as Mckinsey puts it, “We are beginning an evolution from knowledge-based, Gen AI–powered tools—chatbots that answer questions and generate content—to Gen AI-enabled agents that use foundation models to execute complex, multistep workflows across a digital world. In short, the technology is moving from thought to action.”

Still, while the potential of AI in sustainable finance is immense, many organizations are held back by outdated methods for data management. According to a recent survey, nearly half of organizations still manage their ESG data using spreadsheets, restricting their ability to extract meaningful insights and speed up processes and transformation.

Recognizing the importance of moving towards sustainable finance and the limitations attached to outdated approaches, around 90% of organizations are planning to increase their ESG investments in the next three years – where hiring dedicated ESG personnel and buying ESG-specific software, are indicated as the two top areas of these investments.

Having established the growing importance of AI to revolutionize sustainable finance, let’s delve deeper into the specific capabilities of Agent AI. Understanding its unique characteristics and functionalities will provide a clearer picture of how it can address the challenges in ESG reporting and data management.

AI Agents and Their Applications

Artificial intelligence agents, or AI agents, are intelligent software programs capable of interacting with their environment, collecting data, and using that to perform self-determined tasks. Unlike traditional software, AI agents possess autonomy, learning capabilities, and a goal-oriented focus, enabling them to perform multiple functions.

Key Characteristics:

- Autonomy: AI agents can operate independently, making decisions and taking actions without constant human intervention.

- Learning: They can learn from their experiences, adapting their behavior to improve performance over time.

- Goal-Oriented: AI agents are driven by specific objectives and work towards achieving them.

The role of AI agents can be very broad – including customer service, risk management, investment analysis, trading, and operations. Despite the potential, it is essential to consider the ethical implications, regulatory compliance, security measures, and human oversight for their successful implementation.

Core Capabilities of Agent AI for ESG Reporting

Although Agent AI has a wide range of applications across various industries, our focus lies at the intersection of finance and sustainability. Here, it has the potential to greatly enhance ESG reporting for financial institutions and corporates, for example by:

- Leveraging Natural Language Processing (NLP): Agent AI can analyze unstructured text data, such as management commentary and sustainability narratives, to extract key ESG indicators and gain deeper insights.

- Automating data collection and analysis: Efficiently gather and process ESG data from various sources, reducing the time and effort required for manual tasks.

- Providing real-time insights and predictions: Analyze data to identify trends, patterns, and potential risks, enabling organizations to make more informed decisions.

- Enhancing decision-making: By providing actionable insights, Agent AI can support decision-makers in setting and achieving ESG goals.

- Improving regulatory compliance: Agent AI can help organizations stay compliant with complex ESG regulations by automating reporting processes and identifying potential violations.

- Developing innovative ESG products and services: Agent AI can be used to create new ESG-focused products and services, such as sustainable investment funds or carbon footprint calculators.

These AI Agent capabilities can help financial organizations and corporates reduce costs and improve efficiency, with the automation of tasks and the streamlining of complex processes, make better-informed decisions, by using insights and data-driven recommendations, demonstrate their commitment to sustainability, by enhancing ESG reporting and performance, and last but not least, gain a competitive advantage, by differentiate themselves from competitors and attract ESG-focused investors.

For a more comprehensive understanding of the broader generative AI application on sustainability, AWS created an executive’s guide with useful examples to check.

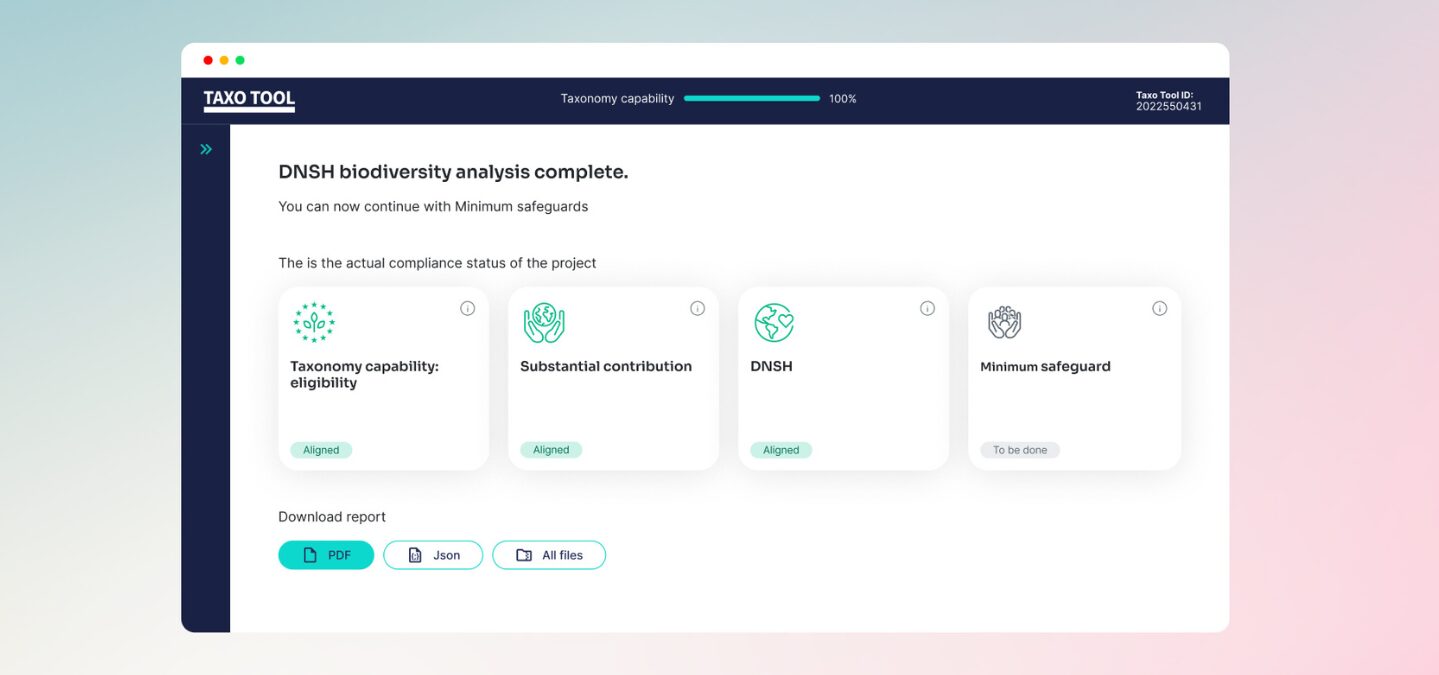

Workflow Example: Agent AI for EU Taxonomy Reporting

To illustrate how sustainability reporting can be streamlined with agents, here’s an example of how your organisation may apply it to EU Taxonomy compliance with Dydon AI, automating the extraction and analysis of key data from a company’s annual report:

Step 1: Report Upload

The user uploads the company’s annual report to the system – typically as a PDF or text document.

Step 2: Processing by Agent AI

The NLP-powered AI agent scans the report and identifies key sections such as “Income Statement,” “Balance Sheet,” “Cash Flow Statement,” and any relevant sustainability disclosures. Specialized sub-agents (e.g., OPEX agent, CAPEX agent) focus on specific data categories, extracting critical financial figures such as revenue, operating profit, and operating expenses.

Additionally, the agent identifies relevant ESG data to ensure compliance with the EU Taxonomy framework. It detects sections tied to sustainable activities, emissions data, or environmental performance.

Step 3: Extraction, Analysis and Calculation

Once the relevant data is extracted, the AI agent (calculation agent) performs essential calculations to check the EU Taxonomy compliance, assessing taxonomy-compliant Operating Expenses (OPEX) and eligible Capital Expenditures (CAPEX) based on the extracted financial and sustainability data.

Step 4: User-Ready Output

After processing the data, the AI agent (coordinator or coordination agent) generates a summarized final report, including key financial figures, compliance metrics for the EU Taxonomy criteria, and year-over-year comparisons for financial and ESG data.

This structured output is designed to be easily understood by both internal stakeholders and external regulators or investors, ensuring clarity and compliance.

Get help from AI for your sustainability reporting

In conclusion, as AI technology like Agent AI continues to evolve, it promises to become an indispensable tool for organizations striving to meet financial performance objectives and regulatory requirements.

Schedule a free consultation today to discuss your specific needs and learn how Dydon AI can help you simplify these processes and achieve your sustainability goals.