The corporate sustainability reporting landscape is evolving rapidly, driven by a growing number of regulations such as the EU Taxonomy, the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS). These regulations are also subject to constant change, as we have seen with the recently published “Omnibus” proposal from the European Commission, which will bring significant changes to these regulations and challenge organisations such as financial institutions and corporates on their reporting and compliance journey.

AI for Sustainability Reporting: Compliance and Value

The challenges traditional approaches to sustainability reporting, which used to involve a lot of manual data collection, analysis, and interpretation now become even more significant when companies must align their reporting with multiple regulations such as the EU Taxonomy Regulation, CSRD reporting requirements, and various ESG frameworks.

To comply with these new regulations and take advantage of some new important opportunities that are emerging, companies are turning to advanced AI tools that streamline data management and enhance reporting accuracy.

Recent trends highlight this shift: some industries have already reported productivity gains of up to 30%, and in a poll conducted at the latest World Economic Forum in Davos, 87% of C-suite executives plan to increase their generative AI investments, and 58% expect to scale AI solutions across their organizations by this year.

The acceleration in the adoption of artificial intelligence solutions, is the result of a maturing technology and of solutions that are always more sophisticated, but also of a growing need for compliance solutions that can streamline the work of companies and financial institutions.

And if undeniable that today’s reporting regulations complexities demand a more intelligent and customizable approach, to comply with new regulations, the business case for advanced sustainability reporting is becoming increasingly clear. Effective sustainability reporting can significantly influence a company’s performance by enhancing corporate transparency and accountability.

Public Vs. Private AI Models for Sustainability Reporting

The transformation of sustainability reporting through private AI systems should represent a significant advancement in how financial institutions handle their EU Taxonomy data and reporting obligations. Understanding how these systems work and their practical implementation is crucial for financial professionals navigating this regulatory landscape.

A private GPT system functions as an intelligent institutional memory for your organization’s sustainability practices. This system combines the power of large language models (LLMs) with secure, organization-specific knowledge management. For financial institutions, this means having a system that intimately understands your organization’s sustainability metrics, reporting frameworks, and compliance requirements while maintaining strict data security.

The foundation of this system is in its knowledge base architecture. Think of this as a sophisticated digital library that contains all your organization’s sustainability-related documentation – from emissions data and supply chain assessments to policy documents and previous reports. Unlike traditional databases, this system understands context and relationships between different pieces of information, making it possible to draw connections that might not be immediately apparent to human analysts.

When processing sustainability data, the system employs a combination of advanced retrieval and analysis methods to ensure accuracy and reliability in reporting. Beyond basic data extraction, it integrates multiple modules that collaboratively analyze historical patterns, cross-reference data from various sources, and verify compliance with current regulatory frameworks.

This modular approach utilizes techniques such as Context-Aware Retrieval, Intelligent Entity Recognition, and Semantic Similarity Analysis—a core component of Retrieval-Augmented Generation (RAG) for identifying relevant text segments. By applying RAG, the system dynamically retrieves contextually relevant data from internal knowledge bases and external regulatory resources, enhancing compliance reports with precise and up-to-date information.

Additionally, methods like Structured Data Extraction and dynamic ranking techniques ensure both quantitative values and qualitative insights are processed with high precision. Automated Relevance Scoring and Consistency Checks further enhance the reliability of extracted information, while built-in Validation Mechanisms help detect discrepancies, ensuring the reports are comprehensive and reliable. Deep neural networks enhance the system’s data processing capabilities by allowing for more complex processing and learning, thereby improving tasks such as classification and pattern recognition.

Transforming Sustainability Reporting with Private Generative AI Models

The evolution of sustainability reporting demands sophisticated technological solutions that can handle complex regulatory requirements while ensuring data security. Private GPT systems represent a big shift in how organizations manage their sustainability reporting.

These systems serve as intelligent institutional memory, combining advanced language processing with organization-specific knowledge management. By processing sustainability data through secure, dedicated environments, private GPT systems enable financial institutions to maintain complete control over their sensitive information while leveraging the power of artificial intelligence for accurate reporting.

A key feature of these systems is the ability to understand context and relationships within sustainability documentation. When generating reports about EU Taxonomy alignment, for instance, these systems analyze historical patterns, cross-reference multiple data sources, and ensure compliance with current regulatory frameworks, all while maintaining strict data security protocols.

Dydon AI’s Approach for AI-based Sustainability Reporting

Building on these foundational capabilities, what we suggest at Dydon AI is to approach AI implementation that goes beyond basic data segregation, introducing innovative learning architecture that becomes more sophisticated with each interaction.

Progressive Specialization Through Dedicated Clusters

Imagine a unique architecture of dedicated data clusters that evolve over time, with each cluster having a specialised knowledge repository that becomes increasingly expert at processing specific types of sustainability documents. If a financial institution regularly submits certain types of reports – such as green real estate investments or renewable energy projects – the system doesn’t just store this information; it develops a deeper understanding of the patterns, metrics and reporting requirements specific to that sector.

For example, if a bank frequently processes energy performance certificates for buildings, their dedicated cluster develops specialized capabilities in extracting and analyzing energy efficiency data. Over time, the system becomes increasingly adept at identifying relevant sustainability indicators, understanding sector-specific terminology, and making connections between different reporting requirements.

Secure Learning Environment

The system’s document processing begins with secure ingestion, immediately routing materials to these specialized client clusters. All learning and improvement stays within each client’s private environment. When the system discovers new patterns or develops better ways to analyze specific types of sustainability data, these improvements remain exclusively within that client’s dedicated space.

Basically, this means that every new document not only contributes to the current reporting needs but also enhances the system’s ability to handle similar documents in the future. For instance, as the system processes more EU Taxonomy alignment reports, it becomes increasingly precise in identifying relevant criteria, calculating alignment percentages, and flagging potential compliance issues.

Dr. Hans-Peter Güllich, CEO of Dydon AI, explains the significance of this approach: “Today’s financial institutions need more than generic AI capabilities—they demand secure, customized solutions. At Dydon AI, we believe in the importance of training private AI systems on complex sustainability reporting regulations, such as the EU Taxonomy, alongside your organization’s internal rules and standards, ensuring your sensitive data remains under your control.”

Sustainability Reporting under the EU Taxonomy simplified with AI

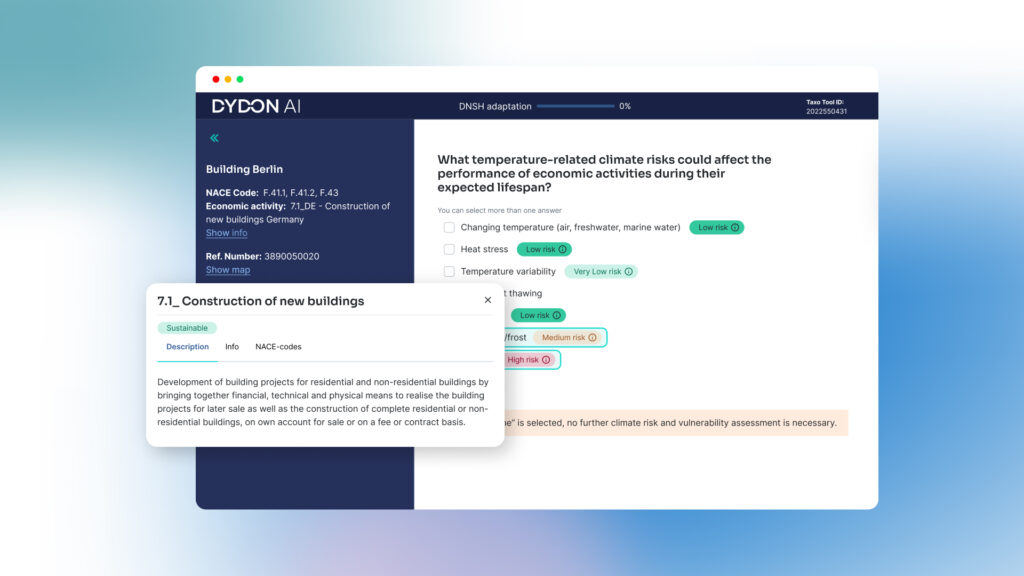

Dydon AI’s TAXO TOOL is a secure AI-powered solution designed to streamline EU Taxonomy compliance for financial institutions and corporations. As regulatory demands grow more complex, managing sustainability reporting with secure and reliable AI is crucial to ensuring accuracy, efficiency, and compliance. TAXO TOOL offers a comprehensive approach to EU Taxonomy reporting, empowering organizations to navigate requirements with confidence. Key features include:

Carbon Emissions and other “Technical Screening Criteria” (TSC) Intelligence

The solution offers calculations and algorithms to automatically process emissions data, or other technical screening criteria from the uploaded documents, making sophisticated calculations accessible even to organizations without extensive data and infrastructure. This capability proves particularly valuable for financial institutions assessing SMEs and private customers, where detailed emissions data might not be readily available.

Climate and Geological Risk Analysis

Through its integration with Munich Re’s comprehensive risk database, TAXO TOOL provides instant, location-specific climate and geological risk assessments. Users need only input a project’s address to receive detailed analyses covering multiple environmental factors, significantly streamlining the Do No Significant Harm (DNSH) assessment process.

Transparent & User-friendly Assessment Workflow

The tool’s visual workflow system transforms complex EU Taxonomy requirements into an intuitive, step-by-step process. Through diagram flows representing the assessment steps, users can navigate assessment stages while maintaining a clear understanding of their progress and remaining requirements.

Step-by-step assessment of Substantial Contribution, Do No Significant Harm (DNSH) and Minimum Safeguards

TAXO TOOL’s structured approach guides users through all critical aspects of EU Taxonomy compliance, including Substantial Contribution, Do No Significant Harm, and Minimum Safeguards criteria. Each assessment component is supported by clear guidance and regulatory context, ensuring comprehensive compliance coverage.

—

Ready to take advantage of the EU Taxonomy and transform your sustainability reporting process? Get in touch to book a free demo!