Human-like learning AI technology: NLP, Agentic AI and fuzzy logic

Automated ESG Insights with NLP and Agentic AI

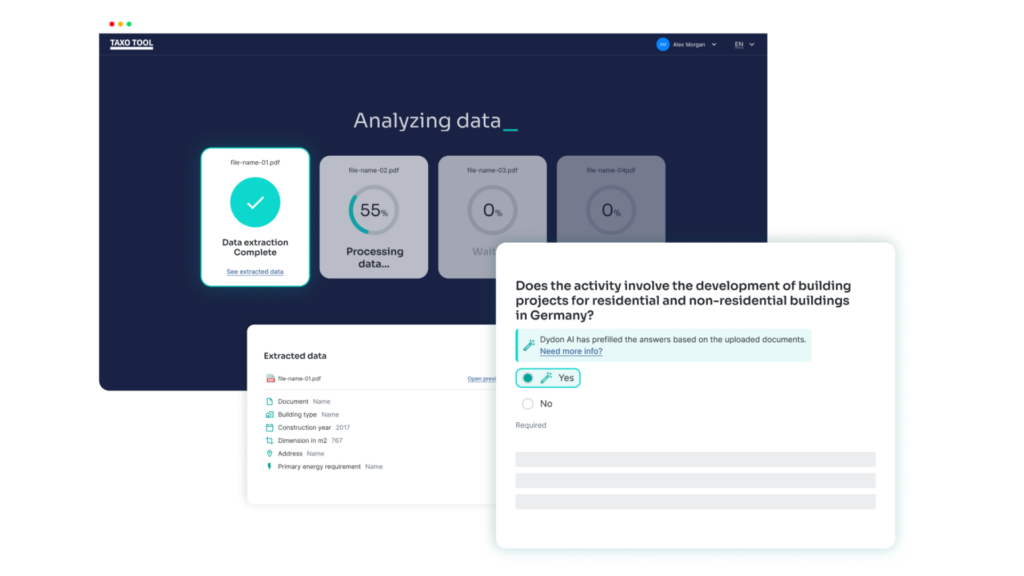

At Dydon AI, we harness Natural Language Processing (NLP) to automatically read and analyze complex documents such as sustainability reports, technical annexes, and financial statements. Our AI extracts and structures relevant ESG and EU Taxonomy data—from activity descriptions to eligibility and alignment criteria—directly from unstructured content.

Building on this, our Agentic AI technology intelligently maps extracted data to the appropriate Key Performance Indicators (KPIs) such as CapEx, OpEx, and Turnover. This ensures a seamless, accurate allocation of sustainability information across reporting dimensions and supports the automated generation of compliant, audit-ready reports.

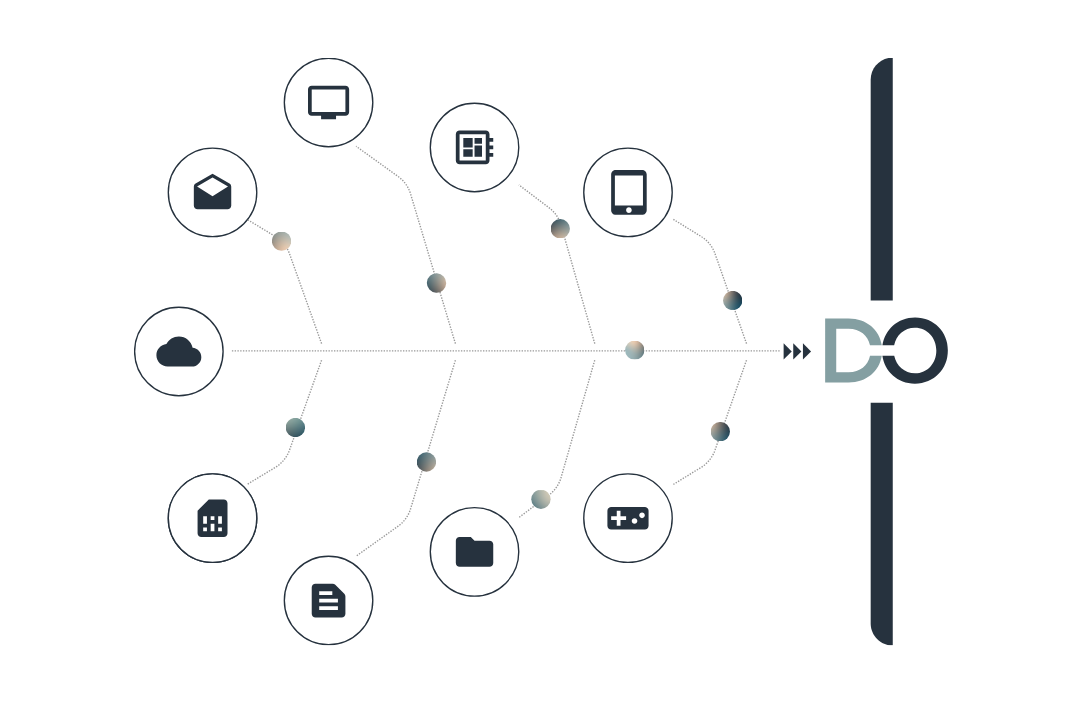

How Dydon AI technology works

01

Data Capture and Crawling

Our platform is able to capture numeric and textual data from various sources and formats. These sources (websites, documents etc.) can be both external and internal data provided by our clients. There is no need for our clients to provide the data in a specific format, we transform it in a way that is processable for us.

02

Natural Language Processing and Data Preparation

A huge number of texts from diverse documents and sources need to be analysed and categorised through a Natural Language Processing stack. One of the core features of our AI technology are semantic taxonomies for information structuring.

03

Calculating KPI’s for the ranking

The objective of this process is the generation of analysis and predictive information in the form of ratings, scores, etc. Such results are based on input variables stemming from various data sources. The platform elaborates KPIs and thresholds based on the previous NPL analysis.

04

Prediction: aggregation via linear and non-linear inference

Our prediction engine makes DYDON unique. Dydon AI’s proven Predictive Reasoning methodology combines several soft computing methods (i.e. mathematical formula, point scoring, rule-based aggregation, fuzzy-logic and NeuroFuzzy) to intelligently link and aggregate uploaded or via text analysis extracted input values. This concept provides full transparency for both the aggregation process and the generated results. Both are important elements to achieve explainable AI results.

05

Transparent result presentation

Results are presented in an understandable way. For example, our decision trees allow to drill down to specific results. Our graphics are fully customizable to fit to your needs.