ESG reporting has evolved from a compliance project to a permanent operational function. European banks now dedicate substantial budgets to CSRD reporting, EU Taxonomy regulation assessments, and SFDR (Sustainable Finance Disclosure Regulation) disclosures.

But the challenge extends beyond cost. On December 9, 2025, Parliament and Council reached a provisional deal on the Omnibus Simplification Package, which still requires formal adoption. The agreement significantly raises CSRD (Corporate Sustainability Reporting Directive) thresholds to capture mainly large companies, including those with more than 1,000 employees and substantially higher turnover, such as €450 million for certain non‑EU groups, and limits due diligence obligations under CSDDD (Corporate Sustainability Due Diligence Directive) to even larger companies with more than 5,000 employees and €1.5 billion in revenue. Beyond that, SFDR 2.0, proposed in November 2025, fundamentally restructures sustainable finance disclosure. And the new EBA (European Banking Authority) guidelines on environmental scenario analysis add analytical requirements for 2027.

Each change creates transition complexity, even as it promises long‑term relief, which is why AI‑powered sustainability reporting software is becoming a critical tool for managing ESG compliance in uncertain times.

The 2026 regulatory landscape: simplification meets transition complexity

The Omnibus Simplification Package perfectly illustrates the challenge of regulatory volatility, demonstrating how regulatory “relief” often creates new operational challenges. After modifications earlier this year, such as the “Stop-the-Clock” directive, which formally received its final approval from the European Council in April 2025, and new negotiations, the provisional agreement substantially narrows the scope of both CSRD and CSDDD.

For banks and corporates planning ahead sustainability reporting under existing rules, last-minute changes to scope, thresholds, or disclosure requirements create operational uncertainty, forcing parallel preparation under multiple scenarios until political agreement crystallizes. This compressed timeline means financial institutions have mere weeks to analyze the final legal text and assess operational impacts before year-end.

This pattern of instability extends across the ESG landscape:

- The “Stop the Clock” delay of CSRD and CSDDD in spring 2025 disrupted implementation timelines.

- EU Taxonomy simplification measures arrived after many financial institutions had already built compliance systems based on the original framework.

- SFDR 2.0 restructures the framework from a pure disclosure regime to product categorisation and is expected to start applying not earlier than 2027, subject to final legislative timelines.

Operational implications for banks

The EU Taxonomy simplification measures adopted July 4, 2025, featuring materiality thresholds, streamlined templates, and reduced reporting requirements, together with the raised CSRD thresholds and narrowed CSDDD scope, require banks to reassess their entire portfolio, opening space for multiple questions.

Which companies previously expected to report under CSRD now fall outside the scope? How does this affect the ESG data banks that have been collecting in anticipation of broader mandatory reporting? Which lending and investment clients can now legitimately decline detailed sustainability data requests?

Furthermore, the agreement’s provisions discouraging extensive sustainability information requests to smaller, out‑of‑scope companies beyond voluntary standards create a bifurcated data environment. Banks must now track which counterparties remain obligated to provide detailed ESG data versus which can refuse requests, fundamentally altering data collection workflows built over the past two years.

Notably, even large corporations within the narrowed CSDDD scope are expected to face significantly weaker or narrower requirements on transition plans aligned with the Paris Agreement, reducing the availability of a data point that many banks had integrated into credit risk models and portfolio decarbonization strategies.

Similarly, the EBA’s environmental scenario analysis guidelines (effective January 2027) will push banks toward more granular, often counterparty‑level, climate data for stress testing. Banks building these capabilities in 2026 would potentially require alternative data sources or estimation methodologies for out-of-scope counterparties.

The AI solution: adaptive compliance architecture for moving targets

Traditional compliance approaches, cannot accommodate regulatory velocity at a sustainable cost. Between Omnibus I negotiations, SFDR 2.0 restructuring, and ongoing EBA guideline implementation, European banks and companies face continuous adaptation requirements that traditional models cannot support.

AI-powered, cross-framework compliance platforms offer fundamentally different economics. Rather than building isolated compliance systems for EU Taxonomy, CSRD, and SFDR, AI-powered sustainability reporting solutions can take ESG data once from counterparty documents into standardized, granular models. The underlying source data is captured at a detailed level that can be re-aggregated as requirements change. With the help of artificial intelligence, what might take compliance teams weeks of manual spreadsheet analysis across relationship management, credit, and ESG functions happens in no time.

Automated EU Taxonomy screening with regulatory intelligence

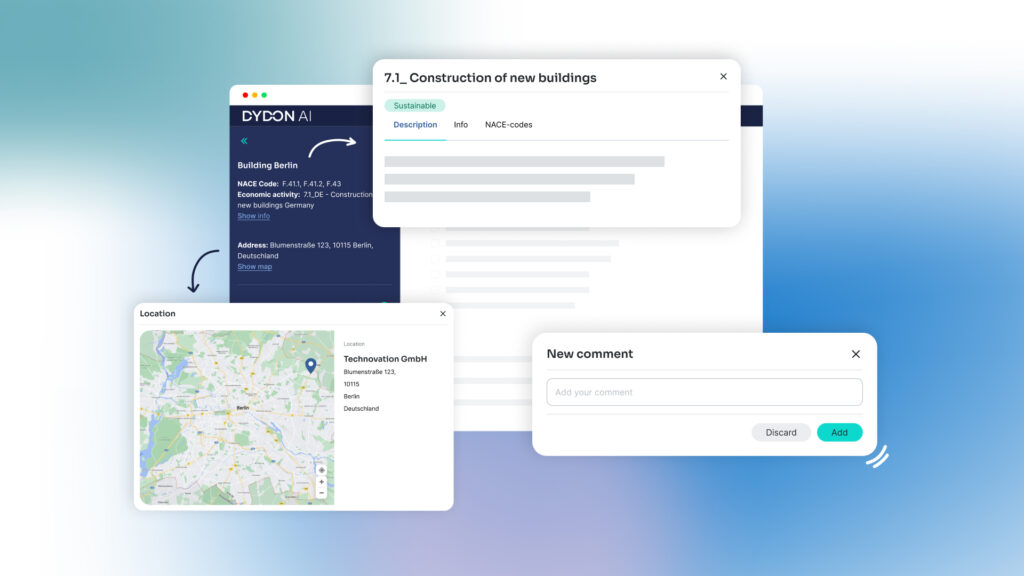

Dydon AI’s TAXO TOOL for EU Taxonomy reporting demonstrates this adaptability in practice.

Our AI reads documents and extracts critical data, answers regulatory assessments, automates screening of economic activities against the EU Taxonomy’s six environmental objectives and technical screening criteria, processing complex counterparty documents to determine alignment eligibility.

TAXO TOOL operates automatically and at scale, assessing all 150+ economic activities defined as eligible by the EU Taxonomy. It provides an audit-ready Article 8 report for companies and a multi-project assessment for banks in case of complex credit checks.

The platform’s geolocation-driven DNSH (Do No Significant Harm) checks integrate real-time climate risk databases from sources like Munich Re, automatically evaluating physical climate risks for financed assets. With support for audit‑ready exports through standardized documentation and workflows, our AI‑based automation simplifies every stage of the reporting process.

Cross-framework intelligence for scenario analysis

As banks prepare for EBA environmental scenario analysis (effective January 2027), AI platforms leverage data already collected for CSRD, EU Taxonomy, and Pillar 3 disclosures rather than requiring separate data collection infrastructure. A single counterparty sustainability assessment feeds multiple outputs: EU Taxonomy eligibility screening, CSRD materiality analysis, SFDR product categorization metrics, and climate stress testing parameters.

When regulatory scope changes reduce the universe of mandatory reporters, cross-framework AI identifies which inputs may lose data availability and pre-populates alternative approaches, whether estimation methodologies, proxy data, or sector benchmarks, maintaining analytical continuity despite upstream regulatory changes.

Augmentation, not replacement

AI handles routine tasks, from document data extraction and technical screening criteria application to threshold calculations and regulatory change monitoring. This frees compliance professionals for work requiring human judgment, materiality assessments, stakeholder engagement, strategic risk evaluation, and navigating the grey areas inevitable when multiple regulations evolve simultaneously.

The question isn’t whether AI can replace compliance teams, but whether compliance teams equipped with AI can manage expanding regulatory obligations without proportional headcount growth, particularly when regulations shift mid-implementation.

Sustainable finance reporting: the case for building now

Regulatory uncertainty is unlikely to be resolved in 2026. Yet beneath regulatory volatility, the climate crisis continues intensifying physical and financial risks. The transition to sustainable finance and a climate neutral economy is therefore inevitable, driven not merely by regulation but by investor demand, capital allocation patterns, and risk management imperatives that transcend political cycles, within and outside of the European union.

Banks waiting for regulatory clarity before building ESG infrastructure are waiting for the wrong signal. The EBA’s environmental scenario analysis guidelines recognize that climate risks materially impact credit portfolios regardless of CSRD scope. Asset managers face investor pressure for sustainable products, whether SFDR 2.0 passes in its current form or gets revised again. Counterparty climate risks don’t diminish because reporting thresholds rise to 1,000 employees and €450 million.

A “wait and see” approach feels prudent but carries hidden costs, like compressed implementation timelines once rules finalize, reactive scrambling when competitors have already built capabilities, and perpetual catch-up mode as new amendments arrive before previous ones are fully implemented. Instead, financial institutions building adaptive, AI-powered sustainability reporting infrastructure in 2026 are not betting on any single regulatory outcome, but on the need to manage climate and sustainability risks across a range of possible rulebooks.

The question isn’t whether regulations will stabilize or whether political consensus on sustainability will strengthen. The question is whether your institution will build infrastructure that serves inevitable market and environmental realities, or remain perpetually reactive to regulatory amendments that, however significant, represent only one dimension of the sustainable finance transition.

The time to act is now. Not despite uncertainty, but because the underlying drivers of financial sustainability are certain, even when the regulatory path remains volatile.

Get in touch today to find out how we can help you move ahead.

Get your free demo

Let’s get in touch, our experts will show you through our solutions with a live demo!