Get Ready for 2026: Calculating Green Asset Ratio (GAR) Under the New Rules

Webinar On Demand: A Practical Guide for Banks Preparing for FY 2025 / FY 2026 Reporting

Green Asset Ratio (GAR) in 2026 after the amended Disclosures Delegated Act in July 2025

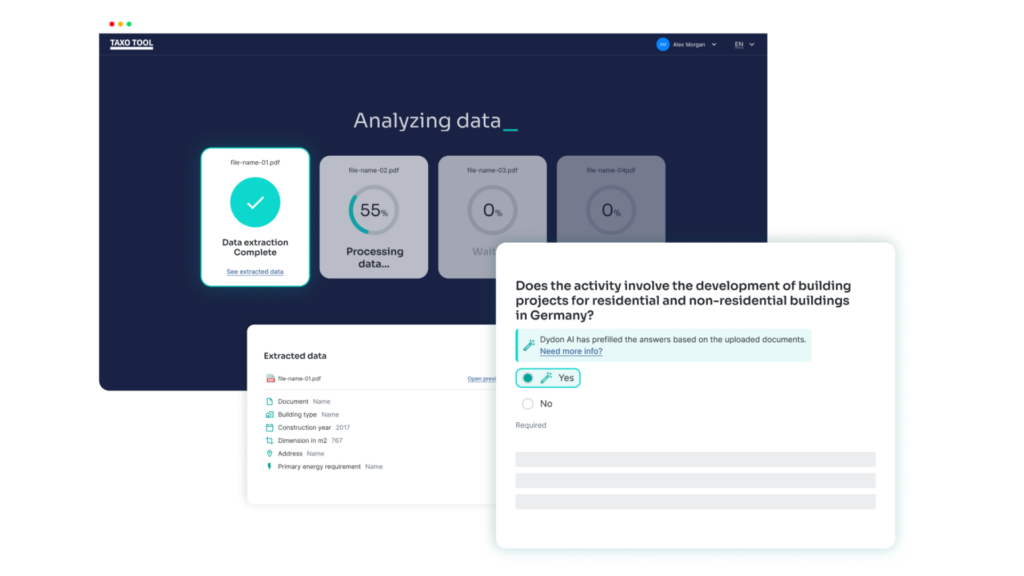

This on-demand webinar delivers practical, implementation-focused guidance on calculating GAR under the updated framework, applying new materiality thresholds, and navigating the three compliance pathways available to banks. Unlike theory-heavy briefings, this webinar bridges regulation to implementation through concrete examples, and the application of AI solutions.

What you’ll learn in this webinar on demand:

_Speakers in the webinar

Dr. Hans-Peter Güllich

CEO & Founder at Dydon AI

Dr. Yuliia Kornieieva

Head of ESG | SDH Professional Services

Lena Franke

Managing Partner at ADVANTA