The European Union’s commitment to sustainable finance, underpinned by the EU Taxonomy Regulation, requires financial institutions to quantify and disclose their exposure to environmentally sustainable activities. For banks, this is primarily measured by the Green Asset Ratio (GAR), which measures the proportion of assets financing Taxonomy-aligned economic activities.

The complexity of the framework, particularly regarding data collection and scope definition, has prompted significant regulatory action. The recent July 2025 Delegated Act amending the Taxonomy Disclosures, Climate and Environmental Delegated Acts and the broader Omnibus simplification package represent a critical moment. These changes aim to reduce administrative burden and cut red tape while safeguarding disclosure integrity, shifting the focus to material exposures and streamlining assessment processes.

To effectively navigate these new requirements, banks must implement substantial operational adjustments. Based on expert analysis from Dr. Yuliia Kornieieva, this article breaks down five critical areas where the 2025 rules are reshaping GAR calculation and reporting.

The dual approach to GAR calculation methodology

Calculating the Green Asset Ratio requires banks to focus on the underlying asset or activity being financed, evaluating its alignment with EU Taxonomy criteria. The methodology fundamentally splits based on the use of proceeds:

Specific Purpose Financing

This applies to lending where the use of proceeds is clearly defined, such as project finance or mortgages. The bank must directly assess the specific activity or asset against the EU Taxonomy’s technical screening criteria (TSC).

General Purpose Financing

When a loan is extended for general corporate purposes without a specified use of proceeds, the bank relies on the borrower’s Taxonomy Key Performance Indicators (KPIs).

As Dr. Yuliia Kornieieva explains, “For general-purpose financing, where a loan is extended without a specified use of proceeds, there is no identifiable activity that can be assessed under the EU Taxonomy. In such cases, the bank must rely on the Taxonomy KPIs disclosed by the borrower under Article 8 of the Taxonomy Regulation to determine the proportion of aligned financing.”

The green portion of the loan, therefore, reflects the share of the counterparty’s activities that are Taxonomy-aligned, based on their reported CapEx or turnover figures.

Defining the denominator: scope, exclusions, and flexibility

A major source of confusion for banks is determining the precise scope of the GAR denominator, the total covered assets. The assessment starts with screening the banking book for relevant on-balance sheet assets provided to in-scope counterparties.

Standard Exclusions

Exposures to out-of-scope counterparties, such as central banks and central governments, are also excluded.

Voluntary Inclusion

The July 2025 Delegate Disclosure Act (DDA) amendments narrow the mandatory scope by excluding companies not subject to compulsory sustainability reporting from the denominator of the GAR. However, the amendments grant banks important flexibility, allowing them to enhance their reported GAR where possible. As clearly explained by Dr. Kornieieva, “banks may still include such exposures in GAR in two specific cases:

– When the counterparty voluntarily reports its Taxonomy KPIs;

– When the exposure finances specific Taxonomy-relevant assets or activities, such as buildings or electric vehicles, for which sufficient data is available to determine Taxonomy alignment.”

This flexibility allows institutions to enhance their GAR beyond the mandatory scope, provided reliable data and supporting documentation are available.

From NACE codes to technical criteria: practical eligibility screening

Before assessing alignment, a bank must first verify the eligibility of a financed activity, checking that it corresponds to one listed in the Climate or Environmental Delegated Acts.

For a corporate loan, like, for example, one financing the expansion of a production line for Battery-Electric Vehicles (BEVs), the bank must match the activity (Manufacture of low-carbon transport technologies) to its technical description. This is where classification systems, such as NACE codes (e.g., C29.1 – Manufacture of motor vehicles), can be misleading.

Dr. Kornieieva stresses the need for technical scrutiny. “The key challenge in assessing Taxonomy eligibility lies in ensuring that the financed activity genuinely meets the description provided in the Delegated Acts. While NACE codes are a useful starting point for mapping activities, they do not automatically determine eligibility.”

This interpretive step requires a detailed, document-based analysis, moving beyond mere industrial classification.

“This interpretation step is often complex and judgment-based, requiring banks to analyse detailed project documentation to understand what is being financed and to compare it line by line with the activity description in the Delegated Acts, not just the activity title.”

Key simplifications of the July 2025 amendments: materiality and scope

The Omnibus simplification package introduces several important, complexity-reducing changes, most notably the new materiality threshold.

Under this rule, banks may omit the Taxonomy assessment for non-material assets (loans or investments with a known use of proceeds) that represent less than 10% of the institution’s overall portfolio of assets with a known use of proceeds. These new thresholds are expected to substantially cut the number of exposures and data points banks need to process.

The amendments also include plans for targeted simplification of the Alignment stage. The European Commission has announced a systematic review of the technical screening criteria, with a particular emphasis on streamlining the “Do No Significant Harm” (DNSH) requirement. By introducing greater clarity, these revised rules are expected to facilitate compliance assessments.

Operational readiness: adjustments for new reporting templates and SPVs

The upcoming regulatory changes demand operational adjustments from banks. While the core assessment methodology remains unchanged, the focus is now on adapting internal data frameworks and processes to enhance their effectiveness.

Banks must adapt their internal systems and reporting processes to align with the simplified new reporting templates and adjust their calculation logic. Furthermore, specific counterparty types are now explicitly in scope, demanding new data mapping capabilities.

A crucial change involves Special Purpose Vehicles (SPVs). Dr. Kornieieva emphasizes the need to adapt systems to track indirect exposures. “Banks should introduce a process for identifying and including exposures to special purpose vehicles (SPVs) that finance CSRD entities and their subsidiaries, as these are now explicitly in scope under the amended DDA.”

Implementing this will require robust data mapping and a clear understanding of ownership structures to attribute the underlying CSRD entity’s KPIs correctly. Banks may also consider preparing for the implementation of voluntary reporting, which involves additional data collection and validation processes.

Navigate the GAR calculation under the new rules: Join the webinar!

The regulatory amendments introduce both welcome simplification and new operational complexity. Understanding how to apply the new materiality thresholds, refine asset scope, and adapt data structures is essential for successful financial sustainability reporting.

To help financial institutions confidently navigate this transition, Dydon AI is hosting a dedicated webinar in collaboration with Dr. Yuliia Kornieieva, Head of ESG & Sustainability Senior Manager at SDH Professional Services GmbH, Lena Franke, Managing Partner at Advanta GmbH WPG.

Webinar: EU Taxonomy 2025: Calculating GAR Under the New Rules – A Practical Guide for Banks

- When: Wednesday, 19th November 2025 from 11:00 to 12:00 am CET

- Speakers: Dr. Yuliia Kornieieva (SDH), Lena Franke (Advanta GmbH WPG), and Amine Gharby (Dydon AI)

- Focus: This session delivers practical, implementation-focused guidance on calculating GAR under the updated framework, applying new materiality thresholds, and navigating the three FY 2025 compliance pathways available to banks.

Register for the Webinar Today!

Automate your EU Taxonomy reporting underlying your GAR calculation with AI

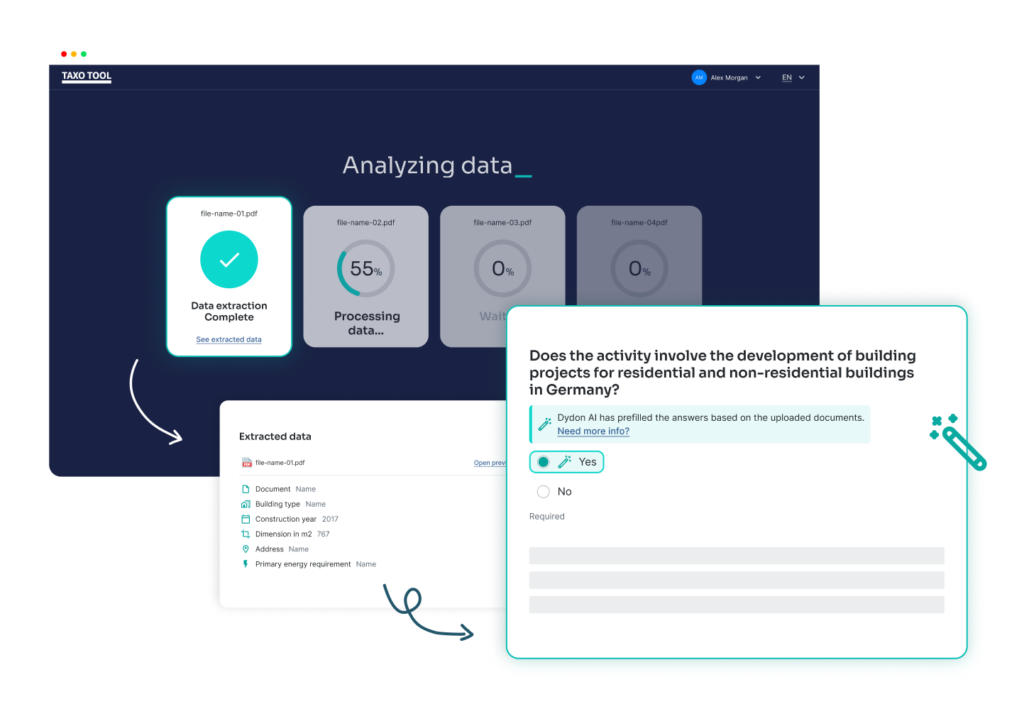

In order to address the operational complexity of EU Taxonomy reporting, which forms the basis of the GAR calculation, Dydon AI has developed TAXO TOOL. This AI-powered solution is designed to automate and streamline the assessment process.

Dydon AI’s TAXO TOOL solution uses AI language models to capture numeric and textual data from various documents. Specifically for energy certificates for buildings, the extracted data can be used to suggest answers to EU Taxonomy questions, thereby accelerating the assessment process.

TAXO TOOL can assess all economic activities (more than 150 EAs) that are defined as eligible by the EU Taxonomy. It provides companies with an audit-ready Article 8 report and banks with multi-project assessment in cases of complex credit checks. AI-supported calculations related to carbon emissions and other technical screening criteria ensure a straightforward and accurate assessment process.

By simply entering the project address, TAXO TOOL retrieves relevant risks and integrates data from Munich Re to provide geolocation-based assessments of climate and geological risks during the Do No Significant Harm (DNSH) assessment.

This allows banks to efficiently navigate the regulatory changes due in 2025, minimise compliance costs and focus their resources on strategic sustainability initiatives rather than administrative burdens.